Bitcoin’s Price Is Not the Only Risk to Riot Blockchain

Vince Martin, 31 March 2021

Less than four years ago, Riot Blockchain (NASDAQ:RIOT) was a failed animal health company named Bioptix. What is now RIOT stock was then BIOP stock — and it traded for less than $4 per share.

That wasn’t because investors put much value on the business: Bioptix in fact had more than $2 per share in cash at the end of 2017’s second quarter. BIOP was basically just another penny stock in the biotech space.

But in October of that year, Bioptix rebranded to Riot Blockchain. It was a move that invited a huge rally — and quite a bit of skepticism.

Blockchain and other cryptocurrencies were hot then, with Bitcoin (CCC:BTC-USD) at one point rising from $900 to $20,000 during 2017. Riot was not alone in moving into crypto and blockchain: Eastman Kodak (NYSE:KODK) infamously was involved in a “KodakCoin” project which never came to fruition. That didn’t stop KODK stock from soaring. Continue reading “Article: Bitcoin’s Price Is Not the Only Risk to Riot Blockchain”

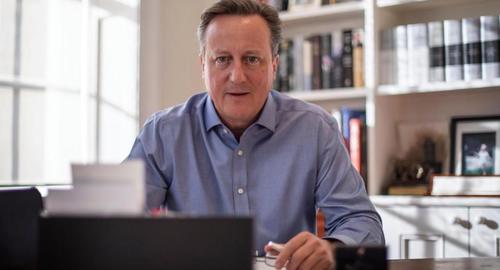

By now, the British media has been inundated with reports about the special access afforded Greensill Capital, the trade-finance firm that collapsed and filed for administration three weeks ago after its main insurer declined to renew policies on some of Greensill’s assets, setting off a chain reaction that ensnared some of Europe’s biggest banks (including the embattled Credit Suisse, which is simultaneously fighting off another scandal in the Archegos Capital blowup).

By now, the British media has been inundated with reports about the special access afforded Greensill Capital, the trade-finance firm that collapsed and filed for administration three weeks ago after its main insurer declined to renew policies on some of Greensill’s assets, setting off a chain reaction that ensnared some of Europe’s biggest banks (including the embattled Credit Suisse, which is simultaneously fighting off another scandal in the Archegos Capital blowup). In what some might take to be the latest sign of exhaustion in global equity markets, shares of Deliveroo tumbled 31% in their market debut Wednesday after pricing at the lower end of their range.

In what some might take to be the latest sign of exhaustion in global equity markets, shares of Deliveroo tumbled 31% in their market debut Wednesday after pricing at the lower end of their range. CONSIDER this hypothetical scenario: In an effort to pump up the price of his holdings in a loss-making distributor of electronic games, Steve Wong logs on to several investor chat rooms on the Internet to start rumours that the company is about to expand its distribution network to untapped overseas markets, in anticipation of tie-ups with big local champions in their respective domestic markets.

CONSIDER this hypothetical scenario: In an effort to pump up the price of his holdings in a loss-making distributor of electronic games, Steve Wong logs on to several investor chat rooms on the Internet to start rumours that the company is about to expand its distribution network to untapped overseas markets, in anticipation of tie-ups with big local champions in their respective domestic markets.  Institutions are slowly warming to Bitcoin, which many market observers believe will lead to substantial long-term price appreciation.

Institutions are slowly warming to Bitcoin, which many market observers believe will lead to substantial long-term price appreciation. As more details from the now infamous debacle surrounding Tiger cub Archegos, whose massive derivative-based exposures spilled out into the open and transformed into the biggest and most painful rolling margin call to hit Wall Street since Lehman, we now know that at least six Prime Brokers scrambled to unwind the biggest hedge fund blowup since LTCM without hammering the overall market.

As more details from the now infamous debacle surrounding Tiger cub Archegos, whose massive derivative-based exposures spilled out into the open and transformed into the biggest and most painful rolling margin call to hit Wall Street since Lehman, we now know that at least six Prime Brokers scrambled to unwind the biggest hedge fund blowup since LTCM without hammering the overall market. Rep. Matt Gaetz possesses text message screenshots, an email, and a typed document that purportedly support his claims that a federal investigation into his relationship with a 17-year-old is related to an extortion scheme against him.

Rep. Matt Gaetz possesses text message screenshots, an email, and a typed document that purportedly support his claims that a federal investigation into his relationship with a 17-year-old is related to an extortion scheme against him.