Wall Street Giants Beat Treasury Auction Rigging MDL

Dean Seal, 30 March 2021

A New York federal judge ruled Wednesday that he has yet to see any direct evidence that Wall Street banks including Goldman Sachs and Credit Suisse conspired to manipulate the $14 trillion market for securities issued by the U.S. Treasury Department.

U.S. District Judge Paul G. Gardephe dismissed long-running multidistrict litigation accusing a group of banks that also included JPMorgan Chase and Morgan Stanley of rigging auctions for Treasury Department bonds and other securities, on top of reducing competition in a secondary market for those securities. Continue reading “Article: Wall Street Giants Beat Treasury Auction Rigging MDL”

Danske Bank A/S’ capital levels and projected first-quarter earnings imply that it could withstand a money-laundering fine of 20.9 billion kroner, or $3.3 billion, today and still achieve its management common equity Tier 1 ratio target of 16%, according to S&P Global Market Intelligence estimates.

Danske Bank A/S’ capital levels and projected first-quarter earnings imply that it could withstand a money-laundering fine of 20.9 billion kroner, or $3.3 billion, today and still achieve its management common equity Tier 1 ratio target of 16%, according to S&P Global Market Intelligence estimates. The Financial Conduct Authority (FCA) has decided to crack down on crypto and fiat currency payments provider Wirex after money laundering allegations surfaced, according to an investigation by Fintech Futures.

The Financial Conduct Authority (FCA) has decided to crack down on crypto and fiat currency payments provider Wirex after money laundering allegations surfaced, according to an investigation by Fintech Futures. Unlike the devastating London Whale debacle in 2012, which was all JPMorgan eventually drawn and quartered quite theatrically before Congress (and was a clear explanation of how banks used Fed reserves to manipulate markets, something most market participants had no idea was possible), this time JPMorgan was nowhere to be found in the aftermath of the historic margin call that destroyed hedge fund Archegos. Which is may explain why JPMorgan bank analyst Kian Abouhossein admits he is quite “puzzled” by the recent fallout from the Archegos implosion (or maybe JPM simply was not a Prime Broker of the notorious Tiger cub), which however does not prevent him from trying to calculate the capital at risk from the Archegos collapse.

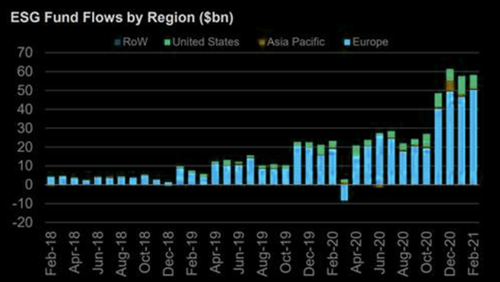

Unlike the devastating London Whale debacle in 2012, which was all JPMorgan eventually drawn and quartered quite theatrically before Congress (and was a clear explanation of how banks used Fed reserves to manipulate markets, something most market participants had no idea was possible), this time JPMorgan was nowhere to be found in the aftermath of the historic margin call that destroyed hedge fund Archegos. Which is may explain why JPMorgan bank analyst Kian Abouhossein admits he is quite “puzzled” by the recent fallout from the Archegos implosion (or maybe JPM simply was not a Prime Broker of the notorious Tiger cub), which however does not prevent him from trying to calculate the capital at risk from the Archegos collapse.  Sustainable investments have seen accelerated trends during the last five years. ESG- screening and ESG compliance ETFs enormous inflows have created a huge demand for clean and “green washed” stocks, that consequently received huge valuation premium to the overall market. This is certainly a long-term trend, but the last year hype has now cooled down with popular stocks like PLUG, RUN, ENPH, NOVA having corrected by between 35% and 60% from their highs (PLUG needs to gain 120% to break even for those long at highs…).

Sustainable investments have seen accelerated trends during the last five years. ESG- screening and ESG compliance ETFs enormous inflows have created a huge demand for clean and “green washed” stocks, that consequently received huge valuation premium to the overall market. This is certainly a long-term trend, but the last year hype has now cooled down with popular stocks like PLUG, RUN, ENPH, NOVA having corrected by between 35% and 60% from their highs (PLUG needs to gain 120% to break even for those long at highs…).

Las Vegas Sands Corp. set up a special committee to look into potential breaches of anti-money laundering procedures at its Singapore casino, which has already been the target of probes by U.S. officials and local police.

Las Vegas Sands Corp. set up a special committee to look into potential breaches of anti-money laundering procedures at its Singapore casino, which has already been the target of probes by U.S. officials and local police. Imagine if Goldman Sachs GS -0.5% lent a billion dollars to RoaringKitty.

Imagine if Goldman Sachs GS -0.5% lent a billion dollars to RoaringKitty. Las Vegas Sands Corp. set up a special committee to look into potential breaches of anti-money-laundering procedures at its Singapore casino, which has already been the target of probes by US officials and local police.

Las Vegas Sands Corp. set up a special committee to look into potential breaches of anti-money-laundering procedures at its Singapore casino, which has already been the target of probes by US officials and local police.