THE MARKET EAR, 30 March 2021

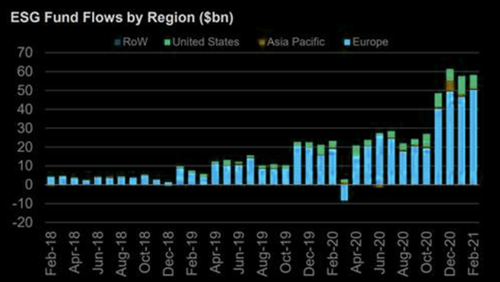

Sustainable investments have seen accelerated trends during the last five years. ESG- screening and ESG compliance ETFs enormous inflows have created a huge demand for clean and “green washed” stocks, that consequently received huge valuation premium to the overall market. This is certainly a long-term trend, but the last year hype has now cooled down with popular stocks like PLUG, RUN, ENPH, NOVA having corrected by between 35% and 60% from their highs (PLUG needs to gain 120% to break even for those long at highs…).

Sustainable investments have seen accelerated trends during the last five years. ESG- screening and ESG compliance ETFs enormous inflows have created a huge demand for clean and “green washed” stocks, that consequently received huge valuation premium to the overall market. This is certainly a long-term trend, but the last year hype has now cooled down with popular stocks like PLUG, RUN, ENPH, NOVA having corrected by between 35% and 60% from their highs (PLUG needs to gain 120% to break even for those long at highs…).

Last year’s huge rally in ESG related stocks coincided with AIMA (Alternative Investment Management Association) presenting strong arguments that Hedge Funds would be better off publishing a net carbon exposure figure than disclosing their gross WACI (Weighted Average Carbon Intensity) score, which would account for their long and short positions. AIMA pointed out that selling short high carbon-intensive businesses and buying long ESG-compliant, or low carbon-intensive companies, would help managers to create a carbon neutral, or theoretically even “negative carbon” portfolio. Even PRI (Principles for Responsible Investment) acknowledged last year that short selling is one way for a hedge fund manager to express the view that an entity is not adequately incorporating ESG factors.

It might have been too easy for Hedge Funds to act as responsible investors by shorting companies with high carbon exposure and netting off by buying ESG compliant companies, generating not only good returns but also a carbon neutral footprint. Everybody is happy…

But short-sellers’ purpose is to expose companies with fundamental problems, overstated revenues, mispriced businesses that have inflated performance or misled investors. Such companies are to be found even in the ESG-space.