Deutsche Bank Avoids Archegos Meltdown, Reports Profit Surge

Patricia Kowsmann, 28 April 2021

Deutsche Bank AG reported its strongest quarter in seven years thanks to activity at its investment bank, while the lender escaped the implosion of Archegos Capital Management that badly hit some rivals.

Deutsche Bank AG reported its strongest quarter in seven years thanks to activity at its investment bank, while the lender escaped the implosion of Archegos Capital Management that badly hit some rivals.

The news sent Deutsche Bank shares up 10% on Wednesday, their highest level since May 2018. Also helping its bottom line were lower charges on bad loans, as customers seemed to be weathering the pandemic effects better than expected.

The bank benefited from frenzied investor activity in financial markets. Its business advising clients on fundraising and mergers and acquisitions also boomed, as companies repositioned growth plans during the pandemic. A cost-savings plan imposed to turn the lender around following years of bad results is also helping. The bank reported a cost-to-income ratio of 77% compared with 89% a year ago. Continue reading “Article: Deutsche Bank Avoids Archegos Meltdown, Reports Profit Surge”

Dutch authorities have hit the third largest bank in the Netherlands with a penalty of more than a half a billion dollars for longstanding failings in nearly every area of its fincrime compliance program, including lax customer risk scoring, shoddy alert investigations and missed reports of potential suspicious activity.

Dutch authorities have hit the third largest bank in the Netherlands with a penalty of more than a half a billion dollars for longstanding failings in nearly every area of its fincrime compliance program, including lax customer risk scoring, shoddy alert investigations and missed reports of potential suspicious activity. Although appellate court judges threw out some claims against the bank, they said that market manipulation allegations were “plausible.”

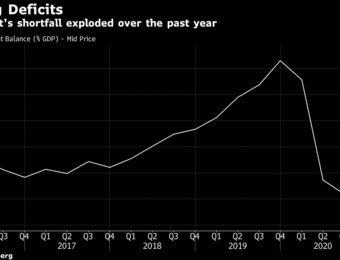

Although appellate court judges threw out some claims against the bank, they said that market manipulation allegations were “plausible.” The Argentine central bank’s fight against inflation is upending the local bond market and squeezing government finances as the country struggles to regain traction while the pandemic rages on.

The Argentine central bank’s fight against inflation is upending the local bond market and squeezing government finances as the country struggles to regain traction while the pandemic rages on. In March 2014, a few days after Vladimir Putin’s forces invaded Crimea, a British official arriving for a meeting of the UK’s National Security Council failed to shield his notes from the Downing Street photographers. Any response to the Kremlin’s aggression should not, the notes read, “close London’s financial centre to Russians”. The government subsequently explained that it “wanted to target action against Moscow and not damage British interests”.

In March 2014, a few days after Vladimir Putin’s forces invaded Crimea, a British official arriving for a meeting of the UK’s National Security Council failed to shield his notes from the Downing Street photographers. Any response to the Kremlin’s aggression should not, the notes read, “close London’s financial centre to Russians”. The government subsequently explained that it “wanted to target action against Moscow and not damage British interests”. It was only when John made a final phone call to confirm the transfer of about €10m to his family trust that he realised he was about to fall victim to a highly sophisticated financial scam.

It was only when John made a final phone call to confirm the transfer of about €10m to his family trust that he realised he was about to fall victim to a highly sophisticated financial scam. Fraudsters, drug dealers and money mules have revealed how crime has gone cashless during the pandemic.

Fraudsters, drug dealers and money mules have revealed how crime has gone cashless during the pandemic.