China Considers New Holding Company for Huarong, Bad-Debt Managers

Bloomberg News, 01 June 2021

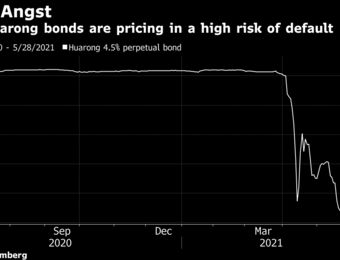

China’s finance ministry is considering a proposal to transfer its shares in China Huarong Asset Management Co. and three other bad-debt managers to a new holding company modeled after the one that owns the government’s stakes in state-run banks, according to a person familiar with the matter.

China’s finance ministry is considering a proposal to transfer its shares in China Huarong Asset Management Co. and three other bad-debt managers to a new holding company modeled after the one that owns the government’s stakes in state-run banks, according to a person familiar with the matter.

Policy makers are re-examining the proposal, which was first tabled three years ago, as part of discussions on how to deal with the financial risks posed by Huarong, said the person, who asked not to be identified discussing private information.

Some officials view the creation of a holding company as a step toward separating the government’s roles as a regulator and shareholder, streamlining oversight and instilling a more professional management culture at Huarong and its peers, the person said. Continue reading “Article: China Considers New Holding Company for Huarong, Bad-Debt Managers”

HONG KONG—Buffeted by rising costs, some Chinese manufacturers are refusing to accept new orders or are even considering shutting down operations temporarily—moves that could put more strain on global supply chains and cause more inflation.

HONG KONG—Buffeted by rising costs, some Chinese manufacturers are refusing to accept new orders or are even considering shutting down operations temporarily—moves that could put more strain on global supply chains and cause more inflation. ew information is revealing that Elon Musk still has the Securities and Exchange Commission (SEC) on his behind acting like Twitter police over his tweets about Tesla.

ew information is revealing that Elon Musk still has the Securities and Exchange Commission (SEC) on his behind acting like Twitter police over his tweets about Tesla. Focusing on romance scams, online sextortion, investment fraud, voice phishing and money laundering associated with illegal online gambling, police in nine Asian countries arrested more than 500 suspects and seized US$83 million, Interpol said on Thursday.

Focusing on romance scams, online sextortion, investment fraud, voice phishing and money laundering associated with illegal online gambling, police in nine Asian countries arrested more than 500 suspects and seized US$83 million, Interpol said on Thursday. AMC Entertainment Holdings (NYSE:AMC) is going on the offensive, selling over $230 million worth of stock to hedge fund operator Mudrick Capital Management at a premium so it can use the proceeds to make acquisitions.

AMC Entertainment Holdings (NYSE:AMC) is going on the offensive, selling over $230 million worth of stock to hedge fund operator Mudrick Capital Management at a premium so it can use the proceeds to make acquisitions.