China Considers New Holding Company for Huarong, Bad-Debt Managers

Bloomberg News, 01 June 2021

China’s finance ministry is considering a proposal to transfer its shares in China Huarong Asset Management Co. and three other bad-debt managers to a new holding company modeled after the one that owns the government’s stakes in state-run banks, according to a person familiar with the matter.

China’s finance ministry is considering a proposal to transfer its shares in China Huarong Asset Management Co. and three other bad-debt managers to a new holding company modeled after the one that owns the government’s stakes in state-run banks, according to a person familiar with the matter.

Policy makers are re-examining the proposal, which was first tabled three years ago, as part of discussions on how to deal with the financial risks posed by Huarong, said the person, who asked not to be identified discussing private information.

Some officials view the creation of a holding company as a step toward separating the government’s roles as a regulator and shareholder, streamlining oversight and instilling a more professional management culture at Huarong and its peers, the person said.

Authorities are also discussing whether to bring in more external investors, effectively reducing the finance ministry’s controlling stakes, the person said. Regulators are still awaiting guidance from senior Chinese leaders on the proposals and on how to resolve Huarong’s debt challenges, the person added.

It’s unclear what impact, if any, the proposed changes would have on Beijing’s willingness to extend financial support to Huarong and its peers during times of stress. Even though the government owns stakes in major Chinese banks indirectly through a company called Central Huijin Investment Ltd., the firms are still considered by creditors and other counterparties to enjoy strong official backing.

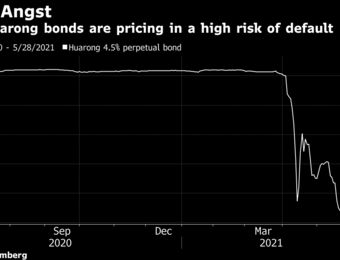

Fears that Huarong might default have rattled bondholders since the end of March, when the company missed a deadline to report annual results. Any move to inflict losses on Huarong’s creditors would mark a significant — and potentially risky — step in President Xi Jinping’s campaign to reduce moral hazard in the world’s second-largest credit market. With nearly 1.6 trillion yuan ($251 billion) of liabilities and a vast web of connections with other financial institutions, Huarong is among China’s most systemically important companies outside the nation’s state-owned banks.