In 2020 Citadel affiliates donated $68 mill to political groups. Included was $37 mill to Senate Leadership Fund and $10 mill to Congressional Leadership Fund. #Robinhood #GameStop

— B.P. Rising (@BP_Rising) February 18, 2021

Article: Trading hot stocks like GameStop seems fun until you look beneath the surface

Article - MediaTrading hot stocks like GameStop seems fun until you look beneath the surface

Congress is asking questions about whether middlemen or “market makers” like Citadel that execute stock trades really give small investors the best prices.

Gretchen Morgenson, ABCNews, 18 February 2021

Market makers like Citadel make money by pocketing the difference between the price at which they buy shares — the bid — and the price they receive from selling them to Robinhood clients, the offer. Other firms in the business are Virtu Americas, G1X Execution Services and Two Sigma Securities.

Tweet: Robert Steele to Dave Portnoy on Melvin Capital & NSA

Tweet@stoolpresidente Show Melvin Capital a good time — listed 10 times in tag cloud at https://t.co/fHcO89SqIU and will hit 25 times in next 30 days. See especially the cartoons and videos at the site, GameStop was first shot, this will not end well for boys. NSA disclosures next?

— Robert David Steele (@OSSRobertSteele) February 17, 2021

Article: SEC Data Show $359 Million of GameStop Shares Failed to Deliver

Article - MediaSEC Data Show $359 Million of GameStop Shares Failed to Deliver

Brandon Kochkodin, Bloomberg, 17 February 2017

-

GameStop surged more than 1,700% before curbs were implemented

-

More than 2 million shares failed to deliver at peak of mania

“Fails-to-deliver can occur for a number of reasons on both long and short sales,” reads a disclaimer on the SEC website. “Therefore, fails-to-deliver are not necessarily the result of short selling, and are not evidence of abusive short selling or ‘naked’ short selling.”

Comment: The SEC is full of shit and a RICO organization complicit in Class A felonies enabled by the Department of Justice and the Senate Banking Committee. For the slow learners, start with the Cartoons.

Article: GameStop Frenzy Prompts SEC to Weigh More Short Sale Transparency

Article - MediaGameStop Frenzy Prompts SEC to Weigh More Short Sale Transparency

House lawmakers meeting Thursday plan to examine the GameStop trading and discuss the dearth of short-sale data

Dave Michaels and Dawn Lim, Wall Street Journal, 17 February 2021

The Securities and Exchange Commission was ordered 11 years ago to impose such rules but never did it. Now, dealing with the fallout from frenetic trading in GameStop Corp. shares, the agency under new leadership is considering using its authority to shine more light on the mechanics of the bearish trades.

Comment: Bearish trades my ass. Naked short selling is a Class A Felony. It is counterfeiting. It is fraud, It is cheating widows and orphans and wiping out inventors and entrepreneurs, turning gold into lead for profit. It is also on occasion collusion with foreign governments (the UK more often than China) and thus treason, sabotaging the US economy the US now being in a state of war.

Web: SEC Data Show $359 Million of GameStop Shares Failed to Deliver – Thank you Bloomberg for finally reporting the news

WebReddit, 17 February 2021

As usual, Bloomberg posting some truth embedded in a sea of lies and narrative.

“GameStop stock, for months among the most heavily shorted on the New York Stock Exchange, surged more than 1,700% from Jan. 1 through Jan. 27 as a legion of Reddit users piled on, forcing bearish traders to scramble for shares and brokers to take the highly unusual step of curbing trading.”

Read more at: https://www.bloombergquint.com/onweb/sec-data-show-359-million-of-gamestop-shares-failed-to-deliver

Apparently “unusual” is the new term for “illegal” 🤦🏻♂️

Article: House Hearing On GameStop Fiasco Will Focus On “Short Selling And Stock Manipulation”

Article - Media, PublicationsHouse Hearing On GameStop Fiasco Will Focus On “Short Selling And Stock Manipulation”

Tyler Durden, Zero Hedge, 16 February 2021

In order to affect change, one has to understand the problem before them. It is by those standards we can confidently say we are near-certain that this week’s upcoming congressional hearings on the GameStop fiasco will be both a useless circus and a intellectual farce.

Mark Cohodes Hears From Robert Steele Tik Tok Tik Tok

TweetMark Cohodes posted this to his “private” twitter:

Robert Steele, intelligence professional, responded:

@AlderLaneeggs Bummer — you are climbing in the tag cloud at https://t.co/fHcO89SqIU. We have it all — every email, every text, every game chat and every single one of your banking transactions. Have a great day, Mr. C. @PatrickByrne

— Robert David Steele (@OSSRobertSteele) February 17, 2021

NOTE: Mr. Cohodes is believed to be well aware there were 50 million counterfeit shares. Evidence of both that fact and his knowledge of and engagement with that fact can be presented to a court court. Mr. Cohodes should have his day in court — in fact, he should have many days in many courts in CA, UK, and US. Tik tok, tik tok . . .

RELATED:

Article: Here’s what to expect at the congressional hearings on GameStop and Robinhood

Article - MediaHere’s what to expect at the congressional hearings on GameStop and Robinhood

Scum sucking sack of shit lawmakers will seek to make headlines, not legislation — and all the witnesses are probably RICO eligible!

Chris Matthews, MarketWatch, 16 February 2021

Executives at Robinhood, market maker Citadel Securities, hedge fund Melvin Capital, social media firm Reddit, and Keith Gill, an independent investor who found fame and riches with his early purchases of GameStop Inc. GME, -5.52% shares, will all testify at the hearing, scheduled for noon on Thursday. Here’s what to expect:

Article: A Silver Price Manipulation Primer

Web A Silver Price Manipulation Primer

A Silver Price Manipulation Primer

Criag Hemke, SprottMoney, 16 February 2021

It has been a long ten years, but it seems that the investing world is finally beginning to realize that the globally-recognized prices of gold and silver are managed and manipulated by the Bullion Banks, which operate as market makers within the fraudulent fractional reserve and digital derivative pricing scheme.

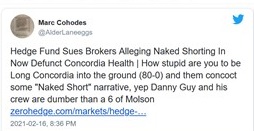

Article: Hedge Fund Sues Brokers Alleging Naked Shorting In Now Defunct Concordia Health

WebHedge Fund Sues Brokers Alleging Naked Shorting In Now Defunct Concordia Health

Tyler Durden, Zero Hedge, 16 February 2021

Several major international brokers have been sued by a Bermuda hedge fund that claims the brokerages coordinated “abusive” naked short selling and spoofing strategies in US and Canadian markets. The suit revolves around the former Concordia Health, which was highly leveraged and ultimately went bankrupt after controversy about price gouging.

CIBC, Bank of America, UBS and TD Bank are among those named as defendants in a lawsuit filed by Harrington Global Opportunity Fund in the US District Court for the Southern District of New York, according to Securities Finance Times.

#UNRIG Video (30:06) Matt Ehret on UK / Central Banks As Main Enemy of the USA

VideoEIN TOON: Goldman Sucks – And SEC Sucks Goldman?

GraphicAlert Reader: Gold and Silver are Money, Everything Else is Debased Currency

LetterAlert Reader writes in:

MONEY VS CURRENCY-

In 1788, Thomas Jefferson wrote:

Paper is poverty. It is only the ghost of money, and not money itself.”

Continue reading “Alert Reader: Gold and Silver are Money, Everything Else is Debased Currency”

Article: Exposing The Robinhood Scam: Here’s How Much Citadel Paid To Robinhood To Buy Your Orders

Article - MediaExposing The Robinhood Scam: Here’s How Much Citadel Paid To Robinhood To Buy Your Orders

Tyler Durden, Zero Hedge, 14 February 2021

Frankly, we’ve had it with the constant stream of lies from Robinhood and neverending bullshit from the company’s CEO, Vlad Tenev.

With Tenev scheduled to testify on Thursday, alongside the CEOs of Citadel, Melvin Capital and Reddit, the apriori mea culpas have started to emerge – if a little too late – the former HFT trader spoke late on Friday on the All-In Podcast hosted by Chamath Palihapitiya, who had strongly criticized Robinhood over the trading restrictions, and Jason Calacanis, a Robinhood investor, and said that “no doubt we could have communicated this a little bit better to customers.”