LA-Based Actor Charged With Running $227 Million Ponzi Scheme

TYLER DURDEN, 08 April 2021

Zachary Horwitz, a little known LA-based actor, has been arrested by the FBI this week and was charged with running “an enormous ponzi scheme” wherein he represented that he had a successful film distribution company.

The reality was that the actor – who has had some roles in small films – was cheating his investors out of $227 million and using most of the money to fund his own lifestyle, according to the NY Post. Horwitz also “used investor funds to pay in cash for a $5.7 million home in Los Angeles’s Beverlywood neighborhood,” the Wall Street Journal added. Continue reading “Article: LA-Based Actor Charged With Running $227 Million Ponzi Scheme”

Markets were shaken but unstirred by the collapse of Greensill and the Archegos unwind trades. Credit Suisse is the ultimate loser of the two scandals – reputationally damaged and holed below the water line. The bank is paying the price of years of flawed management, poor risk awareness. and its self-belief it was still a Tier 1 global player. Its’ challenge is to avoid becoming the Deutsche Bank of Switzerland – which it will struggle to do without a radical and unlikely shakeout.

Markets were shaken but unstirred by the collapse of Greensill and the Archegos unwind trades. Credit Suisse is the ultimate loser of the two scandals – reputationally damaged and holed below the water line. The bank is paying the price of years of flawed management, poor risk awareness. and its self-belief it was still a Tier 1 global player. Its’ challenge is to avoid becoming the Deutsche Bank of Switzerland – which it will struggle to do without a radical and unlikely shakeout.  GameStop plans to elect activist investor Cohen as chairman

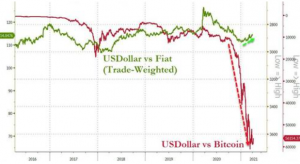

GameStop plans to elect activist investor Cohen as chairman ‘Pro-Crypto’ Peter Thiel Warns Bitcoin “Could Be A Chinese Financial Weapon Against The US”

‘Pro-Crypto’ Peter Thiel Warns Bitcoin “Could Be A Chinese Financial Weapon Against The US” In the aftermath of the Archegos blow up, the biggest nightmare on Wall Street – where there is never just one cockroach – is that (many) more Archegos-style, highly levered “family office” blow ups are waiting just around the corner.

In the aftermath of the Archegos blow up, the biggest nightmare on Wall Street – where there is never just one cockroach – is that (many) more Archegos-style, highly levered “family office” blow ups are waiting just around the corner. The collapse of UK-based supply chain finance firm Greensill Capital continues to reverberate. In Germany the private banking association has paid out around €2.7 billion to more than 20,500 Greensill Bank customers as part of its deposit guarantee scheme after the bank collapsed in early March. But the deposits of institutional investors such as other financial institutions, investment firms, and local authorities are not covered. Fifty municipalities are believed to be nursing losses of at least €500 million.

The collapse of UK-based supply chain finance firm Greensill Capital continues to reverberate. In Germany the private banking association has paid out around €2.7 billion to more than 20,500 Greensill Bank customers as part of its deposit guarantee scheme after the bank collapsed in early March. But the deposits of institutional investors such as other financial institutions, investment firms, and local authorities are not covered. Fifty municipalities are believed to be nursing losses of at least €500 million.  The GameStop saga stopped the stock market in its tracks earlier this year, with wealthy hedge funds losing millions of pounds. The move was orchestrated on a subreddit thread, with vast numbers of average investors joining forces to push up the share price.

The GameStop saga stopped the stock market in its tracks earlier this year, with wealthy hedge funds losing millions of pounds. The move was orchestrated on a subreddit thread, with vast numbers of average investors joining forces to push up the share price. Goldman Sachs managed to avoid billions of dollars in potential losses from the implosion of highly levered hedge fund Archegos Capital Management by breaking ranks with other syndicate banks to dump large blocks of shares representing Archegos’s exposure to a coterie of tech and media names. When the dust settled, the bank told shareholders any losses would be insignificant, while Credit Suisse, the bank with perhaps the biggest exposure, said Tuesday it has booked a nearly $5 billion loss.

Goldman Sachs managed to avoid billions of dollars in potential losses from the implosion of highly levered hedge fund Archegos Capital Management by breaking ranks with other syndicate banks to dump large blocks of shares representing Archegos’s exposure to a coterie of tech and media names. When the dust settled, the bank told shareholders any losses would be insignificant, while Credit Suisse, the bank with perhaps the biggest exposure, said Tuesday it has booked a nearly $5 billion loss.  Over the past few days, Bitcoin Cash has been recording significant price surges, appreciating by over 30 percent in value. Despite the impressive bull run, Bitcoin Cash recently experienced a price correction towards the $600 region. At present, multiple technical indicators are showing BCH could experience further price declines.

Over the past few days, Bitcoin Cash has been recording significant price surges, appreciating by over 30 percent in value. Despite the impressive bull run, Bitcoin Cash recently experienced a price correction towards the $600 region. At present, multiple technical indicators are showing BCH could experience further price declines.  XRP, the currency that runs on the digital payment platform RippleNet, hit $1 on Tuesday morning EDT, becoming the fourth highest-valued cryptocurrency with a $45.5 billion market cap despite being sued by the U.S. agency that works against market manipulation.

XRP, the currency that runs on the digital payment platform RippleNet, hit $1 on Tuesday morning EDT, becoming the fourth highest-valued cryptocurrency with a $45.5 billion market cap despite being sued by the U.S. agency that works against market manipulation.