Namibia: Hedge Funds – Namibia’s Hope to Increase Market Capitalization and Liquidity

Arney Tjaronda, 10 May 2021

Over the course of years, Hedge funds has been a driving force for the Johannesburg Securities Exchange (JSE) market. They have been nicknamed the miracle boy of the JSE due to its performance, so much so that in 2020 alone- despite the pandemic-the Single Manager Composite Index was +6.19% (HedgeNews Africa, January 18, 2021). How is that so? Before answering that question, I will define what hedge funds are.

Definition of hedge funds Continue reading “Article: Namibia: Hedge Funds – Namibia’s Hope to Increase Market Capitalization and Liquidity”

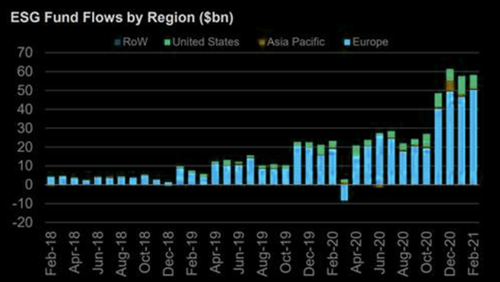

Sustainable investments have seen accelerated trends during the last five years. ESG- screening and ESG compliance ETFs enormous inflows have created a huge demand for clean and “green washed” stocks, that consequently received huge valuation premium to the overall market. This is certainly a long-term trend, but the last year hype has now cooled down with popular stocks like PLUG, RUN, ENPH, NOVA having corrected by between 35% and 60% from their highs (PLUG needs to gain 120% to break even for those long at highs…).

Sustainable investments have seen accelerated trends during the last five years. ESG- screening and ESG compliance ETFs enormous inflows have created a huge demand for clean and “green washed” stocks, that consequently received huge valuation premium to the overall market. This is certainly a long-term trend, but the last year hype has now cooled down with popular stocks like PLUG, RUN, ENPH, NOVA having corrected by between 35% and 60% from their highs (PLUG needs to gain 120% to break even for those long at highs…).