Feedzai’s Financial Crime Report: Fraud rises by 159% Year on Year

Feedzai Inc, 02 June 2021

SAN MATEO, Calif. and LONDON, June 02, 2021 (GLOBE NEWSWIRE) — Feedzai, the world’s leading cloud-based financial crime management platform, has announced its Quarterly Financial Crime Report , an analysis of over 12 billion global banking transactions from January – March 2021. The report identifies trends in spending and in fraud attempts to show that this past quarter, as consumer activities increased, fraudsters attempted to hide their fraudulent transactions in legitimate banking. In fact, combining all banking fraud – internet, telephone, and branch – attacks grew a whopping 159% in Q1 2021 compared to Q4 2020.

Online banking made up 96% of all banking transactions and it accounted for 93% of all fraud attempts in Q1 2021. This leaves in-branch and telephone banking to make up the remaining 4%. And while the numbers are smaller, in-branch banking did increase by 442% this quarter compared with the last as a result of eased lockdown restrictions as businesses begin to open for trade. In addition, telephone scammers upped their efforts and the report shows a 728% increase in telephone banking fraud. Continue reading “Article: Feedzai’s Financial Crime Report: Fraud rises by 159% Year on Year”

Affirm CEO Max Levchin discusses Apple’s announcement that they will collaborate with Goldman Sachs and start allowing customers to buy products using Apple Pay and pay off the purchases in installments, which will be in direct competition with his company. He speaks with Emily Chang on “Bloomberg Technology.”

Affirm CEO Max Levchin discusses Apple’s announcement that they will collaborate with Goldman Sachs and start allowing customers to buy products using Apple Pay and pay off the purchases in installments, which will be in direct competition with his company. He speaks with Emily Chang on “Bloomberg Technology.”

“No single organization can stop synthetic identity fraud on its own,” reports The Federal Reserve. “Fraudster tactics continually evolve to stay a step ahead of detection—and the most sophisticated fraudsters can operate at scale in organized crime rings, generating significant losses for the payments industry. It is imperative that payments industry stakeholders work together, share information and keep up with the threat.”

“No single organization can stop synthetic identity fraud on its own,” reports The Federal Reserve. “Fraudster tactics continually evolve to stay a step ahead of detection—and the most sophisticated fraudsters can operate at scale in organized crime rings, generating significant losses for the payments industry. It is imperative that payments industry stakeholders work together, share information and keep up with the threat.” Stocks finished mixed on Monday with the S&P 500 failing to make a run for a new record and closing slightly in the red. The index is already up about 12% year-to-date, but investors are feeling a bit skittish about inflation.

Stocks finished mixed on Monday with the S&P 500 failing to make a run for a new record and closing slightly in the red. The index is already up about 12% year-to-date, but investors are feeling a bit skittish about inflation. About three months ago, the investing world was left reeling after retail investors proved they can beat Wall Street at its own game.

About three months ago, the investing world was left reeling after retail investors proved they can beat Wall Street at its own game. This time last year, the Swiss National Bank (SNB) had US stock holdings of $94 billion. The portfolio of Switzerland’s central bank has grown by $56 billion since, reporting ownership of $150 billion worth of US listed stocks as at Q1 2021.

This time last year, the Swiss National Bank (SNB) had US stock holdings of $94 billion. The portfolio of Switzerland’s central bank has grown by $56 billion since, reporting ownership of $150 billion worth of US listed stocks as at Q1 2021. A Texas federal judge ruled Wednesday that Apple is entitled to a new damages trial after a jury found in August that it infringed PanOptis’ standard-essential 4G wireless patents and must pay $506 million, saying there is “serious doubt” about the reliability of the verdict.

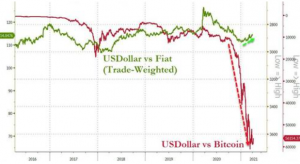

A Texas federal judge ruled Wednesday that Apple is entitled to a new damages trial after a jury found in August that it infringed PanOptis’ standard-essential 4G wireless patents and must pay $506 million, saying there is “serious doubt” about the reliability of the verdict. ‘Pro-Crypto’ Peter Thiel Warns Bitcoin “Could Be A Chinese Financial Weapon Against The US”

‘Pro-Crypto’ Peter Thiel Warns Bitcoin “Could Be A Chinese Financial Weapon Against The US”

Peter Oppenheimer has been on the Board of Directors of Goldman Sachs since 2014. He previously retired from Apple, Inc. as

Peter Oppenheimer has been on the Board of Directors of Goldman Sachs since 2014. He previously retired from Apple, Inc. as