The Next ‘Gamestop’: How China or Russia Could Attack Our Financial System

Robert Carlson, Gray Gaertner, 16 March 2021

Last week, the dramatic rise and fall in the price of Gamestop demonstrated how vulnerable the stock market is to social media speculation. U.S. regulators should now turn their attention to a greater risk—that in the near future, China, Russia, or another adversary could coordinate an unwitting mob to harm the American financial system.

The potential for financial warfare follows from a playbook that China, and especially Russia, have drawn from repeatedly to meddle in U.S. domestic politics. First, foreign state agents have used social media to spread disinformation or stoke existing grievances. Second, they have counted on naive users to share the original posts, allowing the content to reach a larger audience. Finally, they fan the flames to provoke action.

In 2016 and 2020, Russian propaganda decreased U.S. voters’ trust in their candidates and the political system. During last year’s protests over race and policing, foreign bots amplified instances of both racial discrimination and violent protests, further polarizing American society. Following Joe Biden’s electoral victory in November, Russian agents embraced false allegations of fraud, providing the rationale for an armed mob to assault the Capitol Building. China spends at least $10 billion per year on its own influence operations through the United Front Work Department, which promotes pro-Beijing narratives overseas.

Read Full Article

Intro: Four men and a mastermind running a money-laundering syndicate in the city have been arrested by the Hong Kong Police. The officials have dismantled the operation of the gang that used cryptocurrency to process HK$1.2 billion for illegal funds.

Intro: Four men and a mastermind running a money-laundering syndicate in the city have been arrested by the Hong Kong Police. The officials have dismantled the operation of the gang that used cryptocurrency to process HK$1.2 billion for illegal funds.

The old Nicaraguan revolutionary, with his receding hairline and the goatee that he had finally let turn grey, spoke calmly into the camera as police swarmed toward his house, hidden behind a high wall in a leafy Managua neighborhood. Surveillance drones, he said, were watching overhead.

The old Nicaraguan revolutionary, with his receding hairline and the goatee that he had finally let turn grey, spoke calmly into the camera as police swarmed toward his house, hidden behind a high wall in a leafy Managua neighborhood. Surveillance drones, he said, were watching overhead. China’s securities regulator is setting up a team to review plans by Chinese companies for initial public offerings (IPOs) abroad, sources with knowledge of the matter said, including those using a corporate structure which Beijing says has led to abuse.

China’s securities regulator is setting up a team to review plans by Chinese companies for initial public offerings (IPOs) abroad, sources with knowledge of the matter said, including those using a corporate structure which Beijing says has led to abuse. Beijing has been engaged in a battle for public opinion for several years, aggressively promoting a positive vision of China to counter criticisms for its involvement in human rights violations, intellectual property theft, currency manipulation, its engagement with Taiwan and the South China Sea disputes, and its suspected involvement in the COVID-19 outbreak. In 2017, senior Party leaders acknowledged that “the main battlefield for public opinion” occurs on the extensive borderless Internet where people receive their news, express their thoughts, and promote and argue their political and ideological viewpoints. Beijing understands how the Internet is essential in disseminating China-friendly narratives, while at the same time deflecting criticisms and reassigning blame. In essence, it is how Beijing seeks to preserve its image while tarnishing those of others.

Beijing has been engaged in a battle for public opinion for several years, aggressively promoting a positive vision of China to counter criticisms for its involvement in human rights violations, intellectual property theft, currency manipulation, its engagement with Taiwan and the South China Sea disputes, and its suspected involvement in the COVID-19 outbreak. In 2017, senior Party leaders acknowledged that “the main battlefield for public opinion” occurs on the extensive borderless Internet where people receive their news, express their thoughts, and promote and argue their political and ideological viewpoints. Beijing understands how the Internet is essential in disseminating China-friendly narratives, while at the same time deflecting criticisms and reassigning blame. In essence, it is how Beijing seeks to preserve its image while tarnishing those of others.  BEIJING (Reuters) – China’s central bank on Tuesday issued a revised draft anti-money laundering law, under which fines for certain offences would rise to as much as 10 million yuan ($1.6 million) and a host of non-financial institutions would be brought within its scope.

BEIJING (Reuters) – China’s central bank on Tuesday issued a revised draft anti-money laundering law, under which fines for certain offences would rise to as much as 10 million yuan ($1.6 million) and a host of non-financial institutions would be brought within its scope. Congrats to America’s finance bros for finally getting their reward from the Chinese Communist Party. But surely, after obediently lobbying in favor of opening up to Beijing for decades, Wall Street deserved more than it received.

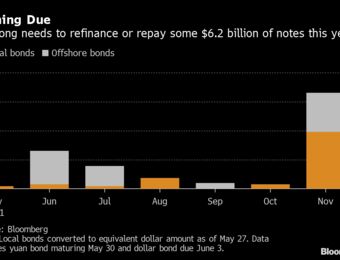

Congrats to America’s finance bros for finally getting their reward from the Chinese Communist Party. But surely, after obediently lobbying in favor of opening up to Beijing for decades, Wall Street deserved more than it received. China Huarong Asset Management Co. made the biggest bond payment since confidence in its financial health began plunging two months ago, adding to signs that the company still has access to near-term liquidity.

China Huarong Asset Management Co. made the biggest bond payment since confidence in its financial health began plunging two months ago, adding to signs that the company still has access to near-term liquidity. The Chinese Communist Party blasted President Biden’s decision to renew the investigation into whether the coronavirus leaked from a Chinese lab as “political manipulation” and one that “does not care about facts and truth.”

The Chinese Communist Party blasted President Biden’s decision to renew the investigation into whether the coronavirus leaked from a Chinese lab as “political manipulation” and one that “does not care about facts and truth.”  However loudly U.S. politicians vow to compete with China, they seem happy to quit the field and let Beijing win in one crucial area: trade. If President Joe Biden hopes to build a coalition in Asia to counterbalance China’s rise, he can’t afford such defeatism.

However loudly U.S. politicians vow to compete with China, they seem happy to quit the field and let Beijing win in one crucial area: trade. If President Joe Biden hopes to build a coalition in Asia to counterbalance China’s rise, he can’t afford such defeatism. Stocks in mainland China retreated from a three-day advance as commodity prices eased and lingering concerns about global inflation soured appetite for risks. Financial markets in Hong Kong were closed for a public holiday.

Stocks in mainland China retreated from a three-day advance as commodity prices eased and lingering concerns about global inflation soured appetite for risks. Financial markets in Hong Kong were closed for a public holiday. Shares in Alibaba surged on Monday after the e-commerce company said that a record $2.8bn (£2bn) fine handed down by Chinese regulators marked the end of an investigation into anti-competitive practices at the company.

Shares in Alibaba surged on Monday after the e-commerce company said that a record $2.8bn (£2bn) fine handed down by Chinese regulators marked the end of an investigation into anti-competitive practices at the company. Being “tough on China” is politically popular in Washington these days, and Biden has come out of the gate swinging against Beijing. But “being tough” isn’t a policy and reflexively applying it to China doesn’t serve U.S. interests. A logical and realistic approach to Beijing, however, can.

Being “tough on China” is politically popular in Washington these days, and Biden has come out of the gate swinging against Beijing. But “being tough” isn’t a policy and reflexively applying it to China doesn’t serve U.S. interests. A logical and realistic approach to Beijing, however, can.