London Money Laundering Raid Nets Almost $250 Million in Bitcoin

Patricia Claus, 13 July 2021

London’s Metropolitan police seized nearly £180 million ($248,993,100) of bitcoin on Saturday as part of a money laundering investigation.

London’s Metropolitan police seized nearly £180 million ($248,993,100) of bitcoin on Saturday as part of a money laundering investigation.

The seizure, announced on Tuesday, is only the latest in a string of such raids, including the confiscation of £114 million ($157,567,950) of the cryptocurrency last month. Police spokesmen told the press that criminal organizations were using cryptocurrency, including bitcoin, as a way to launder their ill-gotten takings. Continue reading “Article: London Money Laundering Raid Nets Almost $250 Million in Bitcoin”

U.S. equity futures and stocks posted modest gains Monday as investors prepared for a key Federal Reserve meeting later in the week. The rally in bond markets lost steam.

U.S. equity futures and stocks posted modest gains Monday as investors prepared for a key Federal Reserve meeting later in the week. The rally in bond markets lost steam.

U.S. Attorney General Merrick Garland warned Wednesday that ransom-motivated cyberattacks are “getting worse and worse,” echoing other top Biden administration officials who have sounded the alarm about the problem in recent weeks.

U.S. Attorney General Merrick Garland warned Wednesday that ransom-motivated cyberattacks are “getting worse and worse,” echoing other top Biden administration officials who have sounded the alarm about the problem in recent weeks.  The U.S. Justice Department released the first official expenditure report for the special investigation into the origins of the FBI’s Russia inquiry — providing a rare bit of insight into the secretive review more than two years after it was begun in response to demands by then-President Donald Trump.

The U.S. Justice Department released the first official expenditure report for the special investigation into the origins of the FBI’s Russia inquiry — providing a rare bit of insight into the secretive review more than two years after it was begun in response to demands by then-President Donald Trump. The Chinese Communist Party blasted President Biden’s decision to renew the investigation into whether the coronavirus leaked from a Chinese lab as “political manipulation” and one that “does not care about facts and truth.”

The Chinese Communist Party blasted President Biden’s decision to renew the investigation into whether the coronavirus leaked from a Chinese lab as “political manipulation” and one that “does not care about facts and truth.”  However loudly U.S. politicians vow to compete with China, they seem happy to quit the field and let Beijing win in one crucial area: trade. If President Joe Biden hopes to build a coalition in Asia to counterbalance China’s rise, he can’t afford such defeatism.

However loudly U.S. politicians vow to compete with China, they seem happy to quit the field and let Beijing win in one crucial area: trade. If President Joe Biden hopes to build a coalition in Asia to counterbalance China’s rise, he can’t afford such defeatism. Stocks in mainland China retreated from a three-day advance as commodity prices eased and lingering concerns about global inflation soured appetite for risks. Financial markets in Hong Kong were closed for a public holiday.

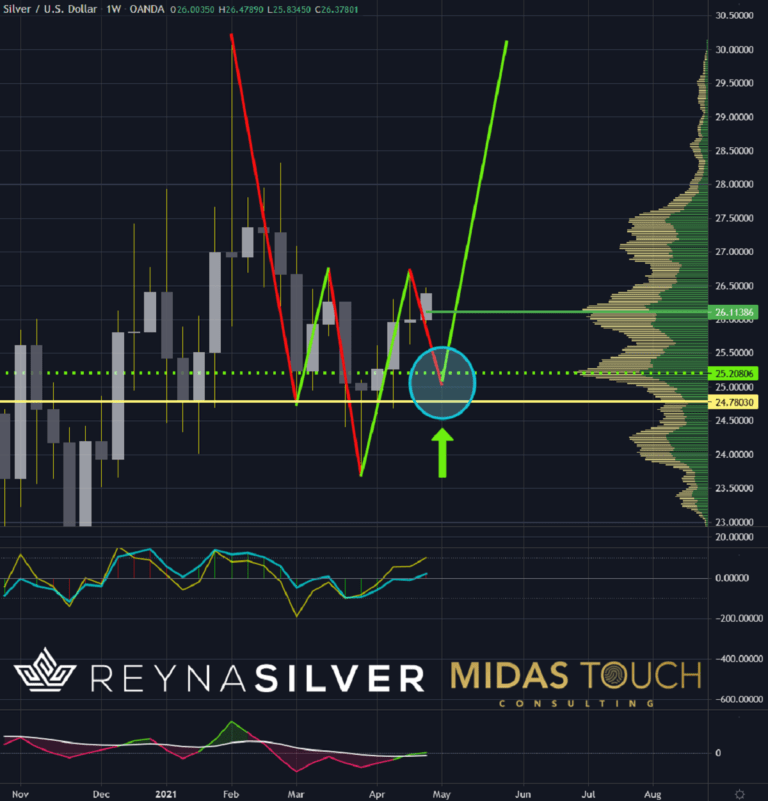

Stocks in mainland China retreated from a three-day advance as commodity prices eased and lingering concerns about global inflation soured appetite for risks. Financial markets in Hong Kong were closed for a public holiday. Gaining certainty about a clear picture of the future is getting more complex by the minute. Data arrives of never-seen occurrences that make it seemingly impossible to know how everything will pan out. President Biden demands higher taxation of the rich and a minimum wage of US$15. News about Silver market manipulation introduces fear into this market sector. Janet Yellen spoke of inflation. Many are talking about a possible hyperinflation. Others however are pointing towards the “Japanization” of America. On top, a recent New York Times headline reads: “Reaching herd immunity is unlikely in the U.S.”. All this noise is creating more confusion and pressure instead of clarity. The good news is: You do not need to know how the future unfolds to preserve your wealth. And Silver eats doubt for breakfast.

Gaining certainty about a clear picture of the future is getting more complex by the minute. Data arrives of never-seen occurrences that make it seemingly impossible to know how everything will pan out. President Biden demands higher taxation of the rich and a minimum wage of US$15. News about Silver market manipulation introduces fear into this market sector. Janet Yellen spoke of inflation. Many are talking about a possible hyperinflation. Others however are pointing towards the “Japanization” of America. On top, a recent New York Times headline reads: “Reaching herd immunity is unlikely in the U.S.”. All this noise is creating more confusion and pressure instead of clarity. The good news is: You do not need to know how the future unfolds to preserve your wealth. And Silver eats doubt for breakfast.  Chris Hedges: Don’t Be Fooled By Joe Biden

Chris Hedges: Don’t Be Fooled By Joe Biden The subsidies for child care in President Biden’s American Families Plan could have some unintended consequences for both families and child care businesses, including price increases, experts tell Fox News.

The subsidies for child care in President Biden’s American Families Plan could have some unintended consequences for both families and child care businesses, including price increases, experts tell Fox News.  Colombo, May 1: India and the US have designated themselves as “strategic partners” with political, economic and military dimensions to the relationship. But the partnership has kept coming under strain.

Colombo, May 1: India and the US have designated themselves as “strategic partners” with political, economic and military dimensions to the relationship. But the partnership has kept coming under strain.