Lydie Hudson is the Chief Compliance and Regulatory Affairs Officer at Credit Suisse AG and has been with Credit Suisse since 2008. She is also a member of the Executive Board of Credit Suisse Group AG and Credit Suisse AG since 2019. Prior to that, she worked at The Boston Consulting Group as a consultant and the Lehman Brothers as an associate analyst. Hudson received her Masters in Business Administration (MBA) at Harvard Business School

Lydie Hudson is the Chief Compliance and Regulatory Affairs Officer at Credit Suisse AG and has been with Credit Suisse since 2008. She is also a member of the Executive Board of Credit Suisse Group AG and Credit Suisse AG since 2019. Prior to that, she worked at The Boston Consulting Group as a consultant and the Lehman Brothers as an associate analyst. Hudson received her Masters in Business Administration (MBA) at Harvard Business School

Subject: Romeo Cerutti

Subject of Interest Romeo Cerutti is the General Counsel of Credit Suisse and a member of the Executive Board of Credit Suisse Group AG and Credit Suisse AG since 2009. Prior to that he was a partner at Lombard Odier Darier Hentsch & Cie Group Holding. He worked at Homburger Rechtsanwälte, Zurich, Attorney at Law, & Latham & Watkins, Los Angeles, Attorney at Law. He received his Post-doctorate degree in Law (Habilitation), University of Fribourg and was admitted to the bar of the State of California.

Romeo Cerutti is the General Counsel of Credit Suisse and a member of the Executive Board of Credit Suisse Group AG and Credit Suisse AG since 2009. Prior to that he was a partner at Lombard Odier Darier Hentsch & Cie Group Holding. He worked at Homburger Rechtsanwälte, Zurich, Attorney at Law, & Latham & Watkins, Los Angeles, Attorney at Law. He received his Post-doctorate degree in Law (Habilitation), University of Fribourg and was admitted to the bar of the State of California.

Release: President Trump Urged to Create DoD-DoJ Task Force on Financial Crime

Release

President Trump Urged to Create DoD-DoJ Task Force on Financial Crime

In combination, NSA data and DTCC discovery will end both naked short selling and money laundering associated with human trafficking as well as trafficking in drugs and weapons.

Continue reading “Release: President Trump Urged to Create DoD-DoJ Task Force on Financial Crime”

#UNRIG Video (*36:28) Naked Short Selling Witness #7 — Official Bill Majcher on Institutionalized Crime

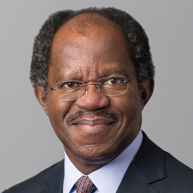

VideoSubject: Adebayo O. Ogunlesi

Subject of Interest Adebayo O. Ogunlesi has been on the Board of Directors of Goldman Sachs since 2012. He is the Lead Director. He is presently the Chairman and Managing Partner, Global Infrastructure Partners, a private equity firm that invests worldwide in infrastructure assets in the energy, transport, water and waste industry sectors. From 2004-2006, he worked for Credit Suisse, a financial services company, as Executive Vice Chairman and Chief Client Officer. Prior to working for Credit Suisse, he was the Law Clerk to the Honorable Thurgood Marshall, Associate Justice of the U.S. Supreme Court (1980-1981). He graduated from Oxford University, Harvard Business School and Harvard Law School.

Adebayo O. Ogunlesi has been on the Board of Directors of Goldman Sachs since 2012. He is the Lead Director. He is presently the Chairman and Managing Partner, Global Infrastructure Partners, a private equity firm that invests worldwide in infrastructure assets in the energy, transport, water and waste industry sectors. From 2004-2006, he worked for Credit Suisse, a financial services company, as Executive Vice Chairman and Chief Client Officer. Prior to working for Credit Suisse, he was the Law Clerk to the Honorable Thurgood Marshall, Associate Justice of the U.S. Supreme Court (1980-1981). He graduated from Oxford University, Harvard Business School and Harvard Law School.

Subject: Edwin Lin

Subject of Interest Edwin Lin is Head of Global Fixed Income at Citadel and is a member of Citadel’s Portfolio Committee. He first joined Citadel in 2011 as a Senior Portfolio Manager focused on global linear relative value strategies. Prior to joining Citadel, he was at Credit Suisse for 10 years where he most recently served as Head of USD Short-end and Basis Trading and as Head of Canadian Rates. Lin received a bachelor’s degree from Harvard College.

Edwin Lin is Head of Global Fixed Income at Citadel and is a member of Citadel’s Portfolio Committee. He first joined Citadel in 2011 as a Senior Portfolio Manager focused on global linear relative value strategies. Prior to joining Citadel, he was at Credit Suisse for 10 years where he most recently served as Head of USD Short-end and Basis Trading and as Head of Canadian Rates. Lin received a bachelor’s degree from Harvard College.

Subject: Lori Pennay

Subject of Interest Lori Pennay is a Senior Managing Director and Global Head of Human Resources and Partnership for Cantor Fitzgerald and BGC Partners, Inc. Previously, Ms. Pennay served as a Vice-President and Assistant General Counsel, where she provided legal advice and representation to Cantor and BGC with respect to employment and partnership matters. Prior to joining Cantor Fitzgerald, Ms. Pennay served as employment counsel for Credit (USA) LLC, where she was primarily responsible for providing legal advice and representation for the private banking and certain back office divisions. She began her career as an employment lawyer with the law firm of Akin, Gump, Strauss, Hauer & Feld, LLP. Ms. Pennay holds a B.A. from Pennsylvania State University with High Distinction honors and a J.D. from the University of Pennsylvania Law School.

Lori Pennay is a Senior Managing Director and Global Head of Human Resources and Partnership for Cantor Fitzgerald and BGC Partners, Inc. Previously, Ms. Pennay served as a Vice-President and Assistant General Counsel, where she provided legal advice and representation to Cantor and BGC with respect to employment and partnership matters. Prior to joining Cantor Fitzgerald, Ms. Pennay served as employment counsel for Credit (USA) LLC, where she was primarily responsible for providing legal advice and representation for the private banking and certain back office divisions. She began her career as an employment lawyer with the law firm of Akin, Gump, Strauss, Hauer & Feld, LLP. Ms. Pennay holds a B.A. from Pennsylvania State University with High Distinction honors and a J.D. from the University of Pennsylvania Law School.

Subject: James Buccola

Subject of Interest James Buccola is currently the Head of Fixed Income at Cantor Fitzgerald & Co., which he joined in December 2017, focusing on all Fixed Income Sales & Trading globally, as well as oversees CCRE, the Firm’s Commercial Mortgage Securities business.Prior to joining Cantor Fitzgerald & Co., Mr. Buccola was the Head of Securitized Products Trading at Credit Suisse Group AG.

James Buccola is currently the Head of Fixed Income at Cantor Fitzgerald & Co., which he joined in December 2017, focusing on all Fixed Income Sales & Trading globally, as well as oversees CCRE, the Firm’s Commercial Mortgage Securities business.Prior to joining Cantor Fitzgerald & Co., Mr. Buccola was the Head of Securitized Products Trading at Credit Suisse Group AG.

Subject: Karen Laureano-Rikardsen

Subject of Interest Karen Laureano-Rikardsen is the Chief Communications and Marketing Officer for Cantor Fitzgerald, L.P. Prior to joining Cantor, Laureano-Rikardsen held various senior communications and marketing roles at financial services firms, including CRT Capital Group, Credit Suisse and Dresdner Kleinwort Wasserstein. Ms. Laureano-Rikardsen earned a Bachelor’s Degree in International Affairs from the University of Maryland UC in Schwäbisch Gmünd Germany.

Karen Laureano-Rikardsen is the Chief Communications and Marketing Officer for Cantor Fitzgerald, L.P. Prior to joining Cantor, Laureano-Rikardsen held various senior communications and marketing roles at financial services firms, including CRT Capital Group, Credit Suisse and Dresdner Kleinwort Wasserstein. Ms. Laureano-Rikardsen earned a Bachelor’s Degree in International Affairs from the University of Maryland UC in Schwäbisch Gmünd Germany.

#UNRIG Video (33:44) Naked Short Selling Interview #4 – Alan M. Pollack on Wall Street Crime – Lock Them Up!

Video#UNRIG Video (39:06) Naked Short Selling Interview #1 – Wes Christian, pioneering attorney on the big picture

VideoArticle: Pandemic May Disrupt Discovery In Credit Suisse Forex Case

Article - Media, PublicationsPandemic May Disrupt Discovery In Credit Suisse Forex Case

Dean Seal, 17 April 2020

Counsel for investors and Credit Suisse cited the COVID-19 pandemic Monday when they asked a New York federal judge to push their discovery deadlines in a suit over alleged foreign exchange market manipulation by nine weeks.

In a letter to U.S. District Judge Lorna G. Schofield, attorneys for both sides in the long-running litigation said that in light of the threat to public health posed by the novel coronavirus, as well as the disruptions it has caused in air travel, continued discovery efforts would be risky and exceedingly difficult. Continue reading “Article: Pandemic May Disrupt Discovery In Credit Suisse Forex Case”

Article: Credit Suisse to Pay $6.5 Mln for Direct Market-Access Violations

Article - MediaCredit Suisse to Pay $6.5 Mln for Direct Market-Access Violations

Regulators on Monday fined Credit Suisse Securities $6.5 million and censured it for failing to control and have procedures for monitoring over $300 million of trading orders it allowed broker-dealers and other institutional clients to enter directly to it on U.S. securities exchanges over four years.

The U.S. unit of the Swiss bank executed over 300 billion shares for its direct market-access (DMA) clients from mid-2010 through mid-2014 without designing surveillance procedures to detect whether the orders were erroneous and potentially manipulative, the Financial Industry Regulatory Authority said in a letter of acceptance, waiver and consent signed by Credit Suisse.

Article: U.S. broker sanctioned for failing to guard against market manipulation

Article - Media, PublicationsU.S. broker sanctioned for failing to guard against market manipulation

James Langton, 23 December 2019

Credit Suisse Securities (USA) LLC has been sanctioned by the U.S. Financial Industry Regulatory Authority (FINRA) and a trio of U.S. exchanges for supervisory violations that allowed possible market manipulation.

The firm has been fined a combined US$6.5 million for a variety of violations that stemmed from providing direct market access that allowed certain clients to engage in potentially manipulative trading activity, including spoofing, layering and wash trading. Continue reading “Article: U.S. broker sanctioned for failing to guard against market manipulation”

Article: FINRA, Exchanges Blast Credit Suisse Over Failure to Prevent Market Manipulation

Article - Media, PublicationsFINRA, Exchanges Blast Credit Suisse Over Failure to Prevent Market Manipulation

Jeff Berman, 23 December 2019

The Financial Industry Regulatory Authority, Nasdaq, the New York Stock Exchange and Cboe Global Markets all censured Credit Suisse Securities and fined the firm $6.5 million for supervisory and Securities Exchange Act of 1934/Market Access Rule violations after repeated failures to prevent market manipulation, FINRA said Monday.

Credit Suisse signed a letter of acceptance, waiver and consent on Nov. 18 in which it agreed to the censure and $6.5 million fine, of which $566,583 is to be paid to FINRA for violating multiple rules. FINRA accepted the letter Nov. 19.

A Credit Suisse spokesman on Monday said only that the firm was “pleased to have resolved these matters with FINRA and these exchanges.” Continue reading “Article: FINRA, Exchanges Blast Credit Suisse Over Failure to Prevent Market Manipulation”