Influential UK Standards Watchdog Targets Cameron’s Greensill Lobbying

TYLER DURDEN, 31 March 2021

By now, the British media has been inundated with reports about the special access afforded Greensill Capital, the trade-finance firm that collapsed and filed for administration three weeks ago after its main insurer declined to renew policies on some of Greensill’s assets, setting off a chain reaction that ensnared some of Europe’s biggest banks (including the embattled Credit Suisse, which is simultaneously fighting off another scandal in the Archegos Capital blowup).

By now, the British media has been inundated with reports about the special access afforded Greensill Capital, the trade-finance firm that collapsed and filed for administration three weeks ago after its main insurer declined to renew policies on some of Greensill’s assets, setting off a chain reaction that ensnared some of Europe’s biggest banks (including the embattled Credit Suisse, which is simultaneously fighting off another scandal in the Archegos Capital blowup).

And many of these stories have focused on the firm’s relationship with former Prime Minister David Cameron, who was hired as a senior advisor by the firm after he left No. 10 Downing Street. Cameron continued to lobby on the firm’s behalf, even after the michegas at GAM a few years back that led to the departure of star trader Tim Haywood, one of the most high-profile investors in London. It was reported that alleged misconduct attributed to Haywood had to do with his investments in Greensill paper – paper that was reportedly tied to Sanjay Gupta’s GFG Alliance group of companies, who have also emerged as main characters in the collapse of a group of Credit Suisse funds (the bank is now tallying client losses and even weighing the possibility of reimbursing some of its more important clients who have threatened to take their business elsewhere). Continue reading “Article: Influential UK Standards Watchdog Targets Cameron’s Greensill Lobbying”

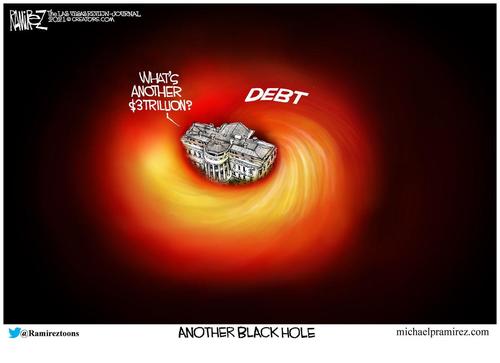

“We are now speeding down the road of wasteful spending and debt, and unless we can escape we will be smashed in inflation.”- Herbert Hoover

“We are now speeding down the road of wasteful spending and debt, and unless we can escape we will be smashed in inflation.”- Herbert Hoover

Earlier, several financial media outlets reported that Credit Suisse was considering dramatically shrinking or selling off its prime brokerage unit, the hedge-fund-focused business that just lost $4.7 billion for the bank, obliterating 18 months of the bank’s average net profits.

Earlier, several financial media outlets reported that Credit Suisse was considering dramatically shrinking or selling off its prime brokerage unit, the hedge-fund-focused business that just lost $4.7 billion for the bank, obliterating 18 months of the bank’s average net profits. ‘Pro-Crypto’ Peter Thiel Warns Bitcoin “Could Be A Chinese Financial Weapon Against The US”

‘Pro-Crypto’ Peter Thiel Warns Bitcoin “Could Be A Chinese Financial Weapon Against The US” In the aftermath of the Archegos blow up, the biggest nightmare on Wall Street – where there is never just one cockroach – is that (many) more Archegos-style, highly levered “family office” blow ups are waiting just around the corner.

In the aftermath of the Archegos blow up, the biggest nightmare on Wall Street – where there is never just one cockroach – is that (many) more Archegos-style, highly levered “family office” blow ups are waiting just around the corner. The collapse of UK-based supply chain finance firm Greensill Capital continues to reverberate. In Germany the private banking association has paid out around €2.7 billion to more than 20,500 Greensill Bank customers as part of its deposit guarantee scheme after the bank collapsed in early March. But the deposits of institutional investors such as other financial institutions, investment firms, and local authorities are not covered. Fifty municipalities are believed to be nursing losses of at least €500 million.

The collapse of UK-based supply chain finance firm Greensill Capital continues to reverberate. In Germany the private banking association has paid out around €2.7 billion to more than 20,500 Greensill Bank customers as part of its deposit guarantee scheme after the bank collapsed in early March. But the deposits of institutional investors such as other financial institutions, investment firms, and local authorities are not covered. Fifty municipalities are believed to be nursing losses of at least €500 million.  Goldman Sachs managed to avoid billions of dollars in potential losses from the implosion of highly levered hedge fund Archegos Capital Management by breaking ranks with other syndicate banks to dump large blocks of shares representing Archegos’s exposure to a coterie of tech and media names. When the dust settled, the bank told shareholders any losses would be insignificant, while Credit Suisse, the bank with perhaps the biggest exposure, said Tuesday it has booked a nearly $5 billion loss.

Goldman Sachs managed to avoid billions of dollars in potential losses from the implosion of highly levered hedge fund Archegos Capital Management by breaking ranks with other syndicate banks to dump large blocks of shares representing Archegos’s exposure to a coterie of tech and media names. When the dust settled, the bank told shareholders any losses would be insignificant, while Credit Suisse, the bank with perhaps the biggest exposure, said Tuesday it has booked a nearly $5 billion loss.  President Biden has come under fire by House Republicans for ‘hypocritically’ using an IRS loophole to avoid paying taxes on $13 million in income for tax years 2017 and 2018, while slamming wealthy Americans for using similar schemes to minimize their tax burden, according to Fox News.

President Biden has come under fire by House Republicans for ‘hypocritically’ using an IRS loophole to avoid paying taxes on $13 million in income for tax years 2017 and 2018, while slamming wealthy Americans for using similar schemes to minimize their tax burden, according to Fox News. More than 2 months have passed since Robinhood shut off trading in Gamestop while the firm’s shares soared past the $400 mark, marking a historic confrontation between an army of GME-hodling “apes” and hedge funds like Melvin Capital, not to mention the mighty hedge fund-market maker Citadel, that would cement GME’s status as a favorite of the “Wall Street Bets” retail-trading army.

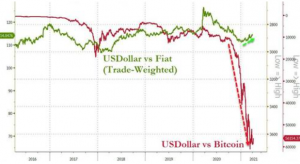

More than 2 months have passed since Robinhood shut off trading in Gamestop while the firm’s shares soared past the $400 mark, marking a historic confrontation between an army of GME-hodling “apes” and hedge funds like Melvin Capital, not to mention the mighty hedge fund-market maker Citadel, that would cement GME’s status as a favorite of the “Wall Street Bets” retail-trading army. Dusted off an anecdote from 2016 that explores the meaning of money. It is worth considering after a quarter in which the US dollar declined by more than 50% versus the dominant digital assets and the S&P 500 closed at an all-time high.

Dusted off an anecdote from 2016 that explores the meaning of money. It is worth considering after a quarter in which the US dollar declined by more than 50% versus the dominant digital assets and the S&P 500 closed at an all-time high. Non-fungible tokens, or NFTs, are changing the way we think about art (and other collectibles), and in 2021, investors have started to take notice. As Decrypt writes, in the last year, NFTs have shot to the forefront of the crypto space. The cryptographically-unique tokens make it possible to create real-world scarcity for digital objects, and artists have seized on the opportunity presented by the technology.

Non-fungible tokens, or NFTs, are changing the way we think about art (and other collectibles), and in 2021, investors have started to take notice. As Decrypt writes, in the last year, NFTs have shot to the forefront of the crypto space. The cryptographically-unique tokens make it possible to create real-world scarcity for digital objects, and artists have seized on the opportunity presented by the technology. It’s official: the Financial Times (citing an informal polling of anonymous bankers) has declared Deliveroo’s botched London offering the “worst IPO in London’s history.”

It’s official: the Financial Times (citing an informal polling of anonymous bankers) has declared Deliveroo’s botched London offering the “worst IPO in London’s history.” Another Wirecard? Invoices Backing Greensill-Issued Bonds Never Existed, Administrator Finds

Another Wirecard? Invoices Backing Greensill-Issued Bonds Never Existed, Administrator Finds By now, the British media has been inundated with reports about the special access afforded Greensill Capital, the trade-finance firm that collapsed and filed for administration three weeks ago after its main insurer declined to renew policies on some of Greensill’s assets, setting off a chain reaction that ensnared some of Europe’s biggest banks (including the embattled Credit Suisse, which is simultaneously fighting off another scandal in the Archegos Capital blowup).

By now, the British media has been inundated with reports about the special access afforded Greensill Capital, the trade-finance firm that collapsed and filed for administration three weeks ago after its main insurer declined to renew policies on some of Greensill’s assets, setting off a chain reaction that ensnared some of Europe’s biggest banks (including the embattled Credit Suisse, which is simultaneously fighting off another scandal in the Archegos Capital blowup).