The Next ‘Gamestop’: How China or Russia Could Attack Our Financial System

Robert Carlson, Gray Gaertner, 16 March 2021

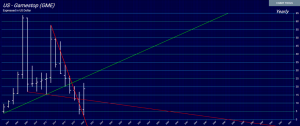

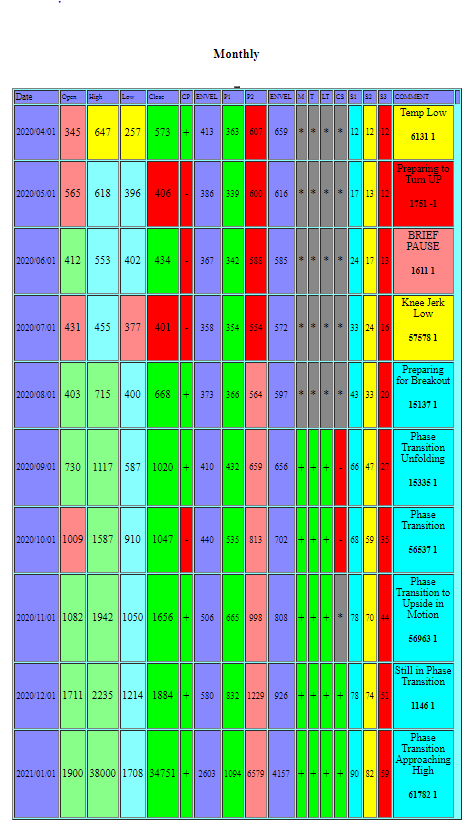

Last week, the dramatic rise and fall in the price of Gamestop demonstrated how vulnerable the stock market is to social media speculation. U.S. regulators should now turn their attention to a greater risk—that in the near future, China, Russia, or another adversary could coordinate an unwitting mob to harm the American financial system.

The potential for financial warfare follows from a playbook that China, and especially Russia, have drawn from repeatedly to meddle in U.S. domestic politics. First, foreign state agents have used social media to spread disinformation or stoke existing grievances. Second, they have counted on naive users to share the original posts, allowing the content to reach a larger audience. Finally, they fan the flames to provoke action.

In 2016 and 2020, Russian propaganda decreased U.S. voters’ trust in their candidates and the political system. During last year’s protests over race and policing, foreign bots amplified instances of both racial discrimination and violent protests, further polarizing American society. Following Joe Biden’s electoral victory in November, Russian agents embraced false allegations of fraud, providing the rationale for an armed mob to assault the Capitol Building. China spends at least $10 billion per year on its own influence operations through the United Front Work Department, which promotes pro-Beijing narratives overseas.

The Korean Stockholders’ Alliance is located in Yeouido, Seoul’s financial and political district, on the fifth floor of an officetel building mostly occupied by financial companies. Jung Eui-jung, the 62-year-old head of the Alliance and the sole resident of its office, points out the window to a large, bright-yellow bus parked outside on Eunhaengro (“bank street”), so named because it is home to South Korea’s two main state banks. The Alliance is an advocacy group that represents retail investors, with around 41,000 members. Its current mission statement is displayed in block letters on the side of the bus: “I hate short selling!”

The Korean Stockholders’ Alliance is located in Yeouido, Seoul’s financial and political district, on the fifth floor of an officetel building mostly occupied by financial companies. Jung Eui-jung, the 62-year-old head of the Alliance and the sole resident of its office, points out the window to a large, bright-yellow bus parked outside on Eunhaengro (“bank street”), so named because it is home to South Korea’s two main state banks. The Alliance is an advocacy group that represents retail investors, with around 41,000 members. Its current mission statement is displayed in block letters on the side of the bus: “I hate short selling!” Keith Patrick Gill (born June 8, 1986) is an American financial analyst and investor known for his posts on the subreddit r/wallstreetbets

Keith Patrick Gill (born June 8, 1986) is an American financial analyst and investor known for his posts on the subreddit r/wallstreetbets At the House Financial Services Committee hearing last week on the GameStop debacle, there was an elephant in the room: naked short selling.

At the House Financial Services Committee hearing last week on the GameStop debacle, there was an elephant in the room: naked short selling.