GameStop Update | Armstrong Economics

Martin Armstrong, 15 March 2021

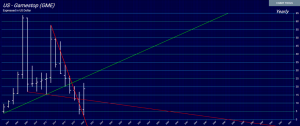

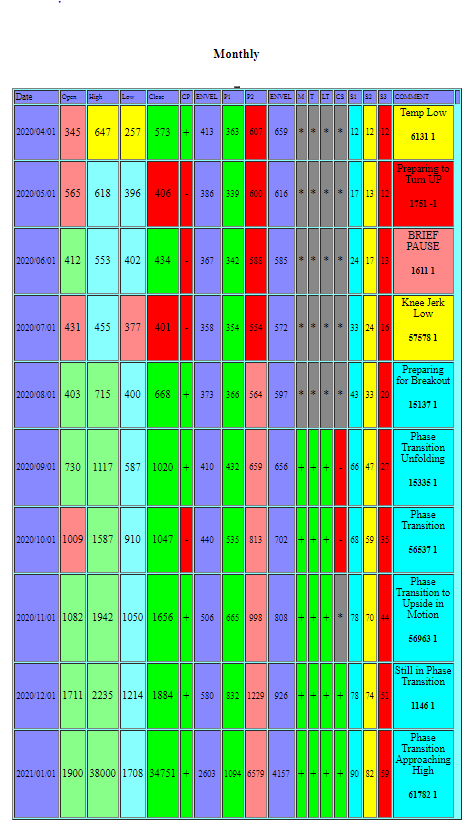

Gamestop has rallied back during the week of March 8th after all the hoopla. Cyclically, it was 13 years down and it was due for a bounce. Even our pattern recognition models picked up the rally starting in August 2020. Quite frankly, this has all the hallmarks of manipulation, but not what you may think. The classic manipulation is to pump up a market touting some player but the pros have already been in the market. This is how the Buffet manipulation of silver was done in 1998 and even the entire Hunt Brothers silver rally back in 1980.

I knew the Hunt Brothers were buying silver from the early 1970s. At the end, their name was attached to silver and the claim was they were taking it to $100. At that time, the exchange pulled the same maneuver and made it a fraction in margin to go short but 10x that to go long. The Hunts were trapped and could not sell anything without everyone jumping in front of them,

Melvin Capital, which was a small hedge fund lost 53% of its capital in January on GameStop. Not sure how that was possible unless the bet was purely a gut-trade rather than quantitative. The four largest asset managers in the world together own 39 percent of GameStop shares, according to regulatory filings. Those stakes, which are mostly held for years in passive index funds, have collectively gained roughly $1 billion in value since the beginning of this year. The hype of a huge short-squeeze seems to be exaggerated. One hedge fund, Senvest Management, recently boasted to clients that it made more than $700 million from a bet on GameStop in September, the Wall Street Journal reported. Certainly, our model was long, not short and I cannot see even a trend-following-model that would have been short. Melvin Capital to lose 53% does not seem to be very professional to lost that much on a single stock. The long-term is not over in this stock.