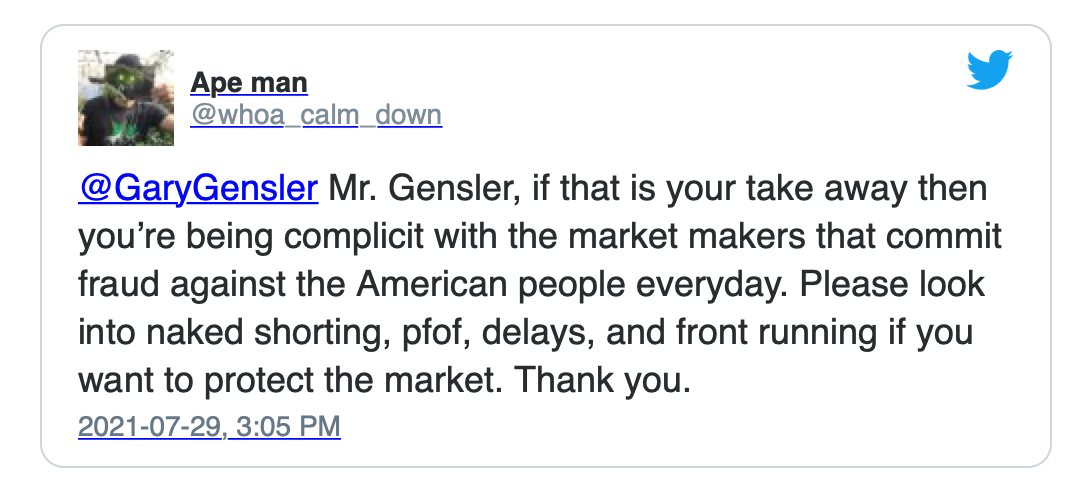

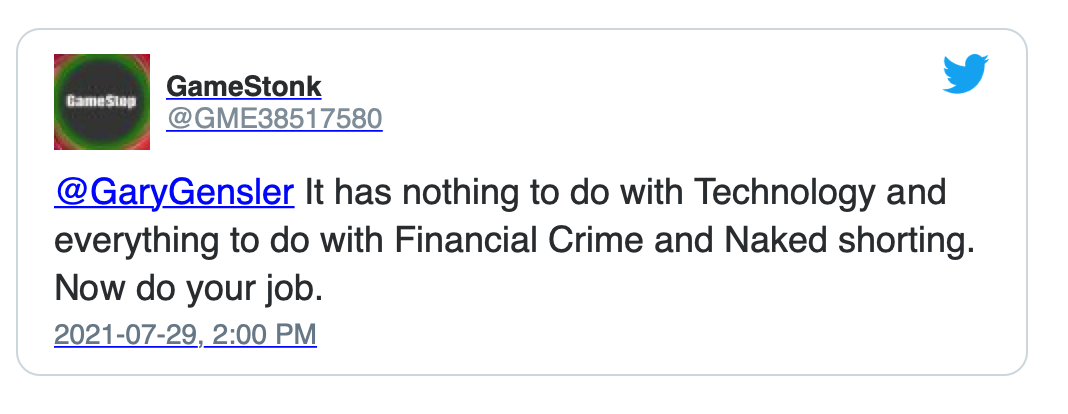

Tweet by GameStonk on Twitter

Tweet

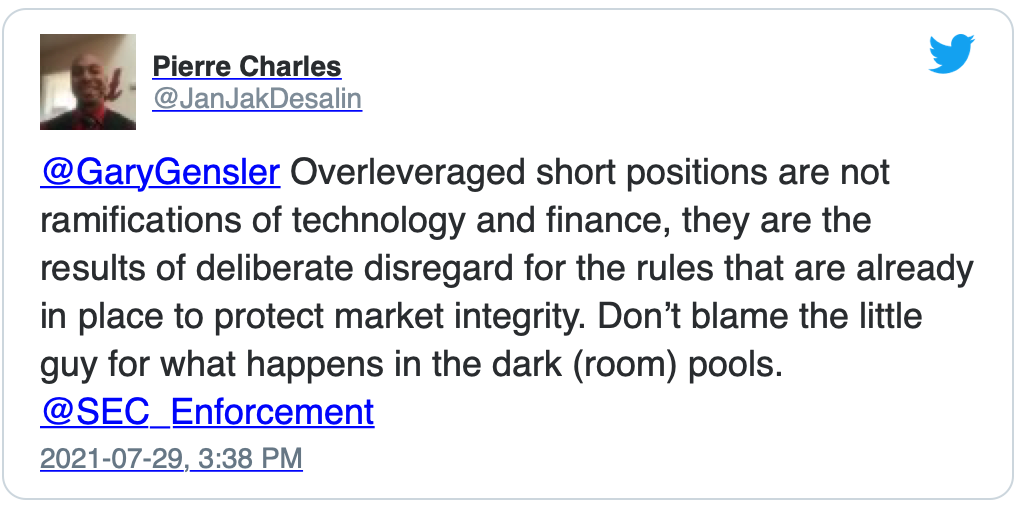

Tweet by Pierre Charles on Twitter

Tweet

Article: Robinhood Says U.S. Demanded Access to CEO Tenev’s Phone Records

Article - MediaRobinhood Says U.S. Demanded Access to CEO Tenev’s Phone Records

Jesse Westbrook, 02 July 2021

Robinhood Markets Inc., dogged by fines and regulatory scrutiny, revealed several new inquires from state and federal watchdogs as it seeks to sell shares in one of the year’s most anticipated public offerings.

Robinhood Markets Inc., dogged by fines and regulatory scrutiny, revealed several new inquires from state and federal watchdogs as it seeks to sell shares in one of the year’s most anticipated public offerings.

Among the fresh disclosures made in its registration statement: U.S. prosecutors demanded access to Chief Executive Officer Vlad Tenev’s mobile phone, New York is poised to penalize the brokerage for alleged money-laundering lapses and brokerage regulators called it out for not reporting trades. Continue reading “Article: Robinhood Says U.S. Demanded Access to CEO Tenev’s Phone Records”

Article: SEC Launches Review Of High-Frequency Traders’ Market Abuses

Article - Media SEC Launches Review Of High-Frequency Traders’ Market Abuses

SEC Launches Review Of High-Frequency Traders’ Market Abuses

Tyler Durden, 09 June 2021

Nearly 8 years have passed since Michael Lewis published “Flash Boys”, raising awareness of the relatively new practice of high-frequency trading and its transformative impact on markets, allowing the most technologically-advanced traders to effectively see a picture of the market that’s nanoseconds ahead of what their non-NFT peers see, giving them a massive advantage.

Now, the SEC is finally considering changing the rules of how stocks are priced and traded to stop exchanges from incentivizing brokers (nowadays, particularly retail trading brokerages that have seen an explosion of activity in the past couple of years).

Tweet by Bob Pisani on Twitter – SEC Chair Gary Gensler V

TweetSEC Chair Gary Gensler @PiperSandler Exchange Conf:

Payment for order flow raises a number of important questions. Do broker-dealers have inherent conflicts of interest? If so, are customers getting best execution in the context of that conflict?

@SEC_News @CNBC— Bob Pisani (@BobPisani) June 9, 2021

Tweet by Bob Pisani on Twitter – SEC Chair Gary Gensler IV

TweetSEC Chair Gary Gensler @PiperSandler Exchange Conf:

Gamification of trading has features that may encourage investors to trade more, leading to more payment for order flow for the brokers. more active trading may result in lower returns for the average trader.@SEC_News @CNBC— Bob Pisani (@BobPisani) June 9, 2021

Tweet by Bob Pisani on Twitter – SEC Chair Gary Gensler III

TweetSEC Chair Gary Gensler @PiperSandler Exchange Conf: public exchanges account for only 53% of trading volume. 9% from dark pools, 38% from off-exchange wholesalers. Exchanges compete to offer best price, but wholesalers use a less competitive benchmark.@SEC_News @CNBC

— Bob Pisani (@BobPisani) June 9, 2021

Tweet by Bob Pisani on Twitter – SEC Chair Gary Gensler II

TweetSEC Chair Gary Gensler @PiperSandler Exchange Conf:

there are signs hat the NBBO [National Best Bid and Offer] is not a complete enough representation of the market with half of the trading interest either in dark pools or is internalized by wholesaler.@SEC_News @CNBC— Bob Pisani (@BobPisani) June 9, 2021

Tweet by Bob Pisani on Twitter – SEC Chair Gary Gensler

TweetSEC Chair Gary Gensler @PiperSandler Exchange Conf:

We now have the technology to further shorten the settlement cycles, not only to T+1, but even to same-day settlement — T+0 or “T+evening. Shortening the settlement cycle could reduce costs and risks.

@SEC_News @CNBC— Bob Pisani (@BobPisani) June 9, 2021

Tweet by 1tallflyer: Buy it and they will come. on Twitter

TweetGary Gensler knows the real story Gaspy. Naked shorts, dark pooling the buys, sending buys to OTC and other places. AMC and GME prices would be 4x where they are now If not for the cheating. Wake up Gaspy and stop speaking for the hedgies. Thank you both.

— 1tallflyer: Buy it and they will come. (@1tallflyer) June 8, 2021

Article: SEC plans to go after market manipulation on social media, executive insider trading, Gensler says

Article - MediaSEC plans to go after market manipulation on social media, executive insider trading, Gensler says

Chris Matthews, 07 June 2021

Securities and Exchange Commission Chairman Gary Gensler said Monday that his agency is focused on adopting new rules to guard against company executives using private information to opportunistically sell shares of companies they oversee, while acknowledging that the SEC must come up with new strategies to guard against market manipulation on social media.

Securities and Exchange Commission Chairman Gary Gensler said Monday that his agency is focused on adopting new rules to guard against company executives using private information to opportunistically sell shares of companies they oversee, while acknowledging that the SEC must come up with new strategies to guard against market manipulation on social media.

The SEC adopted regulations about 20 years ago, called 10b5-1 plans, that enable company insiders to buy and sell securities in their own company if those transactions are made by a third party who is not aware of material, non-public information.

“In my view, these plans have led to real cracks in our insider trading regime,” Gensler said at the Wall Street Journal’s CFO Network Summit Monday.

One concern Gensler has is that there is no “cooling off period” mandated by the SEC for when a 10b5-1 plan is adopted and when it can start trading, though research shows that 40% of such plans begin trading within just two months after they are opened, while 14% start trading within a month.

Futhermore, there is no limitation as to how many 10b5-1 plans insiders can open, making it easier for an insider to shut down one or many plans if he has public information that suggests that it would be profitable to do so.

“Insiders can cancel a plan when they do have material non-public information. This seems upside-down to me. It also may undermine investor confidence,” Gensler said. “In my view, canceling a plan may be as economically significant as carrying out an actual transaction,” he added. “Thus, I’ve asked staff to consider limitations on when and how plans can be canceled.”

Article: ‘Meme’ mob behind Gamestop frenzy might still imperil soaring AMC

Article - Media, Publications‘Meme’ mob behind Gamestop frenzy might still imperil soaring AMC

Charles Gasparino, 29 May 2021

Adam Aron says he wants to increase his Twitter following to include about 1,000 more professed small-investor shareholders of the company he runs, AMC Entertainment.

Adam Aron says he wants to increase his Twitter following to include about 1,000 more professed small-investor shareholders of the company he runs, AMC Entertainment.

His goal is to better “understand this phenomenon that has changed who owns AMC.” But based on the type of AMC shareholder who hangs out on Twitter, he may be surprised — and more than a little embarrassed — by what he finds.

AMC, of course, is the world’s largest movie-chain business, synonymous for many years with blockbuster movies, sticky floors and terribly overpriced popcorn. Continue reading “Article: ‘Meme’ mob behind Gamestop frenzy might still imperil soaring AMC”

Article: SEC chair Gensler says agency will enforce rules ‘aggressively’ against bad actors

Article - Media, Publications SEC chair Gensler says agency will enforce rules ‘aggressively’ against bad actors

SEC chair Gensler says agency will enforce rules ‘aggressively’ against bad actors

Bob Pisani, 20 May 2021

Securities and Exchange Commission Chair Gary Gensler said he would be aggressively pursuing bad financial actors who were “playing with working families’ savings.”

Gensler made his remarks at a Financial Industry Regulatory Authority conference with Robert Cook, president and CEO of FINRA. FINRA is the agency that regulates broker-dealers and exchanges.

As he did in his recent Congressional testimony, Gensler emphasized that enforcement would be a key part of protecting the public.

Article: SEC IMPLEMENTS KEY STEP FOR DERIVATIVES OVERSIGHT 11 YEARS AFTER DODD-FRANK

Article - Media, PublicationsSEC IMPLEMENTS KEY STEP FOR DERIVATIVES OVERSIGHT 11 YEARS AFTER DODD-FRANK

RICK STEVES, 11 May 2021

The U.S. Securities and Exchange Commission (SEC) has approved the DTCC Data Repository (U.S.) application to operate as a registered security-based swap data repository (SBSDR).

The U.S. Securities and Exchange Commission (SEC) has approved the DTCC Data Repository (U.S.) application to operate as a registered security-based swap data repository (SBSDR).

This is a key step in completing the implementation of derivatives oversight in the U.S., which was set out in Title VII of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank). Dodd-Frank divided the regulatory oversight of derivatives between the SEC for security-based swaps (SBS; those that reference single security or loan or a credit default swap that references a narrow-based index) and the Commodity Futures Trading Commission for all other swaps. Continue reading “Article: SEC IMPLEMENTS KEY STEP FOR DERIVATIVES OVERSIGHT 11 YEARS AFTER DODD-FRANK”