All reporting agencies have been fooled by Hedge funds, trading platforms, MMs etc etc…. nothing new… fines are in the millions when they make $Billions with fake reporting and fraudulent trades….@SEC_Enforcement still waking up….$AMC $GME @ORTEX

— real aloy (@rimisback) June 30, 2021

Article: TLC: THE LONG CON: The markets are frothing with liquidity. PART 1

Article - Media TLC: THE LONG CON: The markets are frothing with liquidity. PART 1

TLC: THE LONG CON: The markets are frothing with liquidity. PART 1

Reddit: u/con101smd, 22 June 2021

TLC: THE LONG CON:

The markets are frothing with liquidity.

How Wall St. conquered the wild west of crypto by laundering funds obtained from illegal naked short selling practices through stock market exchanges worldwide.

Mobile Edition & full PDF: https://docs.google.com/document/d/1fdZV5B6RtyVurxcVsXAOtWNn5NE8BZS1TPu24ZAzLkI/edit?usp=sharing

Article: New NSCC Rule Change Poised to End the Short Squeeze Saga

Article - Media

New NSCC Rule Change Poised to End the Short Squeeze Saga

Tim Fries, 22 June 2021

On Wednesday, market makers, which are also DTCC clearing members, will have to tighten up their short-selling belts. Because their available capital will be contrasted more frequently with member deposits, their ability to maintain massive short positions is slated to be crippled.

Article: How the GameStop Hustle Worked

Article - Media How the GameStop Hustle Worked

How the GameStop Hustle Worked

Lucy Komisar, 22 June 2021

I have written previously for the Prospect about the frenzy over GameStop (GME), the video game and electronics company. By now, you know the story. Millions of retail investors made the stock soar by over 1,000 percent in January 2021. This brought disaster upon a handful of hedge funds that had bet on GameStop’s stock to drop. According to Markets Insider, one analyst estimated losses in February of roughly $19 billion. The hedge fund Melvin Capital reportedly closed out its position after taking a drubbing of 51 percent. Another fund, Maplelane, lost 40 percent.

Mirror: Former Hedge Fund Trader Shares Key Insights About AMC and GME

VideoTweet by Susanne Trimbath PhD on Twitter

TweetThe self-regulatory system is a suicide pact. Wall Street will stick to it even in the face of investor protests, issuing company complaints and the next financial crisis. It's 2008 Redux! https://t.co/8wSL1295ji

— Susanne Trimbath PhD (@SusanneTrimbath) June 12, 2021

Taibbi: Let the Apes Have Wall Street

Article - MediaTaibbi: Let the Apes Have Wall Street

Alert Reader Comment:

Ultimately, it doesn’t matter who’s behind the mercurial surges of stocks like GME. Either way, the chaos is exposing

Wall Street for the preposterous collection of circus acts it’s always been, with the naked shorting issue being just one example

Tweet by 1tallflyer: Buy it and they will come. on Twitter

TweetGary Gensler knows the real story Gaspy. Naked shorts, dark pooling the buys, sending buys to OTC and other places. AMC and GME prices would be 4x where they are now If not for the cheating. Wake up Gaspy and stop speaking for the hedgies. Thank you both.

— 1tallflyer: Buy it and they will come. (@1tallflyer) June 8, 2021

Article: Occupy Wall Street 2.0

Article - Media, PublicationsAnonymous, 21 April 2021

It’s going on right now. Here’s your chance to get back at those Wall Street fucks who recklessly crash the economy again and again because you guessed it, they’re going to crash it again. Imminently. Except this time people on the internet caught on and the SEC is passing regulations to control the crash to make sure the hedge funds are the ones left holding the bag.

Create a trading account on Fidelity or something (but NOT Robinhood) and buy a share of Game Stop (GME) and hold it. Hold it while market crashes, except the price GME will go up. Supply and demand; you will be holding a precious share that a hedge fund will need to buy back from you. See, they created millions of “naked short” shares and traded them back and forth in an attempt to bankrupt GameStop so they could keep the money for themselves, tax free. But for the first time ever retail investors, (i.e. you) spoiled their plan by buying them up and holding them. The apes on r/Superstonk can explain it better than I can so do yourself a favor and learn. One share is hovering around $150 before takeoff. Then one share could quite possibly sell for millions and they will HAVE to buy it from you.

Article: GameStop plans to elect activist investor Cohen as chairman

Article - Media, Publications GameStop plans to elect activist investor Cohen as chairman

GameStop plans to elect activist investor Cohen as chairman

Reuters, 08 April 2021

GameStop Corp, which has been part of a recent Reddit-driven trading frenzy, said on Thursday it intends to elect activist investor Ryan Cohen as chairman, putting him in the driver’s seat as he looks to transform the videogame retailer.

Since Chewy co-founder Cohen joined GameStop’s board in January, he has been pushing towards transformation of the brick-and-mortar retailer into an e-commerce firm that can take on big-box retailers such as Target Corp and technology firms such as Microsoft Corp.

Article: GameStop Takes $6 Billion Round Trip as Results Shrugged Off

Article - Academic, Publications GameStop Takes $6 Billion Round Trip as Results Shrugged Off

GameStop Takes $6 Billion Round Trip as Results Shrugged Off

Bailey Lipschultz,27 March 2021

GameStop Corp. is ending the week where it started, after an earnings-related selloff was quickly reversed, with retail investors refusing to let go of their commitment to the stock.

Investors were quick to get over GameStop’s 12th consecutive quarter of slowing sales and management’s decision to not take questions on its earnings call on Tuesday, despite warnings from most Wall Street analysts. After see-sawing to as low as $118.62, the stock was trading near last week’s closing level on Friday. That created a more than $6.4 billion swing in market value from Monday’s intraday high to a bottom on Wednesday.

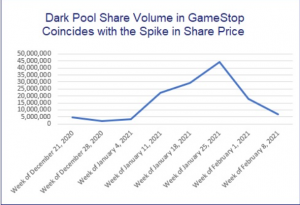

Article: A Massive Increase in Trading in GameStop by Dark Pools Owned by the Mega Wall Street Banks Coincided with the Spike in its Share Price

Article - Media, PublicationsPam Martens and Russ Martens, 26 March 2021

If the Securities and Exchange Commission is not taking a hard look at the involvement of Dark Pools owned by the biggest banks on Wall Street during the meteoric spike in the price of GameStop shares in late January, then we have to conclude that it doesn’t want to actually get at the truth.

Wall Street On Parade spent one hour combing through the Dark Pool trading data available through Wall Street’s self-regulator, FINRA, and the evidence of Dark Pools’ involvement in the dodgy trading in GameStop is striking. (GameStop is a New York Stock Exchange listed company and it has been trading like a penny stock operated out of a boiler room – raising questions about the integrity of U.S. markets.

Article: Stocks Dump’n’Pump; Dollar Gains Amid Bitcoin, Bond Pain

Article - Media, Publications Stocks Dump’n’Pump; Dollar Gains Amid Bitcoin, Bond Pain

Stocks Dump’n’Pump; Dollar Gains Amid Bitcoin, Bond Pain

Tyler Durden,25 March 2021

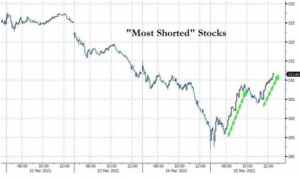

Thanks to yet another big short-squeeze that began shortly ahead of the EU close. This was the biggest short-squeeze since late January. Small Caps went from down over 1.5% ahead of the EU close to up over 2.5%. Nasdaq ended lower as late day selling pressure hit…

Before today, the last six days have seen the market has dropped in the last hour. S&P and Dow are back to unch on the week, Nasdaq remains red and Small Caps still down over 4.3%.Value outperformed Growth today but both ripped off the EU close…

Robert Steele: The Rigging Continues, SEC & DTCC Lying Again

Uncategorized DTCC is a “self-regulating organization” which is code for Licensed to Steal with Impunity. The SEC and DTCC (and the Senate Banking Commission and the US Attorney for the Southern District of New York) are RICO organizations. The fraud continues apace.

DTCC is a “self-regulating organization” which is code for Licensed to Steal with Impunity. The SEC and DTCC (and the Senate Banking Commission and the US Attorney for the Southern District of New York) are RICO organizations. The fraud continues apace.

Alert Reader comments:

Continue reading “Robert Steele: The Rigging Continues, SEC & DTCC Lying Again”

Article: Class Action Lawsuit Filed Against ‘Roaring Kitty’ After GameStop Short Squeeze: What You Need To Know

Article - Media, PublicationsMelanie Schaffer, 17 February 2021

Lawsuits related to the Gamestop Corporation GME 0.1% short squeeze have been stacking up following the volatile trading in the stock in January.

Lawsuits related to the Gamestop Corporation GME 0.1% short squeeze have been stacking up following the volatile trading in the stock in January.

Keith Patrick Gill, viewed by many as the leader of the debacle, is now facing a class action lawsuit. What Happened: On Tuesday, the law firm Hagens Berman announced that it has filed a securities class action suit against Gill in U.S. District Court, accusing him of “price manipulation of GameStop stock.”

Gill is known as “Roaring Kitty” on YouTube and DeepF*ckingValue on Reddit. In prepared remarks Gill plans to deliver to the U.S. House Committee on Financial Services on Thursday, he denies wrongdoing.

A Massive Increase in Trading in GameStop by Dark Pools Owned by the Mega Wall Street Banks Coincided with the Spike in its Share Price

A Massive Increase in Trading in GameStop by Dark Pools Owned by the Mega Wall Street Banks Coincided with the Spike in its Share Price