FOCUS-Results tally up billions in profit from Texas freeze for gas and power sellers

Devika Krishna Kumar, Scott DiSavino and Jessica Resnick-Ault, 06 May 2021

Natural gas suppliers, pipeline companies and banks that trade commodities have emerged as the biggest market winners from February’s U.S. winter blast that roiled gas and power markets, according to more than two dozen interviews and quarterly earnings reports.

The deep freeze caught Texas’s utilities off-guard, killed more than 100 people and left 4.5 million without power. Demand for heat pushed wholesale power costs to 400 times the usual amount and propelled natural gas prices to record highs, forcing utilities and consumers to pay exorbitant bills. Continue reading “Article: FOCUS-Results tally up billions in profit from Texas freeze for gas and power sellers”

Money managers intimate a growing confidence that oil prices have room to run higher this year, thanks to expectations of a robust economic rebound and rising global demand for crude.

Money managers intimate a growing confidence that oil prices have room to run higher this year, thanks to expectations of a robust economic rebound and rising global demand for crude.  Having the collateral to cover stock trading is important to oil the market cogs. With margin trading, it is critical, a lesson learned the hard way from “Bill” Hwang last month. From today, the SEC will decide which brokerages failed to cover their securities trading, and what punishments it will dish out.

Having the collateral to cover stock trading is important to oil the market cogs. With margin trading, it is critical, a lesson learned the hard way from “Bill” Hwang last month. From today, the SEC will decide which brokerages failed to cover their securities trading, and what punishments it will dish out. What happens when a company set up by the Chinese government to help clean up toxic debt in the country’s banking system gets into trouble itself? We’re finding out now. Investors were spooked in April after China Huarong Asset Management Co., one of the country’s biggest distressed asset managers, failed to release financial statements in the wake of the execution of its former top executive for bribery. That raised questions about its financial health — and broader worries about whether China would let an institution backed by the central government fail. The ending of a presumed safety net that’s long been priced into Chinese bond values would mean a seismic shift for investors across emerging markets.

What happens when a company set up by the Chinese government to help clean up toxic debt in the country’s banking system gets into trouble itself? We’re finding out now. Investors were spooked in April after China Huarong Asset Management Co., one of the country’s biggest distressed asset managers, failed to release financial statements in the wake of the execution of its former top executive for bribery. That raised questions about its financial health — and broader worries about whether China would let an institution backed by the central government fail. The ending of a presumed safety net that’s long been priced into Chinese bond values would mean a seismic shift for investors across emerging markets.  Markets were shaken but unstirred by the collapse of Greensill and the Archegos unwind trades. Credit Suisse is the ultimate loser of the two scandals – reputationally damaged and holed below the water line. The bank is paying the price of years of flawed management, poor risk awareness. and its self-belief it was still a Tier 1 global player. Its’ challenge is to avoid becoming the Deutsche Bank of Switzerland – which it will struggle to do without a radical and unlikely shakeout.

Markets were shaken but unstirred by the collapse of Greensill and the Archegos unwind trades. Credit Suisse is the ultimate loser of the two scandals – reputationally damaged and holed below the water line. The bank is paying the price of years of flawed management, poor risk awareness. and its self-belief it was still a Tier 1 global player. Its’ challenge is to avoid becoming the Deutsche Bank of Switzerland – which it will struggle to do without a radical and unlikely shakeout.  In the aftermath of the Archegos blow up, the biggest nightmare on Wall Street – where there is never just one cockroach – is that (many) more Archegos-style, highly levered “family office” blow ups are waiting just around the corner.

In the aftermath of the Archegos blow up, the biggest nightmare on Wall Street – where there is never just one cockroach – is that (many) more Archegos-style, highly levered “family office” blow ups are waiting just around the corner. Goldman Sachs managed to avoid billions of dollars in potential losses from the implosion of highly levered hedge fund Archegos Capital Management by breaking ranks with other syndicate banks to dump large blocks of shares representing Archegos’s exposure to a coterie of tech and media names. When the dust settled, the bank told shareholders any losses would be insignificant, while Credit Suisse, the bank with perhaps the biggest exposure, said Tuesday it has booked a nearly $5 billion loss.

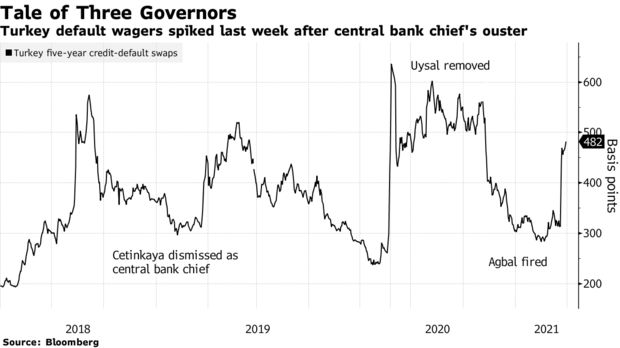

Goldman Sachs managed to avoid billions of dollars in potential losses from the implosion of highly levered hedge fund Archegos Capital Management by breaking ranks with other syndicate banks to dump large blocks of shares representing Archegos’s exposure to a coterie of tech and media names. When the dust settled, the bank told shareholders any losses would be insignificant, while Credit Suisse, the bank with perhaps the biggest exposure, said Tuesday it has booked a nearly $5 billion loss.  The market meltdown following Turkey’s central-bank shakeup is reviving a longtime debate among the world’s largest money managers and Ivy League economists over the vulnerability of developing nations.

The market meltdown following Turkey’s central-bank shakeup is reviving a longtime debate among the world’s largest money managers and Ivy League economists over the vulnerability of developing nations. It’s official: the Financial Times (citing an informal polling of anonymous bankers) has declared Deliveroo’s botched London offering the “worst IPO in London’s history.”

It’s official: the Financial Times (citing an informal polling of anonymous bankers) has declared Deliveroo’s botched London offering the “worst IPO in London’s history.”