Donate to the Cartoonist Directly: http://paypal.me/baileytoons

Donate to the Cartoonist Directly: http://paypal.me/baileytoons

Goldman Faces New Forex Rigging Suit From Currency Trader

Richard Crump, 12 March 2021

Goldman Sachs is being sued in London over allegations that its traders manipulated foreign exchange markets for profit, in the latest lawsuit filed by a British currency investment firm over trade front-running.

Goldman Sachs is being sued in London over allegations that its traders manipulated foreign exchange markets for profit, in the latest lawsuit filed by a British currency investment firm over trade front-running.

ECU Group alleges that traders at Goldman Sachs International misused its confidential information to make secret profits by trading ahead of foreign exchange transactions by the British company, an illegal tactic known as front-running, according to the High Court claim filed in November but only recently made public. Continue reading “Article: Goldman Faces New Forex Rigging Suit From Currency Trader”

Gary Gensler (born October 18, 1957) is an American academic, former investment banker, and former government official. Gensler leads the Biden–Harris transition’s Federal Reserve, Banking and Securities Regulators agency review team. He is also a professor at the MIT Sloan School of Management.

Gary Gensler (born October 18, 1957) is an American academic, former investment banker, and former government official. Gensler leads the Biden–Harris transition’s Federal Reserve, Banking and Securities Regulators agency review team. He is also a professor at the MIT Sloan School of Management.

Gensler previously served as the 11th chairman of the Commodity Futures Trading Commission, under President Barack Obama, from May 26, 2009 to January 3, 2014. He was the Under Secretary of the Treasury for Domestic Finance (1999–2001), and the Assistant Secretary of the Treasury for Financial Markets (1997–1999). Prior to his career in the federal government, Gensler worked at Goldman Sachs, where he was a partner and co-head of finance. Gensler also served as the CFO for the Hillary Clinton 2016 presidential campaign. Continue reading “Official: Gary Gensler”

Richard K. Crump Richard Crump joined the Federal Reserve Bank of New York in 2009. His research interests are in Econometric Theory and Financial Economics.

Richard K. Crump Richard Crump joined the Federal Reserve Bank of New York in 2009. His research interests are in Econometric Theory and Financial Economics.

He holds a Ph.D. in Economics and an M.A. in Statistics from the University of California at Berkeley, along with a B.S. in Economics from MIT. Prior to graduate school he worked as an Associate in the US Economic Research Group and the Global Markets Research Group at Goldman Sachs.

Articles:

Article: Burford Loses Bid For LSE Trader Info In Short-Selling Attack

What’s Going On At Goldman? Another Senior Exec Just Jumped Ship

TYLER DURDEN, 02 March 2021

In the last few days, Goldman Sachs has lost two very senior executives from the investment bank’s two biggest bets on the future – consumer finance (Marcus) and wealth-management – and now, the behemoth’s chief lawyer is abandoning ship.

Leaving many asking – what is going on at Goldman? Continue reading “Article: What’s Going On At Goldman? Another Senior Exec Just Jumped Ship”

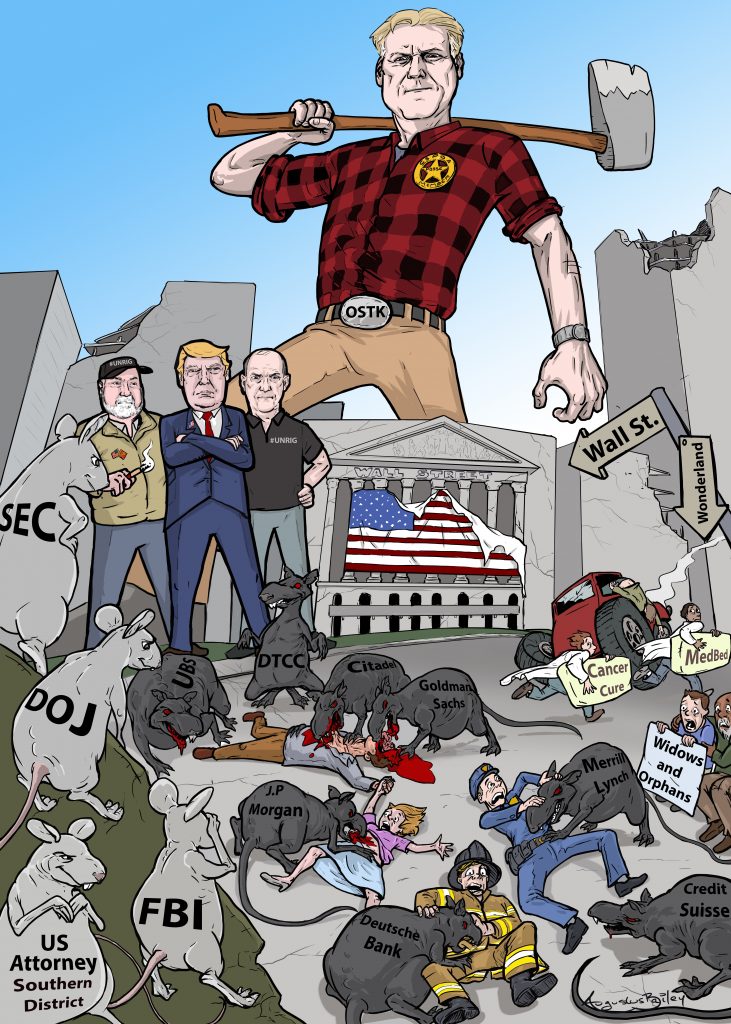

Henry Merritt “Hank” Paulson Jr. (born March 28, 1946) is an American banker who served as the 74th United States Secretary of the Treasury from 2006 to 2009. Prior to his role in the Department of the Treasury, Paulson was the chairman and chief executive officer (CEO) of Goldman Sachs..

Henry Merritt “Hank” Paulson Jr. (born March 28, 1946) is an American banker who served as the 74th United States Secretary of the Treasury from 2006 to 2009. Prior to his role in the Department of the Treasury, Paulson was the chairman and chief executive officer (CEO) of Goldman Sachs..

He served as Treasury Secretary under President George W. Bush. Paulson served through the end of the Bush administration, leaving office on January 20, 2009. He is now the chairman of the Paulson Institute, which he founded in 2011 to promote sustainable economic growth and a cleaner environment around the world, with an initial focus on the United States and China. Continue reading “Banker: Henry Paulson”

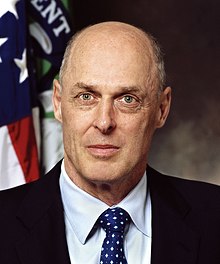

The GameStop Mess Exposes the Naked Short Selling Scam

LUCY KOMISAR, 25 February 2021

At the House Financial Services Committee hearing last week on the GameStop debacle, there was an elephant in the room: naked short selling.

At the House Financial Services Committee hearing last week on the GameStop debacle, there was an elephant in the room: naked short selling.

Short selling, effectively betting that a stock will go down, involves a trader selling shares he does not own, hoping to buy them back at a lower price to make money on the spread. The trader is supposed to locate (or have a “reasonable belief” he can locate) or borrow the shares in brokerage accounts, and then transfer them to the buyer within two days. This accounts for as much as 50 percent of daily trading. Continue reading “Article: The GameStop Mess Exposes the Naked Short Selling Scam”

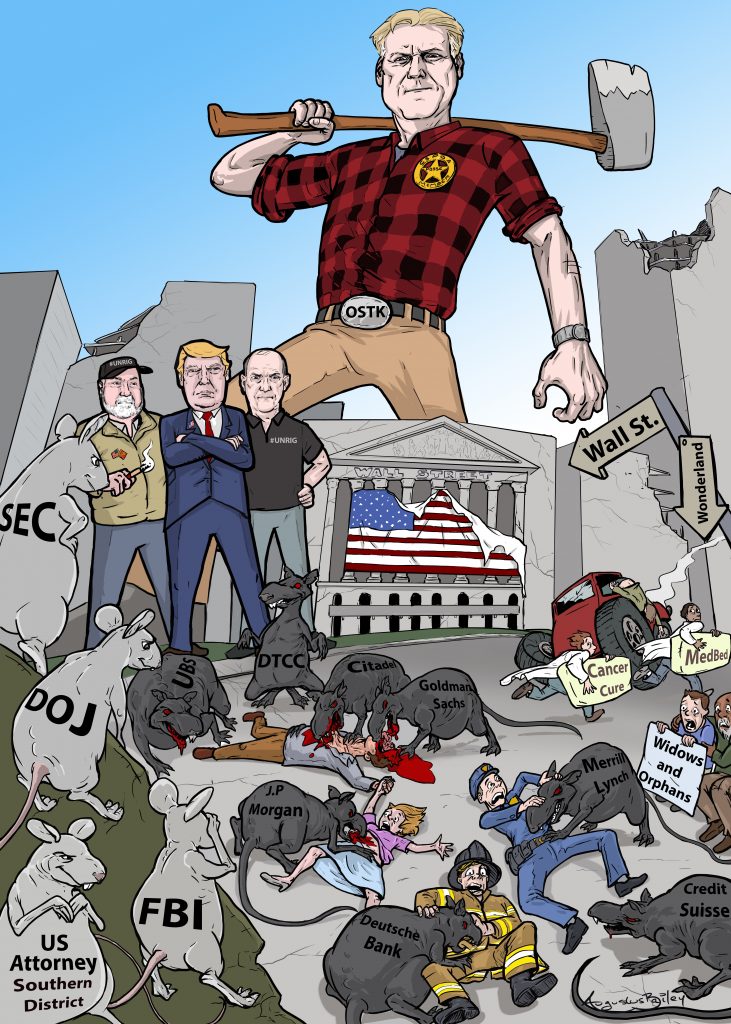

Meet Patrick Byrne: Bitcoin Messiah, CEO of Overstock, Scourge of Wall Street

Cade Metz, WIRED, 18 February 2021

The problem with the modern economy, Byrne says, is that it rests on the whims of our government and our big banks, that each has the power to create money that’s backed by nothing but themselves. Thanks to what’s called fractional reserve banking, a bank can take in $10 in deposits, but then loan out $100. The government can make more dollars at any time, instantly reducing the currency’s value. Eventually, he says, laying down a classic libertarian metaphor, this “magic money tree” will come crashing down.

The Gamers’ Uprising Against Wall Street Has Deep Populist Roots

Wall Street may own the country, as Kansas populist leader Mary Elizabeth Lease once declared, but a new generation of “retail” stock market traders is fighting back.

Ellen Brown, SheerPost, 10 February 2021

A short squeeze frenzy driven by a new generation of gamers captured financial headlines in recent weeks, centered on a struggling strip mall video game store called GameStop. The Internet and a year off in this shut down to study up have given a younger generation of investors the tools to compete in the market. Gerald Celente calls it the “Youth Revolution.” A group of New York Young Republicans who protested in the snow on January 31 called it “Re-occupy Wall Street.” Others have called it Occupy Wall Street 2.0.

Continue reading “Article: The Gamers’ Uprising Against Wall Street Has Deep Populist Roots”

The Manipulative, Little Known Billionaire Who Nearly Ruined The Country’s Richest Black Person

Christopher Helman, 05 February 2021

Ever since Ford Motor Company began selling its Model T in 1908, few pieces of technology have been as important to car dealer profit margins as the DocuPad.

The 45-by-29-inch flat screen sits atop a salesman’s desk, giving him the ability to quickly coax customers through what would normally be mountains of paperwork. By enabling car buyers to check boxes with a stylus and sign contracts on the interactive screen, the DocuPad takes the friction out of a car salesman’s stock in trade—the upsell. Continue reading “Article: The Manipulative, Little Known Billionaire Who Nearly Ruined The Country’s Richest Black Person”