VIDEO | After Hindenburg Research report, Lordstown Motors set to face investors today

Justin Dennis, 17 March 2021

Lordstown Motors has vowed to refute last week’s scathing short-seller report, which called demand for its Endurance all-electric pickup truck a “mirage” and claimed the company has been misleading investors.

LORDSTOWN — Lordstown Motors Corp. executives are expected to address the company’s investors during their end-of-year financial report this afternoon.

The report comes days after Hindenburg Research, a short-selling stock market research firm, delivered a damaging deep-dive into the Voltage Valley leader, claiming that its investors are being misled; that its all-electric pickup truck the Endurance is actually years away from production, despite executives’ September 2021 target; and that its book of about 100,000 non-binding pre-orders for the vehicle “are largely fictitious and used as a prop to raise capital and confer legitimacy.”

Lordstown Motors on Monday vowed to refute the report “in due time,” and a spokesperson last week promised a “thorough” statement. CEO Steve Burns, addressing reporters during a Monday tour of the plant where dozens of test vehicles are currently being built, reassured the Endurance is on-track.

“Whatever anybody thinks of us in the world, the main thing is we are going to be the first electric pickup truck in the United States, full-size, and that starts in September,” Burns said, as reported by The Business Journal.

Read Full Article

Nate Anderson’s Hindenburg Research, the short activist firm that burst onto the scene last fall with an exposé of electric truck maker Nikola, is back with its fifth big takedown of a special-purpose acquisition company.

Nate Anderson’s Hindenburg Research, the short activist firm that burst onto the scene last fall with an exposé of electric truck maker Nikola, is back with its fifth big takedown of a special-purpose acquisition company.

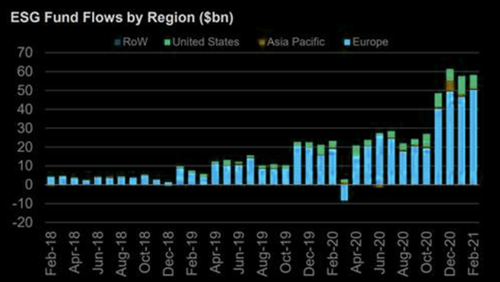

Sustainable investments have seen accelerated trends during the last five years. ESG- screening and ESG compliance ETFs enormous inflows have created a huge demand for clean and “green washed” stocks, that consequently received huge valuation premium to the overall market. This is certainly a long-term trend, but the last year hype has now cooled down with popular stocks like PLUG, RUN, ENPH, NOVA having corrected by between 35% and 60% from their highs (PLUG needs to gain 120% to break even for those long at highs…).

Sustainable investments have seen accelerated trends during the last five years. ESG- screening and ESG compliance ETFs enormous inflows have created a huge demand for clean and “green washed” stocks, that consequently received huge valuation premium to the overall market. This is certainly a long-term trend, but the last year hype has now cooled down with popular stocks like PLUG, RUN, ENPH, NOVA having corrected by between 35% and 60% from their highs (PLUG needs to gain 120% to break even for those long at highs…).