China Asks Citic Group to Examine Huarong’s Finances

Charlie Zhu, Zheng Li, Jun Luo, and Heng Xie, 28 June 2021

China has asked one of its biggest state-owned conglomerates to examine the finances of China Huarong Asset Management Co., people familiar with the matter said, adding a new twist to the drama that has roiled the world’s second-largest credit market for months.

China has asked one of its biggest state-owned conglomerates to examine the finances of China Huarong Asset Management Co., people familiar with the matter said, adding a new twist to the drama that has roiled the world’s second-largest credit market for months.

Citic Group, whose businesses span everything from banking to securities and mining, recently dispatched a team to Huarong to pore over the embattled distressed-debt manager’s books, the people said, asking not to be identified discussing private information. Continue reading “Article: China Asks Citic Group to Examine Huarong’s Finances”

China’s finance ministry is considering a proposal to transfer its shares in China Huarong Asset Management Co. and three other bad-debt managers to a new holding company modeled after the one that owns the government’s stakes in state-run banks, according to a person familiar with the matter.

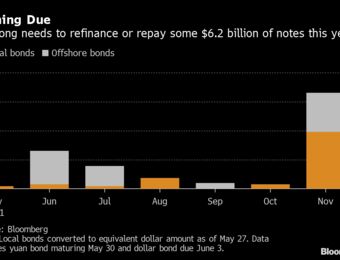

China’s finance ministry is considering a proposal to transfer its shares in China Huarong Asset Management Co. and three other bad-debt managers to a new holding company modeled after the one that owns the government’s stakes in state-run banks, according to a person familiar with the matter. China Huarong Asset Management Co. made the biggest bond payment since confidence in its financial health began plunging two months ago, adding to signs that the company still has access to near-term liquidity.

China Huarong Asset Management Co. made the biggest bond payment since confidence in its financial health began plunging two months ago, adding to signs that the company still has access to near-term liquidity. After the collapse of Lehman Brothers Holdings Inc., the Big Three rating companies were blamed for their enabling roles in the subprime mortgage crisis. Troubled securitized products would not have been marketed and sold without their seal of investment-grade approval. In fact, investors relied on their ratings, often blindly.

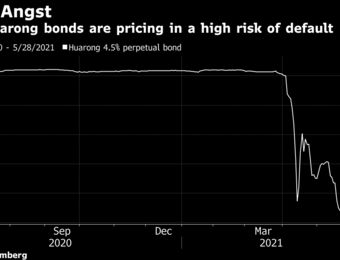

After the collapse of Lehman Brothers Holdings Inc., the Big Three rating companies were blamed for their enabling roles in the subprime mortgage crisis. Troubled securitized products would not have been marketed and sold without their seal of investment-grade approval. In fact, investors relied on their ratings, often blindly. What happens when a company set up by the Chinese government to help clean up toxic debt in the country’s banking system gets into trouble itself? We’re finding out now. Investors were spooked in April after China Huarong Asset Management Co., one of the country’s biggest distressed asset managers, failed to release financial statements in the wake of the execution of its former top executive for bribery. That raised questions about its financial health — and broader worries about whether China would let an institution backed by the central government fail. The ending of a presumed safety net that’s long been priced into Chinese bond values would mean a seismic shift for investors across emerging markets.

What happens when a company set up by the Chinese government to help clean up toxic debt in the country’s banking system gets into trouble itself? We’re finding out now. Investors were spooked in April after China Huarong Asset Management Co., one of the country’s biggest distressed asset managers, failed to release financial statements in the wake of the execution of its former top executive for bribery. That raised questions about its financial health — and broader worries about whether China would let an institution backed by the central government fail. The ending of a presumed safety net that’s long been priced into Chinese bond values would mean a seismic shift for investors across emerging markets.  Trading in more than 50 Hong Kong-listed companies was suspended on Thursday, after a number of firms failed to report earnings ahead of the March 31 deadline.

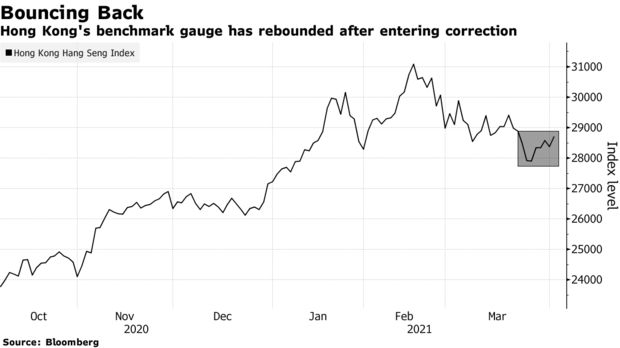

Trading in more than 50 Hong Kong-listed companies was suspended on Thursday, after a number of firms failed to report earnings ahead of the March 31 deadline.