Sheelah Kolhatkar, 10 May 2021

Early on the morning of January 19th, Cody Herdman woke to the vibration of his smartphone alarm under his pillow. He immediately checked the finance app Robinhood for the trading price of a company called GameStop. Herdman, who is nineteen, is a freshman computer-science major at Dakota State University, where until recently he played center for the Dakota State Trojans football team, and he had been investing in the stock market for a month.

Robinhood, which offers zero-commission trading in stocks and cryptocurrencies, pitches itself as an enlightened version of Wall Street; its stated mission is to “democratize finance for all.” Herdman’s friend Chase Bradshaw had introduced him to trading on the app, which now consumed much of the time that he used to spend playing video games. Continue reading “Article: Robinhood’s Big Gamble”

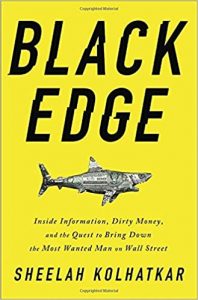

Sheelah Kolhatkar, a former hedge fund analyst, is a staff writer at The New Yorker, where she writes about Wall Street, Silicon Valley, and politics, among other things. She has appeared as a speaker and commentator on business and economics issues at conferences and on broadcast outlets including CNBC, Bloomberg Television, Charlie Rose, PBS NewsHour, WNYC and NPR. Her writing has also appeared in Bloomberg Businessweek, New York, The Atlantic, The New York Times and other publications. She lives in New York City.

Sheelah Kolhatkar, a former hedge fund analyst, is a staff writer at The New Yorker, where she writes about Wall Street, Silicon Valley, and politics, among other things. She has appeared as a speaker and commentator on business and economics issues at conferences and on broadcast outlets including CNBC, Bloomberg Television, Charlie Rose, PBS NewsHour, WNYC and NPR. Her writing has also appeared in Bloomberg Businessweek, New York, The Atlantic, The New York Times and other publications. She lives in New York City.