Biggest Players In The Short-Selling Game Are Getting A Pass

ERIK SCHATZKER, BRANDON KOCHKODIN, 10 March 2021

It’s in the air again, on Reddit, in Congress, in the C-suite: Hedge funds that get rich off short-selling are the enemy. The odd thing is, the biggest players in the game are getting a pass.

Those would be the asset managers, pension plans and sovereign wealth funds that provide the vast majority of securities used to take bearish positions. Without the likes of BlackRock Inc. and State Street Corp., the California Public Employees’ Retirement System and the Kuwait Investment Authority filling such an elemental role, investors such as Gabe Plotkin, whose Melvin Capital Management became a piñata for day traders in the GameStop Corp. saga, wouldn’t have shares to sell short.

“Anytime we short a stock, we locate a borrow,” Plotkin said Feb. 18 at the House Financial Services Committee hearing on the GameStop short squeeze.

“Anytime we short a stock, we locate a borrow,” Plotkin said Feb. 18 at the House Financial Services Committee hearing on the GameStop short squeeze.

There’s plenty to choose from. As of mid-2020, some $24 trillion of stocks and bonds were available for such borrowing, with $1.2 trillion in shares—equal to a third of all hedge-fund assets—actually out on loan, according to the International Securities Lending Association.

It’s a situation that on the surface defies logic. Given the popular belief that short sellers create unjustified losses in some stocks, why would shareholders want to supply the ammunition for attacks against their investments? The explanation is fairly straight forward: By loaning out securities for a small fee plus interest, they can generate extra income that boosts returns. That’s key in an industry where fund managers are paid to beat benchmarks and especially valuable in a world of low yields.

The trade-off is simple: For investors with large, diversified portfolios, a single stock plummeting under the weight of a short-selling campaign has little impact over the long run. And in the nearer term, the greater the number of aggregate bets against a stock—the so-called short interest—the higher the fee a lender can charge.

Read Full Article

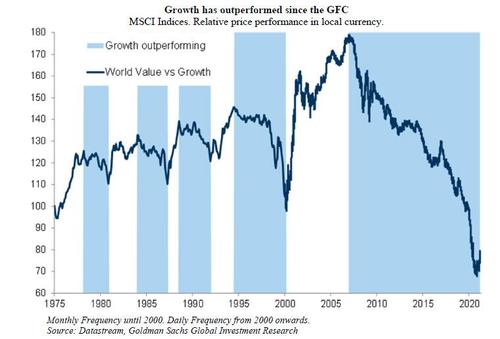

In many ways, David Einhorn’s Greenlight appears to be back to its “new normal” – in a letter sent to investors, Einhorn writes that Greenlight again underperformed the market and returned -0.1% in the first quarter, badly underperforming the 6.2% return for the S&P 500 index, before proceeding to bash the Fed, broken markets, Chamath and Elon, the basket of short stocks and much more.

In many ways, David Einhorn’s Greenlight appears to be back to its “new normal” – in a letter sent to investors, Einhorn writes that Greenlight again underperformed the market and returned -0.1% in the first quarter, badly underperforming the 6.2% return for the S&P 500 index, before proceeding to bash the Fed, broken markets, Chamath and Elon, the basket of short stocks and much more. In the aftermath of the Archegos blow up, the biggest nightmare on Wall Street – where there is never just one cockroach – is that (many) more Archegos-style, highly levered “family office” blow ups are waiting just around the corner.

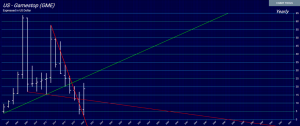

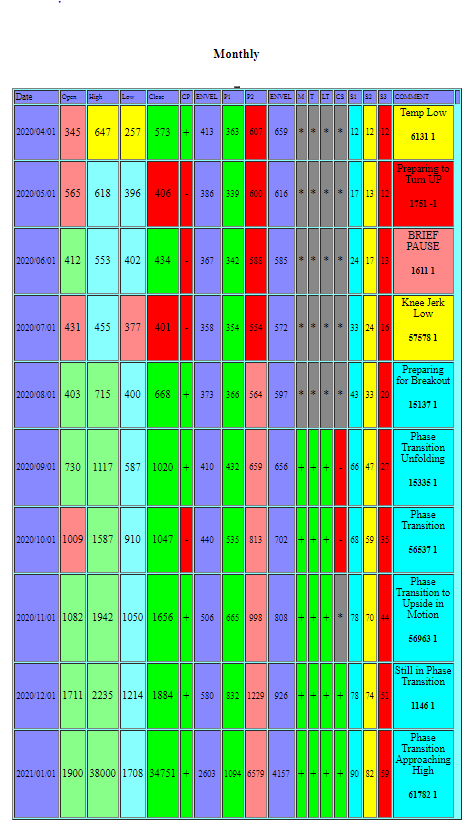

In the aftermath of the Archegos blow up, the biggest nightmare on Wall Street – where there is never just one cockroach – is that (many) more Archegos-style, highly levered “family office” blow ups are waiting just around the corner. More than 2 months have passed since Robinhood shut off trading in Gamestop while the firm’s shares soared past the $400 mark, marking a historic confrontation between an army of GME-hodling “apes” and hedge funds like Melvin Capital, not to mention the mighty hedge fund-market maker Citadel, that would cement GME’s status as a favorite of the “Wall Street Bets” retail-trading army.

More than 2 months have passed since Robinhood shut off trading in Gamestop while the firm’s shares soared past the $400 mark, marking a historic confrontation between an army of GME-hodling “apes” and hedge funds like Melvin Capital, not to mention the mighty hedge fund-market maker Citadel, that would cement GME’s status as a favorite of the “Wall Street Bets” retail-trading army.

A Congressional hearing into the GameStop mania that triggered the largest weekly selloff since late October is underway, with some of the key players in the saga—billionaire Citadel CEO Kenneth Griffin, Robinhood CEO Vladimir Tenev, Reddit Cofounder Steve Huffman and the 34-year-old securities broker behind the Roaring Kitty online persona—all set to testify.

A Congressional hearing into the GameStop mania that triggered the largest weekly selloff since late October is underway, with some of the key players in the saga—billionaire Citadel CEO Kenneth Griffin, Robinhood CEO Vladimir Tenev, Reddit Cofounder Steve Huffman and the 34-year-old securities broker behind the Roaring Kitty online persona—all set to testify. Max Keiser does not really understand what the monetary expansion has to cover.

Max Keiser does not really understand what the monetary expansion has to cover. Federal authorities are investigating whether massive gains in “meme stocks” like GameStop in January were caused by market manipulation or other illegal behavior, the Wall Street Journal reported Thursday.

Federal authorities are investigating whether massive gains in “meme stocks” like GameStop in January were caused by market manipulation or other illegal behavior, the Wall Street Journal reported Thursday.