Major players plead guilty in ‘funnel account’ scam at Rio Rico bank

Nogales International, 2 May 2021

Three key members of a scheme to transfer organized crime proceeds from the United States to Mexico through so-called “funnel accounts” opened at the Wells Fargo bank in Rio Rico have now pleaded guilty to federal charges.

Three key members of a scheme to transfer organized crime proceeds from the United States to Mexico through so-called “funnel accounts” opened at the Wells Fargo bank in Rio Rico have now pleaded guilty to federal charges.

The latest guilty plea, which was accepted by a judge during a hearing on Wednesday at U.S. District Court in Tucson, was from Carlos Antonio Vasquez, the former manager of the bank branch. He agreed to plead guilty to one count of conspiracy to commit money laundering – a crime that normally carries a maximum sentence of 20 years in prison, but for which Vasquez will receive no more than 34 months (2 years, 10 months) in exchange for his plea.

The conspiracy reportedly lasted from February 2017 until August 2019. Continue reading “Article: Major players plead guilty in ‘funnel account’ scam at Rio Rico bank”

A Chinese money-launderer was about to pick up Mexican drug-cartel cash in Chicago, federal authorities say, when his plans suddenly changed.

A Chinese money-launderer was about to pick up Mexican drug-cartel cash in Chicago, federal authorities say, when his plans suddenly changed. India does not see any logic in the United States putting it on a monitoring list of currency manipulators, a trade ministry official said on Tuesday.

India does not see any logic in the United States putting it on a monitoring list of currency manipulators, a trade ministry official said on Tuesday. Blockchain evaluation agency, Chainalysis’ newest crime report has named Mirror Buying and selling Worldwide (MTI) as the largest cryptocurrency rip-off of 2020. Chainalysis arrived at this conclusion after an investigation discovered that MTI had taken in $589 million from greater than 471,000 deposits. In line with the report, MTI’s haul is considerably greater than that of Forsage and J-enco, the following greatest scams. Each scams raked in lower than $350 million every.

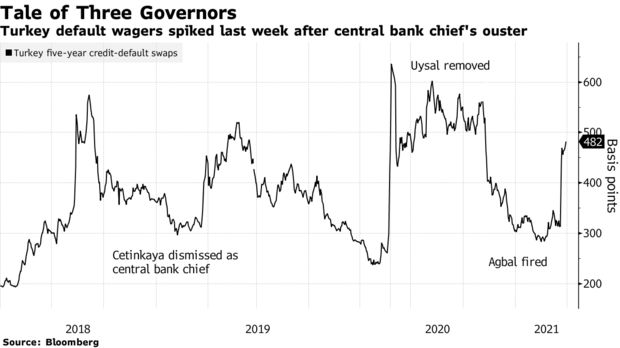

Blockchain evaluation agency, Chainalysis’ newest crime report has named Mirror Buying and selling Worldwide (MTI) as the largest cryptocurrency rip-off of 2020. Chainalysis arrived at this conclusion after an investigation discovered that MTI had taken in $589 million from greater than 471,000 deposits. In line with the report, MTI’s haul is considerably greater than that of Forsage and J-enco, the following greatest scams. Each scams raked in lower than $350 million every.  The market meltdown following Turkey’s central-bank shakeup is reviving a longtime debate among the world’s largest money managers and Ivy League economists over the vulnerability of developing nations.

The market meltdown following Turkey’s central-bank shakeup is reviving a longtime debate among the world’s largest money managers and Ivy League economists over the vulnerability of developing nations. A former governor of Tamaulipas, Mexico on Thursday pleaded guilty in a Texas court for taking over $3.5 million in bribes for government contracts, which he then laundered in the United States.

A former governor of Tamaulipas, Mexico on Thursday pleaded guilty in a Texas court for taking over $3.5 million in bribes for government contracts, which he then laundered in the United States. HSBC was guilty of a “blatant failure” to implement anti-money laundering controls and wilfully flouted US sanctions, American prosecutors said, as the bank was forced to pay a record $1.9bn (£1.2bn) to settle allegations it allowed terrorists to move money around the financial system.

HSBC was guilty of a “blatant failure” to implement anti-money laundering controls and wilfully flouted US sanctions, American prosecutors said, as the bank was forced to pay a record $1.9bn (£1.2bn) to settle allegations it allowed terrorists to move money around the financial system.