Hindenburg Research Shorts One of the Biggest SPAC Winners: DraftKings

Michelle Celarier, 15 June 2021

Nate Anderson’s Hindenburg Research, the short activist firm that burst onto the scene last fall with an exposé of electric truck maker Nikola, is back with its fifth big takedown of a special-purpose acquisition company.

Nate Anderson’s Hindenburg Research, the short activist firm that burst onto the scene last fall with an exposé of electric truck maker Nikola, is back with its fifth big takedown of a special-purpose acquisition company.

This time Anderson has set his sights on DraftKings, the online gambling site which went public in one of the hottest SPAC deals of 2020. His firm alleges that DraftKings has “extensive dealings in black-market gaming, money laundering, and organized crime.” Continue reading “Article: Hindenburg Research Shorts One of the Biggest SPAC Winners: DraftKings”

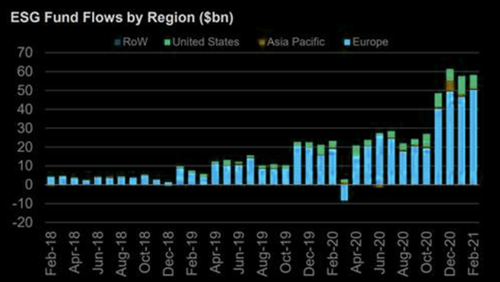

Sustainable investments have seen accelerated trends during the last five years. ESG- screening and ESG compliance ETFs enormous inflows have created a huge demand for clean and “green washed” stocks, that consequently received huge valuation premium to the overall market. This is certainly a long-term trend, but the last year hype has now cooled down with popular stocks like PLUG, RUN, ENPH, NOVA having corrected by between 35% and 60% from their highs (PLUG needs to gain 120% to break even for those long at highs…).

Sustainable investments have seen accelerated trends during the last five years. ESG- screening and ESG compliance ETFs enormous inflows have created a huge demand for clean and “green washed” stocks, that consequently received huge valuation premium to the overall market. This is certainly a long-term trend, but the last year hype has now cooled down with popular stocks like PLUG, RUN, ENPH, NOVA having corrected by between 35% and 60% from their highs (PLUG needs to gain 120% to break even for those long at highs…).