Robinhood Gets Ready for the Meme Stock World It Created

Annie Massa, 14 July 2021

Hi all, it’s Annie from Bloomberg’s investing team. Soon, Robinhood Markets Inc. will go public. The debut—which could happen in the coming weeks—will see Robinhood entrust its share price to the same retail investors who have been using its app to roil markets.

Hi all, it’s Annie from Bloomberg’s investing team. Soon, Robinhood Markets Inc. will go public. The debut—which could happen in the coming weeks—will see Robinhood entrust its share price to the same retail investors who have been using its app to roil markets.

The free stock trading app has been around for eight eventful years. During the pandemic, Robinhood traders congregated on Reddit message boards and drove wild swings in the price of companies like GameStop Corp. and AMC Entertainment Holdings Inc. Then, when Robinhood put limits on customer purchases of those stocks, the startup incurred social media wrath, along with some lawsuits. Continue reading “Article: Robinhood Gets Ready for the Meme Stock World It Created”

Afew years ago, no one would have expected for one man to introduce so much volatility into the crypto space. Elon Musk filled that ignoble role, but everything has its expiry date.

Afew years ago, no one would have expected for one man to introduce so much volatility into the crypto space. Elon Musk filled that ignoble role, but everything has its expiry date. Independence Day weekend brings to mind freedom, of course. And before too long, we may have independence from the banks, from the third parties, and from the financial system itself. Or maybe not.

Independence Day weekend brings to mind freedom, of course. And before too long, we may have independence from the banks, from the third parties, and from the financial system itself. Or maybe not. Fraudsters, drug dealers and money mules have revealed how crime has gone cashless during the pandemic.

Fraudsters, drug dealers and money mules have revealed how crime has gone cashless during the pandemic.

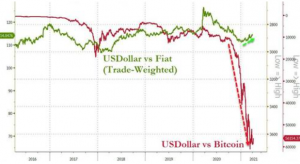

‘Pro-Crypto’ Peter Thiel Warns Bitcoin “Could Be A Chinese Financial Weapon Against The US”

‘Pro-Crypto’ Peter Thiel Warns Bitcoin “Could Be A Chinese Financial Weapon Against The US” Peter Andreas Thiel (/tiːl/; born 11 October 1967) is a German-American billionaire entrepreneur and venture capitalist. A co-founder of PayPal, Palantir Technologies, and Founders Fund, he was the first outside investor in Facebook. He was ranked No. 4 on the Forbes Midas List of 2014, with a net worth of $2.2 billion, and No. 391 on the Forbes 400 in 2020, with a net worth of $2.1 billion. In 2016, Thiel confirmed that he had funded Hulk Hogan in the Bollea v. Gawker lawsuit because Gawker had previously outed him as gay. The lawsuit eventually bankrupted Gawker.

Peter Andreas Thiel (/tiːl/; born 11 October 1967) is a German-American billionaire entrepreneur and venture capitalist. A co-founder of PayPal, Palantir Technologies, and Founders Fund, he was the first outside investor in Facebook. He was ranked No. 4 on the Forbes Midas List of 2014, with a net worth of $2.2 billion, and No. 391 on the Forbes 400 in 2020, with a net worth of $2.1 billion. In 2016, Thiel confirmed that he had funded Hulk Hogan in the Bollea v. Gawker lawsuit because Gawker had previously outed him as gay. The lawsuit eventually bankrupted Gawker.