Hedge Funds Make Biggest Short Bet on Junk Bonds Since 2008

Laura Benitez and Tasos Vossos, 07 May 2021

Hedge funds have accumulated the biggest short position on junk bonds since 2008 in another sign that investors are lining up to bet against frothy debt markets. About $55 billion of global high-yield bonds has been sold short, according to data from IHS Markit Ltd. That’s up from $35 billion at the start of the year.

The heady mix of rich valuations and willingness of bond bulls to throw cash at ever-riskier companies is raising alarm bells that credit markets are looking increasingly stretched. Add in the threat of rising interest rates, and there’s plenty of reason for some investors to be nervous. Continue reading “Article: Hedge Funds Make Biggest Short Bet on Junk Bonds Since 2008”

The altcoins market is bustling with new all-time highs and crypto scammers are once again round the corner. Members of the popular WallStreetBets Reddit forum were recently targeted by a spammy and dummy Telegram group duping investors of $2 million in losses.

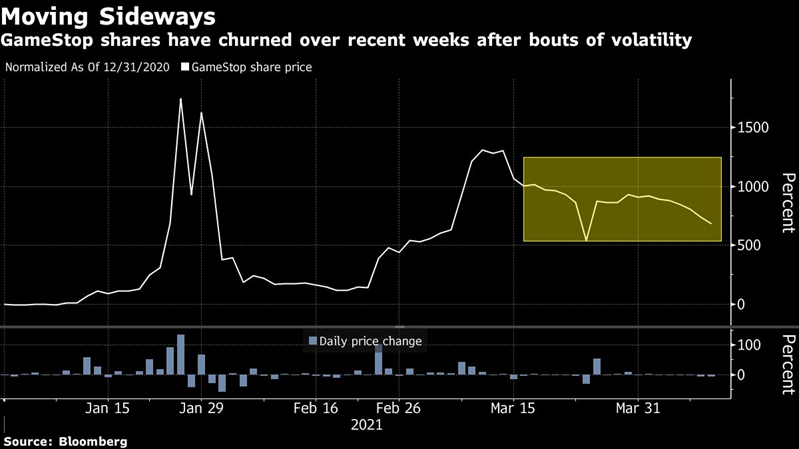

The altcoins market is bustling with new all-time highs and crypto scammers are once again round the corner. Members of the popular WallStreetBets Reddit forum were recently targeted by a spammy and dummy Telegram group duping investors of $2 million in losses. The GameStop story returned short-sellers to the front pages of the global financial press. The Reddit crowd’s “Main Street Takes Revenge on Wall Street” narrative cast these short sellers as the villains of the financial markets. It also created enough consensus buying pressure to squeeze their positions into margin calls and realized losses.

The GameStop story returned short-sellers to the front pages of the global financial press. The Reddit crowd’s “Main Street Takes Revenge on Wall Street” narrative cast these short sellers as the villains of the financial markets. It also created enough consensus buying pressure to squeeze their positions into margin calls and realized losses. Jung Eui-Jung, a former South Korean bank employee, recalls his bitter experience as a novice stock trader more than a decade ago, when he lost Won25m ($22,000) after the small metal group he invested in was delisted.

Jung Eui-Jung, a former South Korean bank employee, recalls his bitter experience as a novice stock trader more than a decade ago, when he lost Won25m ($22,000) after the small metal group he invested in was delisted. Reddit has traditionally taken a laissez-faire approach to policing content on its platform. The company hosts a loose federation of old-school internet forums, known as subreddits, which are each overseen by a team of volunteer moderators. Reddit sets certain baseline rules banning things like child porn, drug sales, and (as of 2015) harassment. But the rest is up to the users in each subreddit, who set their own community-specific norms and empower unpaid moderators to enforce them.

Reddit has traditionally taken a laissez-faire approach to policing content on its platform. The company hosts a loose federation of old-school internet forums, known as subreddits, which are each overseen by a team of volunteer moderators. Reddit sets certain baseline rules banning things like child porn, drug sales, and (as of 2015) harassment. But the rest is up to the users in each subreddit, who set their own community-specific norms and empower unpaid moderators to enforce them. The Reddit revolution in the US has drawn attention to the potential power that a growing force of retail investors can wield in stock markets when equipped by social media.

The Reddit revolution in the US has drawn attention to the potential power that a growing force of retail investors can wield in stock markets when equipped by social media. (Bloomberg) — GameStop Corp.’s Reddit-fueled trading surge is likely going to fade as threats from digital game downloads sink in, according to one skeptical Wall Street analyst.

(Bloomberg) — GameStop Corp.’s Reddit-fueled trading surge is likely going to fade as threats from digital game downloads sink in, according to one skeptical Wall Street analyst. GameStop plans to elect activist investor Cohen as chairman

GameStop plans to elect activist investor Cohen as chairman Shares in GameStop fell on Monday after the video-game retailer said it may sell up to $1bn (£720m) worth of stock as it tries to make the best of the 900% surge in its shares from a Reddit-driven rally this year.

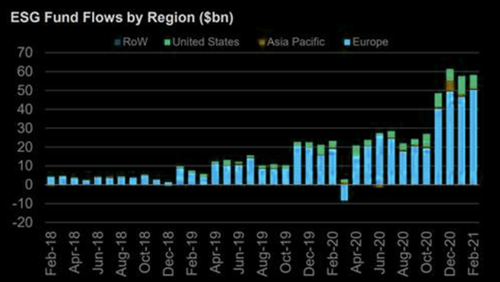

Shares in GameStop fell on Monday after the video-game retailer said it may sell up to $1bn (£720m) worth of stock as it tries to make the best of the 900% surge in its shares from a Reddit-driven rally this year. Sustainable investments have seen accelerated trends during the last five years. ESG- screening and ESG compliance ETFs enormous inflows have created a huge demand for clean and “green washed” stocks, that consequently received huge valuation premium to the overall market. This is certainly a long-term trend, but the last year hype has now cooled down with popular stocks like PLUG, RUN, ENPH, NOVA having corrected by between 35% and 60% from their highs (PLUG needs to gain 120% to break even for those long at highs…).

Sustainable investments have seen accelerated trends during the last five years. ESG- screening and ESG compliance ETFs enormous inflows have created a huge demand for clean and “green washed” stocks, that consequently received huge valuation premium to the overall market. This is certainly a long-term trend, but the last year hype has now cooled down with popular stocks like PLUG, RUN, ENPH, NOVA having corrected by between 35% and 60% from their highs (PLUG needs to gain 120% to break even for those long at highs…).  GameStop Takes $6 Billion Round Trip as Results Shrugged Off

GameStop Takes $6 Billion Round Trip as Results Shrugged Off