What were the biggest short squeezes in history?

IG Analyst, 07 May 2021

From Piggly Wiggly to GameStop, short squeezes have been causing drama on the stock markets for more than a century. Read on to learn about the biggest short squeezes in history and how to take part in the next one.

From Piggly Wiggly to GameStop, short squeezes have been causing drama on the stock markets for more than a century. Read on to learn about the biggest short squeezes in history and how to take part in the next one.

What are short squeezes?

Short squeezes are market events where traders push up the value of a stock, forcing short sellers to buy (go long) to minimise their losses.

As the short sellers buy stock, the share value rises even higher, increasing the profits of the short-squeezing traders.

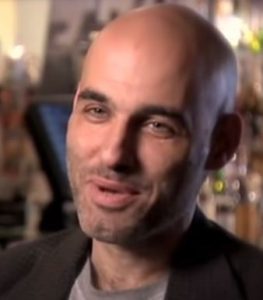

Darren Saunders was an investor, activist, and one of the stars in

Darren Saunders was an investor, activist, and one of the stars in