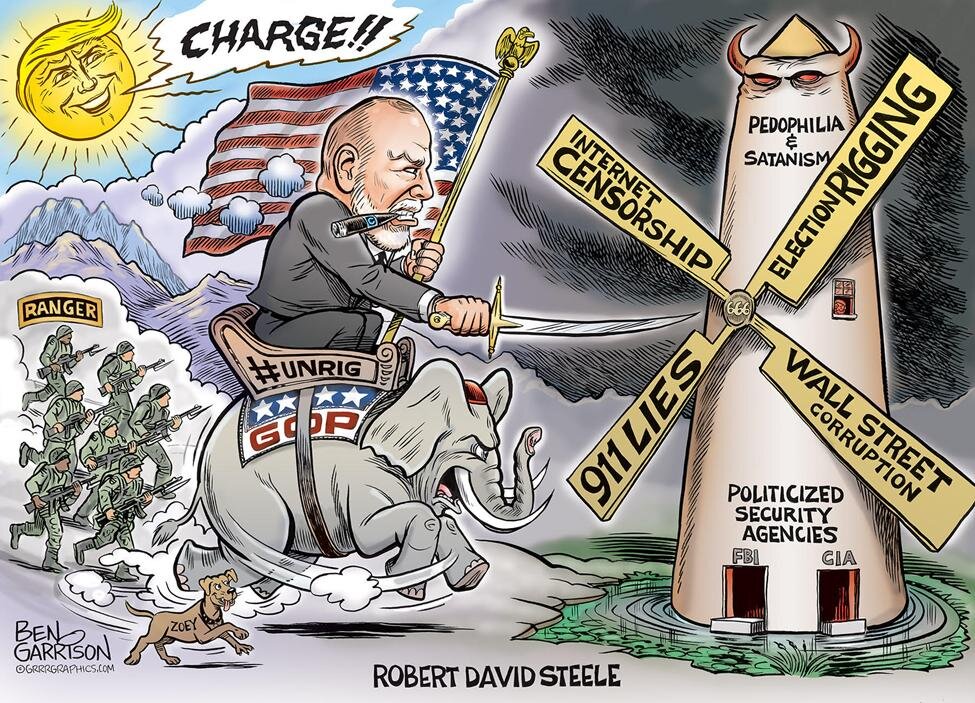

$100 Trillion Stolen by Wall Street Recoverable — Robert Steele’s Open Letter to the President

LetterOpen Letter to the President

Leverage NSA, Clean Up Wall Street, Engage Authentic Black Leaders

Mr. President,

It is my good fortune to be a former spy and also good friends with Bill Binney and known to Mike Flynn. It has taken me months to arrange for Bill Binney to speak on the record, in a sixteen minute video at https://tinyurl.com/NSA-10-30-100. With ten people in thirty days Bill can deliver all the data you need to confiscate, through civil and criminal forfeiture, $100 trillion (or more) in assets acquired by varied Wall Street financial criminals among whom Goldman Sachs is by far the largest, using naked short selling and money laundering to steal from all.

Web: WOPR AI New Offering from BuyIns.com & ShareIntel Combined

Web10 Statistically Accurate Market Predictive Technologies!

- Insider 94.38% accurate

- Group Correlation 84.55% accurate

- PatternsScan 79.81% accurate

- GATS 78.47% accurate

- SqueezeTrigger 74.82% accurate

- Seasonality 86.67% accurate

- Events 81.05% accurate

- Naked Shorts 78.64% accurate

- Earnings 75.15% accurate

- Friction Factor 70.85% accurate

Article: Has Wall Street Stolen $100 Trillion from the American Public? Will Donald Trump Get It Back?

Article - MediaHas Wall Street Stolen $100 Trillion from the American Public? Will Donald Trump Get It Back?

Tehran Times, May 26, 2020 – International

TEHRAN – Robert David Steele, a former Marine Corps infantry officer and CIA spy as well as an activist for Open Source Everything Engineering (OSEE), contributes regularly to Tehran Times.

Data Guru: David E. Wenger

Data Guru David E. Wenger is the President and Chief Executive Officer and founded Shareholder Intelligence Services, LLC (ShareIntel) in 2003. During his career on Wall Street, Mr. Wenger has been involved in numerous transactions involving investment banking, private equity financing, portfolio management, retail and institutional sales. Mr. Wenger was a founder and shareholder of Auerbach Financial Group, Inc. and Auerbach Pollak & Richardson, Inc. In this capacity, he was responsible for the strategic development and growth of the firm and he led and managed the firm’s Private Equity Group. Previously, Mr. Wenger was associated with a number of global financial firms and investment banks, including PaineWebber, Inc., Lehman Brothers and Drexel Burnham Lambert, where he focused primarily on client service, training, and new business development.

David E. Wenger is the President and Chief Executive Officer and founded Shareholder Intelligence Services, LLC (ShareIntel) in 2003. During his career on Wall Street, Mr. Wenger has been involved in numerous transactions involving investment banking, private equity financing, portfolio management, retail and institutional sales. Mr. Wenger was a founder and shareholder of Auerbach Financial Group, Inc. and Auerbach Pollak & Richardson, Inc. In this capacity, he was responsible for the strategic development and growth of the firm and he led and managed the firm’s Private Equity Group. Previously, Mr. Wenger was associated with a number of global financial firms and investment banks, including PaineWebber, Inc., Lehman Brothers and Drexel Burnham Lambert, where he focused primarily on client service, training, and new business development.

Article: Part 2 in Series on Illegal Naked Shorting’s Role in Stock Manipulation- Conventional Wisdom on How Short Sales are Executed

Article - MediaLarry Smith

Smith On Stocks, 4 April 2019

The current conventional wisdom on how a short sale is transacted is that a short seller borrows stock from a specific investor who is long the stock, then at some later point buys back the stock in the open market. They then return the stock to that “same specific investor” from whom it was borrowed. Before I met ShareIntel, this is what I thought happened, but as I began to work with them and to do more research on my own, I was jolted when I realized that this is not what goes on in the real world of Wall Street and in later reports I will address how the actual process facilitates widespread naked shorting that enables stock manipulation by some hedge funds..

Article: Part 1 in a Series of Reports on Blatant, Widespread Stock Manipulation that is Enabled by Illegal, Naked Shorting

Article - MediaLarry Smith

Smith On Stocks, 27 March 2019

I am convinced that price manipulation by Wall Street bad actors is endemic in the capital markets and swindles legitimate investors out of billions of dollars each year. This criminal enterprise is particularly directed against the stocks of emerging growth companies that are at the cutting edge of technological innovation and jobs creation and are so critical to solving humanity’s greatest challenges. Because my research deals with biotechnology, I am most aware of innumerable, vicious attacks on biotechnology companies, but the scheme is perpetrated on all types of companies, primarily small but also large.