"…Depository Trust Clearing Corporation, the shadowy colossus…" I wonder if this will go as viral as @mtaibbi calling Goldman Sachs "…a great vampire squid…"? Not quite the same ring to it. I call them the 500 pound gorilla. https://t.co/HB66N6dKYn

— Susanne Trimbath PhD (@SusanneTrimbath) June 12, 2021

Taibbi: Let the Apes Have Wall Street

Article - MediaTaibbi: Let the Apes Have Wall Street

Alert Reader Comment:

Ultimately, it doesn’t matter who’s behind the mercurial surges of stocks like GME. Either way, the chaos is exposing

Wall Street for the preposterous collection of circus acts it’s always been, with the naked shorting issue being just one example

Matt Taibbi: Let the Apes Have Wall Street

Article - Media Let the Apes Have Wall Street

Let the Apes Have Wall Street

Matt Taibbi, 10 June 2021

The much-publicized war over “meme stocks” drags a longstanding Wall Street ripoff out of the shadows, to hilarious results

On CNBC’s Fast Money last week, anchor Melissa Lee appeared to mention the unmentionable. She was talking with Tim Seymour, CEO of Seymour Asset Management, who made offhand mention of the hedge funds shorting now-infamous stocks like AMC and GameStop. “Look, there are a lot of short sellers out there who have been borrowing stock they didn’t have,” Seymour said.

“Naked shorts, yeah,” said Lee.

Mirror: Matt Taibbi: Is the SEC Covering up Wall Street Crimes?

VideoArticle: The Gamers’ Uprising Against Wall Street Has Deep Populist Roots

WebThe Gamers’ Uprising Against Wall Street Has Deep Populist Roots

Wall Street may own the country, as Kansas populist leader Mary Elizabeth Lease once declared, but a new generation of “retail” stock market traders is fighting back.

Ellen Brown, SheerPost, 10 February 2021

A short squeeze frenzy driven by a new generation of gamers captured financial headlines in recent weeks, centered on a struggling strip mall video game store called GameStop. The Internet and a year off in this shut down to study up have given a younger generation of investors the tools to compete in the market. Gerald Celente calls it the “Youth Revolution.” A group of New York Young Republicans who protested in the snow on January 31 called it “Re-occupy Wall Street.” Others have called it Occupy Wall Street 2.0.

Continue reading “Article: The Gamers’ Uprising Against Wall Street Has Deep Populist Roots”

Article: In Response to “New York,” Re: GameStop

Article - MediaAuthor: Matt Taibbi / Feb 6, 2021

The Big Apple mag takes a shot at purveyors of “balefully misguided progressive discourse,” i.e. me and a few others who cheered the GameStop rally. A note in reply

https://taibbi.substack.com/p/in-response-to-new-york-re-gamestop

Article: Has Wall Street Stolen $100 Trillion from the American Public? Will Donald Trump Get It Back?

Article - MediaHas Wall Street Stolen $100 Trillion from the American Public? Will Donald Trump Get It Back?

Tehran Times, May 26, 2020 – International

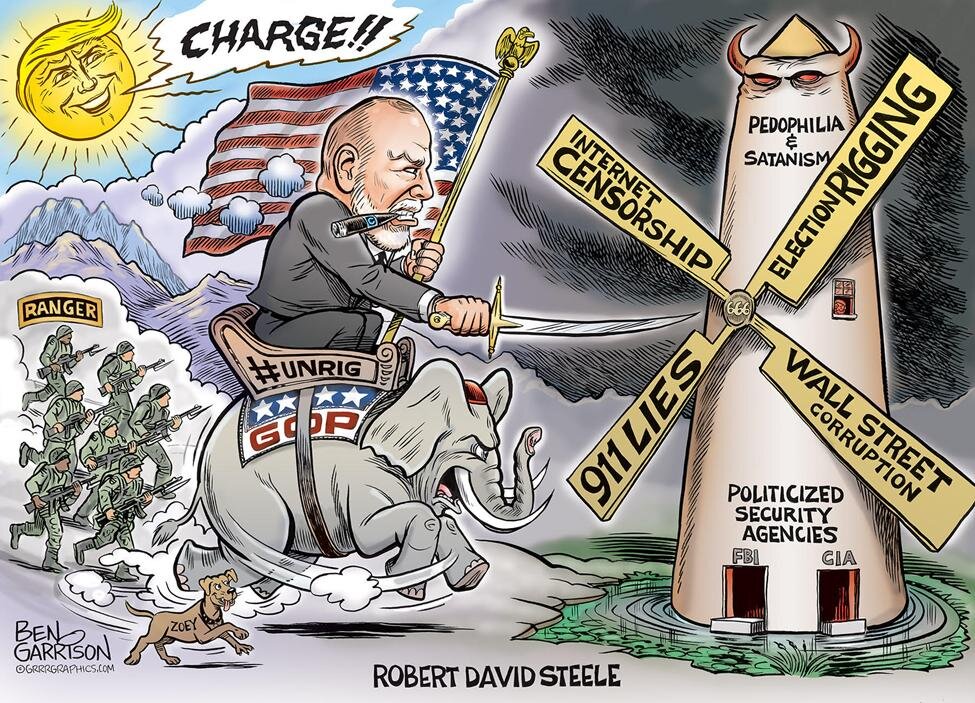

TEHRAN – Robert David Steele, a former Marine Corps infantry officer and CIA spy as well as an activist for Open Source Everything Engineering (OSEE), contributes regularly to Tehran Times.

Article: How the COVID-19 Bailout Gave Wall Street a No-Lose Casino

Article - Media How the COVID-19 Bailout Gave Wall Street a No-Lose Casino

How the COVID-19 Bailout Gave Wall Street a No-Lose Casino

While ordinary Americans face record unemployment and loss, the COVID-19 bailout has saved the very rich

Matt Taibbi

Rolling Stone, 13 May 2020

This financial economy is a fantasy casino, where the winnings are real but free chips cover the losses. For a rarefied segment of society, failure is being written out of the capitalist bargain.

Continue reading “Article: How the COVID-19 Bailout Gave Wall Street a No-Lose Casino”

Web: Wikipedia – Naked Short Selling

WebNaked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the security or ensuring that the security can be borrowed, as is conventionally done in a short sale. When the seller does not obtain the shares within the required time frame, the result is known as a “failure to deliver” (“FTD”). The transaction generally remains open until the shares are acquired by the seller, or the seller’s broker settles the trade.

Media: Matt Taibbi

Media Matthew C. Taibbi born March 2, 1970 is an American author and journalist. He has reported on politics, media, finance, and sports. He is a contributing editor for Rolling Stone.

Matthew C. Taibbi born March 2, 1970 is an American author and journalist. He has reported on politics, media, finance, and sports. He is a contributing editor for Rolling Stone.

Taibbi has authored several books, including The Great Derangement (2009); Griftopia (2010); The Divide (2014); Insane Clown President (2017);[5] I Can’t Breathe (2017); and Hate Inc. (2019).

Book: The Divide – American Injustice in the Ago of the Wealth Gap by Matt Taibbi

Book

SUMMARY REVIEW

Seven Stars Life Transformational — Sickening Detailed Account of Trillion Dollar Crimes by Bankers Ignored While Black and Latino Workers are Beaten Daily for Profit at the Bottom of the Injustice Pyramid

Review by Robert David Steele

Continue reading “Book: The Divide – American Injustice in the Ago of the Wealth Gap by Matt Taibbi”

Article: Looting the Pension Funds All across America, Wall Street is grabbing money meant for public workers

Article - MediaAll across America, Wall Street is grabbing money meant for public workers

Matt Taibbi

Rolling Stone, 10 October 2013

Raimondo’s strategy for saving money involved handing more than $1 billion – 14 percent of the state fund – to hedge funds, including a trio of well-known New York-based funds: Dan Loeb’s Third Point Capital was given $66 million, Ken Garschina’s Mason Capital got $64 million and $70 million went to Paul Singer’s Elliott Management.

The state’s workers, in other words, were being forced to subsidize their own political disenfranchisement, coughing up at least $200 million to members of a group that had supported anti-labor laws.

This is the third act in an improbable triple-fucking of ordinary people that Wall Street is seeking to pull off as a shocker epilogue to the crisis era.

Baker reported that, had public pension funds not been invested in the stock market and exposed to mortgage-backed securities, there would be no shortfall at all.

It’s a scam of almost unmatchable balls and cruelty, accomplished with the aid of some singularly spineless politicians. And it hasn’t happened overnight. This has been in the works for decades, and the fighting has been dirty all the way.

Union leaders all over the country have started to figure out the perils of hiring a bunch of overpriced Wall Street wizards to manage the public’s money.

Article: Secrets and Lies of the Bailout

Article - MediaSecrets and Lies of the Bailout

Matt Taibbi

Rolling Stone, 4 January 2013

It has been four long winters since the federal government, in the hulking, shaven-skulled, Alien Nation-esque form of then-Treasury Secretary Hank Paulson, committed $700 billion in taxpayer money to rescue Wall Street from its own chicanery and greed. To listen to the bankers and their allies in Washington tell it, you’d think the bailout was the best thing to hit the American economy since the invention of the assembly line. Not only did it prevent another Great Depression, we’ve been told, but the money has all been paid back, and the government even made a profit. No harm, no foul – right?

Article: Barron’s Gary Weiss Caught Plagiarizing Matt Taibbi, Find-Replaces Style With Spin

Article - MediaBarron’s Gary Weiss Caught Plagiarizing Matt Taibbi, Find-Replaces Style With Spin

Patrick Byrne

DeepCapture, 7 August 2012

Two months ago a schlubby-but-savage Goldman lawyer named Joseph E. Floren made a mistake that caused some previously redacted information about Goldman Sachs to slip into the public’s hands. The event was ably covered by such globally-respected publications as Bloomberg, the Economist, and Rolling Stone.

Since May I have wondered, With the truth emerge at last in publications such as Economist, Bloomberg, and Rolling Stone, surely the Bad Guys must understand they have lost control of the narrative. Surely, I thought, they are working out some new damage control strategy to deflect or usurp the truth as it comes out.

And as always, Gary Weiss doesn’t let us down.

Article: Lawyers For The Major Banks Accidentally Leaked E-mails About Their Clients Naked Short-Selling Overstock.com

Article - MediaLinette Lopez

Business Insider, 16 May 2012

For years, Overstock.com has been in a legal battle with Goldman Sachs, Bank of America, Merrill Lynch and more. The online retailer accuses the banks of naked short-selling its stock.

Overstock.com lost that battle, but they’re still trying to get the banks to unseal documents that would prove their case.