DOJ Casts the FCPA Spotlight on Brazil-Related Enforcement

Kevin Roberts, Lex Urban, Duncan Grieve, Stephen Weiss, 12 June 2021

On May 25, 2021, the U.S. Department of Justice (“DOJ”) unsealed an indictment charging two Austrian citizens, Peter Weinzierl (“Weinzierl”) and Alexander Waldstein (“Waldstein”), for their roles in a scheme to launder hundreds of millions of dollars through the U.S. financial system on behalf of the Brazilian construction conglomerate, Odebrecht S.A. (“Odebrecht”). The indictment alleges that Weinzierl and Waldstein helped Odebrecht funnel money to offshore accounts to pay bribes to government officials in Brazil, Panama, and Mexico. The announcement was timed to coincide with the arrest of Weinzierl in the United Kingdom; however, Waldstein remains at large.

This enforcement action is notable for a number of reasons:

(1) DOJ has used U.S. money laundering statutes to charge Weinzierl and Waldstein with bribery-related misconduct because both individuals likely fall outside of the ambit of the Foreign Corrupt Practices Act (“FCPA”); Continue reading “Article: DOJ Casts the FCPA Spotlight on Brazil-Related Enforcement”

Wall Street banks must speed up their efforts to stop using Libor, regulators said Friday, issuing one of their sternest warnings yet about abandoning the scandal-plagued benchmark.

Wall Street banks must speed up their efforts to stop using Libor, regulators said Friday, issuing one of their sternest warnings yet about abandoning the scandal-plagued benchmark. JBS USA said it paid $11 million in ransom to criminals responsible for the cyberattack that disrupted meat processing across North America and Australia, the latest high profile example of large corporations falling prey to extortion.

JBS USA said it paid $11 million in ransom to criminals responsible for the cyberattack that disrupted meat processing across North America and Australia, the latest high profile example of large corporations falling prey to extortion. After weeks of drift and doubt, Wall Street was looking for a decisive signal on price growth to help put the reflation trade back on track. Instead it got another mixed message.

After weeks of drift and doubt, Wall Street was looking for a decisive signal on price growth to help put the reflation trade back on track. Instead it got another mixed message. The wife of Mexican drug kingpin Joaquin “El Chapo” Guzman pleaded guilty on Thursday to narcotics trafficking and money laundering conspiracy charges, almost two years after Guzman was sentenced to life in prison.

The wife of Mexican drug kingpin Joaquin “El Chapo” Guzman pleaded guilty on Thursday to narcotics trafficking and money laundering conspiracy charges, almost two years after Guzman was sentenced to life in prison. U.S. Attorney General Merrick Garland warned Wednesday that ransom-motivated cyberattacks are “getting worse and worse,” echoing other top Biden administration officials who have sounded the alarm about the problem in recent weeks.

U.S. Attorney General Merrick Garland warned Wednesday that ransom-motivated cyberattacks are “getting worse and worse,” echoing other top Biden administration officials who have sounded the alarm about the problem in recent weeks.  NEW YORK (Reuters) – Wall Street ended a see-saw session lower on Wednesday as market participants awaited inflation data for clues as to when the U.S. Federal Reserve might tighten its dovish monetary policy.

NEW YORK (Reuters) – Wall Street ended a see-saw session lower on Wednesday as market participants awaited inflation data for clues as to when the U.S. Federal Reserve might tighten its dovish monetary policy. Bitcoin’s fans have long argued that its decentralized design makes it a currency free from government control and manipulation. But on Monday, the US Justice Department said it had reached into a bitcoin “wallet” and swiped back $2.3 million that Colonial Pipeline had paid to hackers after a ransomware attack in May.

Bitcoin’s fans have long argued that its decentralized design makes it a currency free from government control and manipulation. But on Monday, the US Justice Department said it had reached into a bitcoin “wallet” and swiped back $2.3 million that Colonial Pipeline had paid to hackers after a ransomware attack in May. In just two months last year, the FBI watched three companies pay hackers wielding ransomware called NetWalker millions in Bitcoin to get their hacked data back. While that seems like a big win for the cybercriminals, it also gave investigators in the U.S. and elsewhere a new roadmap for tracking and prosecuting them.

In just two months last year, the FBI watched three companies pay hackers wielding ransomware called NetWalker millions in Bitcoin to get their hacked data back. While that seems like a big win for the cybercriminals, it also gave investigators in the U.S. and elsewhere a new roadmap for tracking and prosecuting them. Biblical cycle expert and financial analyst Bo Polny predicted in November of 2020 the stock market (DOW) would “top out in May 2021 at around 33,000 to 34,000 and then crash in June.” So far, half of the prediction is spot on, and we are waiting for the crash. Polny says, “The greatest financial event in human history is not and will not happen on a Trump watch. I repeat, the greatest financial event in human history is not going down on a Trump watch. It’s going to go down under the current, whatever you want to call him. Trump is a builder. The builder comes in to fix things.”

Biblical cycle expert and financial analyst Bo Polny predicted in November of 2020 the stock market (DOW) would “top out in May 2021 at around 33,000 to 34,000 and then crash in June.” So far, half of the prediction is spot on, and we are waiting for the crash. Polny says, “The greatest financial event in human history is not and will not happen on a Trump watch. I repeat, the greatest financial event in human history is not going down on a Trump watch. It’s going to go down under the current, whatever you want to call him. Trump is a builder. The builder comes in to fix things.” A United Soccer League player has been indicted on charges that he allegedly catfished two people out of a combined $215,000.

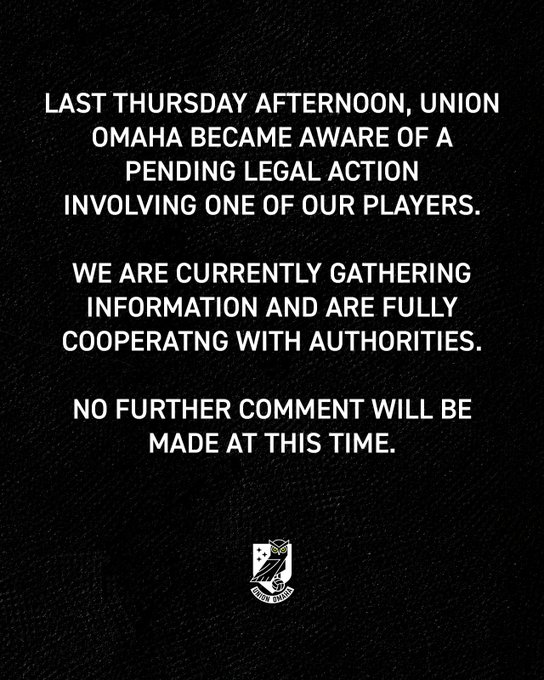

A United Soccer League player has been indicted on charges that he allegedly catfished two people out of a combined $215,000.  FinTech fraud spikes 159 percent in Q1 2021 along with stimulus spending.

FinTech fraud spikes 159 percent in Q1 2021 along with stimulus spending. For every $1 Americans spend on food, just 14.3 cents go to farmers. As the first link in our food supply chain, farmers and ranchers don’t get to set the price of their products and assume incredible risk with every planting and each herd of animals.

For every $1 Americans spend on food, just 14.3 cents go to farmers. As the first link in our food supply chain, farmers and ranchers don’t get to set the price of their products and assume incredible risk with every planting and each herd of animals.