Brad Sherman (D-CA) is a committee member of the 116th Congress U.S. House Committee on Financial Services. Sherman is an American politician serving as a member of the United States House of Representatives. A Democrat, Sherman is in his 12th term as a congressman, having served since 1997. He currently represents California’s 30th congressional district within the San Fernando Valley, in Los Angeles County and the eastern Simi Hills in Ventura County. He previously represented the state’s 24th and 27th congressional districts, located in Los Angeles County. He graduated from the University of California, Los Angeles (B.A.), Harvard University (J.D.)

Brad Sherman (D-CA) is a committee member of the 116th Congress U.S. House Committee on Financial Services. Sherman is an American politician serving as a member of the United States House of Representatives. A Democrat, Sherman is in his 12th term as a congressman, having served since 1997. He currently represents California’s 30th congressional district within the San Fernando Valley, in Los Angeles County and the eastern Simi Hills in Ventura County. He previously represented the state’s 24th and 27th congressional districts, located in Los Angeles County. He graduated from the University of California, Los Angeles (B.A.), Harvard University (J.D.)

Subject: Nydia M. Velázquez

Subject of Interest Nydia M. Velázquez (D-NY) is a committee member of the 116th Congress U.S. House Committee on Financial Services. She is a Puerto Rican-American politician serving in the United States House of Representatives since 1993. Velázquez, a Democrat from New York was the chair of the Congressional Hispanic Caucus until January 3, 2011. Her district, located in New York City, was numbered the 12th district from 1993 to 2013 and has been numbered the 7th district since 2013. In 1976, Velázquez received an M.A. in political science from New York University. She subsequently served as an instructor of political science at the University of Puerto Rico at Humacao from 1976 to 1981. After returning to New York City, Velázquez was an adjunct professor of Puerto Rican studies at Hunter College from 1981 to 1983.

Nydia M. Velázquez (D-NY) is a committee member of the 116th Congress U.S. House Committee on Financial Services. She is a Puerto Rican-American politician serving in the United States House of Representatives since 1993. Velázquez, a Democrat from New York was the chair of the Congressional Hispanic Caucus until January 3, 2011. Her district, located in New York City, was numbered the 12th district from 1993 to 2013 and has been numbered the 7th district since 2013. In 1976, Velázquez received an M.A. in political science from New York University. She subsequently served as an instructor of political science at the University of Puerto Rico at Humacao from 1976 to 1981. After returning to New York City, Velázquez was an adjunct professor of Puerto Rican studies at Hunter College from 1981 to 1983.

Subject: Carolyn B. Maloney

Subject of Interest Carolyn B. Maloney (D-NY) is a committee member of the 116th Congress U.S. House Committee on Financial Services. She is an American politician serving as the U.S. Representative for New York’s 12th congressional district since 2013. A member of the Democratic Party, she is in her 14th term in Congress, having represented the state’s 14th congressional district from 1993 until redistricting in 2013, and the 12th from 2013 to the present. Maloney, for several years, she worked as a teacher and an administrator for the New York City Board of Education. In 1977, she obtained a job working for the New York State Legislature and held senior staff positions in both the State Assembly and the State Senate. She graduated from Greensboro College (BA).

Carolyn B. Maloney (D-NY) is a committee member of the 116th Congress U.S. House Committee on Financial Services. She is an American politician serving as the U.S. Representative for New York’s 12th congressional district since 2013. A member of the Democratic Party, she is in her 14th term in Congress, having represented the state’s 14th congressional district from 1993 until redistricting in 2013, and the 12th from 2013 to the present. Maloney, for several years, she worked as a teacher and an administrator for the New York City Board of Education. In 1977, she obtained a job working for the New York State Legislature and held senior staff positions in both the State Assembly and the State Senate. She graduated from Greensboro College (BA).

Subject: Maxine Waters

Subject of Interest Maxine Moore Waters (D-CA) is currently the chairwoman of the 116th Congress U.S. House Committee on Financial Services. She is an American politician serving as the U.S. Representative for California’s 43rd congressional district since 1991. The district, numbered as the 29th district from 1991–1993 and as the 35th district from 1993 to 2013. Waters is a member of the Democratic Party and is currently in her 15th term in the House. Before becoming a U.S. Representative, Waters served in the California State Assembly, to which she was first elected in 1976. Waters received her Bachelors Degree in Sociology in 1971 at Los Angeles State College (now California State University, Los Angeles), where she received a bachelor’s degree in sociology in 1971.

Maxine Moore Waters (D-CA) is currently the chairwoman of the 116th Congress U.S. House Committee on Financial Services. She is an American politician serving as the U.S. Representative for California’s 43rd congressional district since 1991. The district, numbered as the 29th district from 1991–1993 and as the 35th district from 1993 to 2013. Waters is a member of the Democratic Party and is currently in her 15th term in the House. Before becoming a U.S. Representative, Waters served in the California State Assembly, to which she was first elected in 1976. Waters received her Bachelors Degree in Sociology in 1971 at Los Angeles State College (now California State University, Los Angeles), where she received a bachelor’s degree in sociology in 1971.

Subject: Dennis T. Palmeri

Subject of Interest Dennis T. Palmeri was a former top Shearson Lehman Hutton Inc. executive, who plead guilty to criminal charges in a broad government investigation of the stock-loan industry that also involves other brokerages. Palmeri was in charge of stock loans. The case was said to be derived from information from jailed speculator Ivan F. Boesky, a major source of evidence for Wall Street securities investigations since he was ensnared in an insider trading probe in 1986. Palmeri received illegal kickbacks while head of the stock-loan operation. Palmeri began working at Shearson in 1979. He resigned June 28, 1989. He had supervised a department that specializes in lending blocks of stock mostly to large institutional investors and speculators.

Dennis T. Palmeri was a former top Shearson Lehman Hutton Inc. executive, who plead guilty to criminal charges in a broad government investigation of the stock-loan industry that also involves other brokerages. Palmeri was in charge of stock loans. The case was said to be derived from information from jailed speculator Ivan F. Boesky, a major source of evidence for Wall Street securities investigations since he was ensnared in an insider trading probe in 1986. Palmeri received illegal kickbacks while head of the stock-loan operation. Palmeri began working at Shearson in 1979. He resigned June 28, 1989. He had supervised a department that specializes in lending blocks of stock mostly to large institutional investors and speculators.

Release: Phunware Retains BUYINS.NET to Surveil Short Sellers and Market Makers

ReleasePhunware Retains BUYINS.NET to Surveil Short Sellers and Market Makers

- Approximately 92.3 Million Total Shares Shorted Since February 2019

- Short Squeeze Expected To Begin Above $2.61 Trigger Price

Comment: Phunware trading 56,000,000 shares HUGE naked short if they are forced to cover the stock would go past its old high of $207 in Aug of 2018 the last squeeze NASDAQ, FINRA cant find 1 naked short — this one stands out.

Article: Mercurity Fintech Holding Inc.

Article - Media, PublicationsMercurity Fintech Holding Inc.

SEC, 20 May 2020

Mercurity Fintech Holding Inc. is regulated by the U.S. Security and Exchange Commission . Mercurity Fintech Holding Inc is primarely in the business of services-computer processing & data preparation. This page includes all SEC registration details as well as a list of all documents (S-1, Prospectus, Current Reports, 8-K, 10K, Annual Reports) filed by Mercurity Fintech Holding Inc..

JMU Ltd is an online platform providing B2B (Business to business) services to food-industry suppliers and customers in China. The company connects suppliers and customers in the food service industry through its online platform. It offers a selection of products at competitive prices through its website and mobile applications as well as it offers convenient payment options and comprehensive customer services.

Tip: TikTok New Major Naked Short Victim?

TipTikTok Owner’s Value Exceeds $100 Billion in Private Markets

ByteDance Ltd.’s valuation has risen at least a third to more than $100 billion in recent private share transactions, people familiar with the matter said, reflecting expectations the owner of video phenom TikTok will keep pulling in advertisers despite the Covid-19 pandemic.

Comment: This is absolute bullshit and no with a brain should believe it. This company is probably going to be driven into the ground by a group that has shills and others in place. This is also what China is worried about and this is why Xi and Trump will be talking about naked short selling soon.

Tip: Genetic Technologies About to Get Naked Short Sold?

Article - MediaYahoo Finance, 20 May 2020

Comment: FRAUD ST at its best

Article: Nano Dimension’s stock tumbles after share offering prices at deep discount — did ThinkEquity and Fordham Financial Screw Their Customer?

Article - MediaNano Dimension’s stock tumbles after share offering prices at deep discount

Tomi Kilgore

MarketWatch, 20 May 2020

Shares of Nano Dimension Ltd. pulled a sharp U-turn to trade down 22% in premarket trading, to pullback from the previous session’s more-than 4-fold rally, after the Israel-based 3D printing company priced a share offering at a deep discount. The stock had been up as much as 91% early in the premarket session.

Video: Wall Street as Musical Chairs Fraud

Video

Continue reading “Video: Wall Street as Musical Chairs Fraud”

Article: Another U.S Bank Bailout Under Cover of a Virus

Article - MediaAnother U.S Bank Bailout Under Cover of a Virus

Ellen Brown

Global Research, 19 May 2020

When the Dodd Frank Act was passed in 2010, President Obama triumphantly declared, “No more bailouts!” But what the Act actually said was that the next time the banks failed, they would be subject to “bail ins” – the funds of their creditors, including their large depositors, would be tapped to cover their bad loans.

Then bail-ins were tried in Europe. The results were disastrous.

Record Your Story — 5 Minute Videos Solicited

Administration If you have a Naked Short Selling story, consider recording it and sending the file in. If in true name, record video. If for witness protection, leave video off and we will convert voice to an overlay that cannot be recognized. Five minutes is our standard but up to fifteen minutes considered.

If you have a Naked Short Selling story, consider recording it and sending the file in. If in true name, record video. If for witness protection, leave video off and we will convert voice to an overlay that cannot be recognized. Five minutes is our standard but up to fifteen minutes considered.

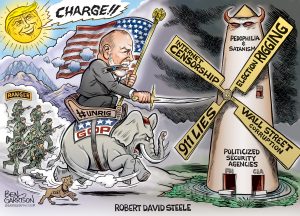

Send file to robert.david.steele.vivas AT gmail DOT com

Tip: Nano Dimension Today’s Naked Short Leader

TipArticle: SmileDirectClub Sues NBC Over News Report, Seeking $2.85 Billion

Article - MediaSmileDirectClub Sues NBC Over News Report, Seeking $2.85 Billion

SmileDirectClub attorney was lawyer in suit against ABC News for stories on beef called ‘pink slime’ by critics

Benjamin Mullin

Wall Street Journal, 18 May 2020

Teledentistry company SmileDirectClub Inc. sued Comcast Corp.’s NBCUniversal, seeking nearly $3 billion in damages for what it alleges were defamatory news reports about the company’s treatment methods.

The suit, filed Monday in a Tennessee court, focuses on a Feb. 13 “NBC Nightly News” segment that described complaints by some SmileDirectClub customers and warnings about teledentistry from an orthodontics professor. The lawsuit also says that an online article accompanying the segment is inaccurate.

RELATED: