Ex-South African Leader Zuma Secures Postponement in Graft Case

S’thembile Cele, 20 July 2021

South Africa’s High Court postponed former South African President Jacob Zuma’s trial on corruption, money laundering and racketeering charges until Aug. 10.

South Africa’s High Court postponed former South African President Jacob Zuma’s trial on corruption, money laundering and racketeering charges until Aug. 10.

Judge Piet Koen agreed to the delay at a hearing in the eastern town of Pietermaritzburg on Tuesday, after Zuma’s lawyer Dali Mpofu argued that his client should be physically present in court. Proceedings have taken place remotely this week due to security concerns linked to a wave of protests in the region. Continue reading “Article: Ex-South African Leader Zuma Secures Postponement in Graft Case”

The last month has been pretty rough on AMC Entertainment (NYSE:AMC). The theater chain erased a great deal of its gains over the last few weeks, thanks to slowing momentum in the world of meme stocks. Investors in this highly volatile investing sect have seemingly turned their attention away from large plays like AMC and sent prices tumbling. But now, the company is closing a deal that can bring it some crucial revenue over the next few years; two theaters in the Los Angeles area will become AMC theaters, with the chain signing a years-long lease on the locations. As a result, AMC stock is gaining once again.

The last month has been pretty rough on AMC Entertainment (NYSE:AMC). The theater chain erased a great deal of its gains over the last few weeks, thanks to slowing momentum in the world of meme stocks. Investors in this highly volatile investing sect have seemingly turned their attention away from large plays like AMC and sent prices tumbling. But now, the company is closing a deal that can bring it some crucial revenue over the next few years; two theaters in the Los Angeles area will become AMC theaters, with the chain signing a years-long lease on the locations. As a result, AMC stock is gaining once again.  Before dark pools, institutional investors had to trade in blocks of shares outside trading hours to avoid upsetting the market. Now, the utility found within dark pools is so high that some market makers have embedded them within their operations. There are certainly some benefits here in terms of increased liquidity, but there’s another side of the coin as well.

Before dark pools, institutional investors had to trade in blocks of shares outside trading hours to avoid upsetting the market. Now, the utility found within dark pools is so high that some market makers have embedded them within their operations. There are certainly some benefits here in terms of increased liquidity, but there’s another side of the coin as well. Citigroup Inc., Barclays Plc, and other top banks got a federal appeals court in Manhattan on Monday to uphold their win against antitrust claims over an alleged scheme to rig the multitrillion-dollar market for bonds backed by foreign governments and multinational institutions.

Citigroup Inc., Barclays Plc, and other top banks got a federal appeals court in Manhattan on Monday to uphold their win against antitrust claims over an alleged scheme to rig the multitrillion-dollar market for bonds backed by foreign governments and multinational institutions. There has been an increase of banks and credits unions that have spoken on working with cannabis businesses. In recent times reports have come out about how these financial institutes have remained stable over the last quarter. This updated info has come from published federal data.

There has been an increase of banks and credits unions that have spoken on working with cannabis businesses. In recent times reports have come out about how these financial institutes have remained stable over the last quarter. This updated info has come from published federal data. WASHINGTON: The United States and Vietnam on Monday said they had reached an agreement to resolve a dispute over the value of Hanoi’s dong currency, which Washington had briefly accused it of manipulating. Washington in April withdrew its accusation, but Vietnam remains on the US Treasury’s “Monitoring List” for scrutiny of its currency policies.

WASHINGTON: The United States and Vietnam on Monday said they had reached an agreement to resolve a dispute over the value of Hanoi’s dong currency, which Washington had briefly accused it of manipulating. Washington in April withdrew its accusation, but Vietnam remains on the US Treasury’s “Monitoring List” for scrutiny of its currency policies. Oil was the biggest loser in a broad market selloff after OPEC+ agreed to boost crude supply as a resurgent virus shook investor confidence in the global economic recovery.

Oil was the biggest loser in a broad market selloff after OPEC+ agreed to boost crude supply as a resurgent virus shook investor confidence in the global economic recovery. The Jeffrey Epstein Cover Up: Pedophilia, Lies, and Videotape

The Jeffrey Epstein Cover Up: Pedophilia, Lies, and Videotape

The City regulator has warned bosses at Britain’s biggest retail banks that they must do more to stop money laundering or face personal consequences for failing to comply with the rules.

The City regulator has warned bosses at Britain’s biggest retail banks that they must do more to stop money laundering or face personal consequences for failing to comply with the rules. Affirm CEO Max Levchin discusses Apple’s announcement that they will collaborate with Goldman Sachs and start allowing customers to buy products using Apple Pay and pay off the purchases in installments, which will be in direct competition with his company. He speaks with Emily Chang on “Bloomberg Technology.”

Affirm CEO Max Levchin discusses Apple’s announcement that they will collaborate with Goldman Sachs and start allowing customers to buy products using Apple Pay and pay off the purchases in installments, which will be in direct competition with his company. He speaks with Emily Chang on “Bloomberg Technology.” Back in February, I wrote about the national grocery chain Kroger’s announcement that it was closing low-performing stores in Seattle and Long Beach, California, after the two cities passed laws requiring grocery stores to pay their front-line workers additional $4-per-hour “hero pay” during the pandemic.

Back in February, I wrote about the national grocery chain Kroger’s announcement that it was closing low-performing stores in Seattle and Long Beach, California, after the two cities passed laws requiring grocery stores to pay their front-line workers additional $4-per-hour “hero pay” during the pandemic.  When Keith “Roaring Kitty” Gill announced he was buying GameStop (NYSE:GME) shares and options on Reddit’s r/WallStreetBets, regulators might have considered his outrageous claims as parody — speech protected by First Amendment rights. Who could take $20 calls on GME seriously when the stock was trading at $5?

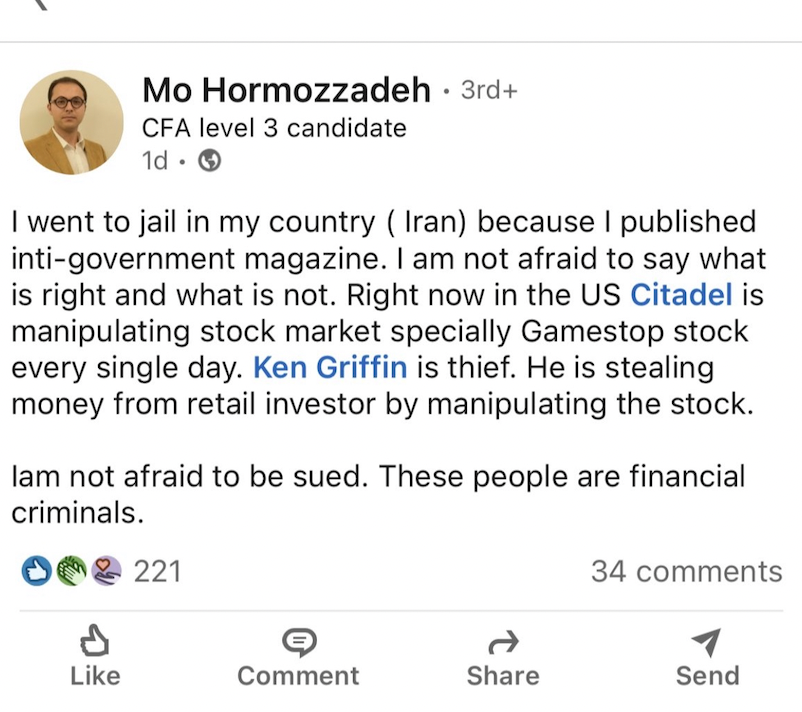

When Keith “Roaring Kitty” Gill announced he was buying GameStop (NYSE:GME) shares and options on Reddit’s r/WallStreetBets, regulators might have considered his outrageous claims as parody — speech protected by First Amendment rights. Who could take $20 calls on GME seriously when the stock was trading at $5?