US courts dismiss manipulation allegations involving Bitcoin Cash

Shaurya Malwa, 02 April 2021

US courts dismissed an antitrust lawsuit that alleged prominent investors and individuals schemed to hijack the Bitcoin Cash network, the world’s thirteenth largest crypto network by market cap.

A controversy around Bitcoin Cash

The complaint, amended in March 2020 and filed by crypto company United American Corp (UAC), named Bitcoin Cash proponent Roger Ver, crypto exchange Kraken founder Jesse Powell, BTC mining giant Bitmain and CEO Jihan Wu, and Bitcoin Cash developers Shammah Chancellor and Jason Cox as the alleged participants in the scheme.

UAC first brought its suit in December 2018 and alleging the named individuals had effectively manipulated and devalued Bitcoin and pushed the firm out of the network after it had invested over $4 million. Continue reading “Article: US courts dismiss manipulation allegations involving Bitcoin Cash”

US investment bank Morgan Stanley has filed an update to its prospectus related to bitcoin (BTC) with the Securities and Exchange Commission (SEC). The institution applied for 12 of its funds to have exposure with the first cryptocurrency.

US investment bank Morgan Stanley has filed an update to its prospectus related to bitcoin (BTC) with the Securities and Exchange Commission (SEC). The institution applied for 12 of its funds to have exposure with the first cryptocurrency. Institutions are slowly warming to Bitcoin, which many market observers believe will lead to substantial long-term price appreciation.

Institutions are slowly warming to Bitcoin, which many market observers believe will lead to substantial long-term price appreciation. The UK’s financial regulator, the Financial Conduct Authority (FCA), has announced a shake-up of its anti-money laundering activities which will see firms dealing in cryptoassets obliged to file annual reports on their trading activities.

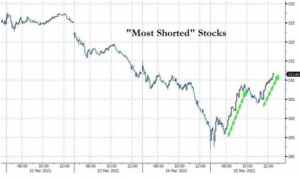

The UK’s financial regulator, the Financial Conduct Authority (FCA), has announced a shake-up of its anti-money laundering activities which will see firms dealing in cryptoassets obliged to file annual reports on their trading activities. Stocks Dump’n’Pump; Dollar Gains Amid Bitcoin, Bond Pain

Stocks Dump’n’Pump; Dollar Gains Amid Bitcoin, Bond Pain The FBI arrested six people in the town of Keene, New Hampshire, on money laundering charges. Agents removed a Bitcoin ATM from a local bar believed to be used in the crime, according to a report in the New Hampshire Union Leader.

The FBI arrested six people in the town of Keene, New Hampshire, on money laundering charges. Agents removed a Bitcoin ATM from a local bar believed to be used in the crime, according to a report in the New Hampshire Union Leader.