Joen Coronel, 09 April 2021

On Thursday, Apr. 8, Robinhood announced a staggering surge in the number of its customers who engage in cryptocurrency trading. The financial services company which was founded on Apr. 18, 2013, has recorded that 9.5 million people have used the platform during the first quarter of this year.

The said number shoots up to a stupendous 458% increase in users, which only accounts for 1.7 million in 2020’s Q4.

How Robinhood Sudden Became Popular in Crypto Trading Continue reading “Article: Robinhood Faces 458% Spike in Crypto Customers–Massive Increase from 1.7 Million to 9.5 Million in Q1 of 2021”

Bitcoin Shows Us That Not All Volatilities Are Created Equal

Bitcoin Shows Us That Not All Volatilities Are Created Equal Over the past few days, Bitcoin Cash has been recording significant price surges, appreciating by over 30 percent in value. Despite the impressive bull run, Bitcoin Cash recently experienced a price correction towards the $600 region. At present, multiple technical indicators are showing BCH could experience further price declines.

Over the past few days, Bitcoin Cash has been recording significant price surges, appreciating by over 30 percent in value. Despite the impressive bull run, Bitcoin Cash recently experienced a price correction towards the $600 region. At present, multiple technical indicators are showing BCH could experience further price declines.  South Korea’s government has pledged to focus on illegal activities in crypto markets.

South Korea’s government has pledged to focus on illegal activities in crypto markets.  XRP bulls are back!

XRP bulls are back! Novelist-philosopher Ayn Rand famously admonished us to “check our premises.” That’s a fancy way of saying that it pays to ask ourselves if we might be missing something—especially when confronted with a situation that makes no sense.

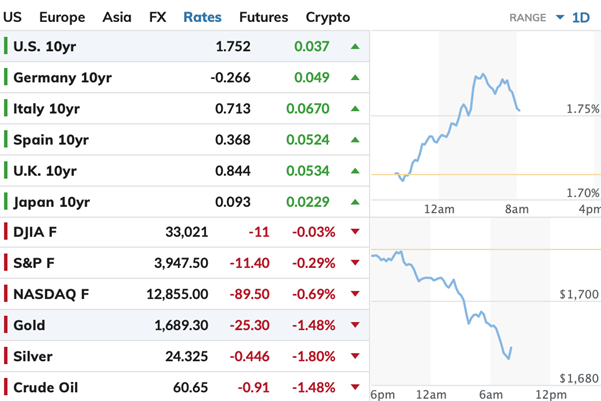

Novelist-philosopher Ayn Rand famously admonished us to “check our premises.” That’s a fancy way of saying that it pays to ask ourselves if we might be missing something—especially when confronted with a situation that makes no sense. Bitcoin, other cryptocurrencies, and essentially all digital assets have surged in price recently amid surging interest by the public, investors of all types, and the financial industry. Despite a steadily growing acceptance and anticipation of a crypto-friendly regulatory environment under the new administration in Washington, the future regulatory framework for digital assets is complex and uncertain.

Bitcoin, other cryptocurrencies, and essentially all digital assets have surged in price recently amid surging interest by the public, investors of all types, and the financial industry. Despite a steadily growing acceptance and anticipation of a crypto-friendly regulatory environment under the new administration in Washington, the future regulatory framework for digital assets is complex and uncertain.  BCH Price rose over 10% on Monday, settling at $625 as at the time of writing. Bitcoin cash turned into a sideways consolidation in late February after hitting yearly highs at $773. While it’s recovering today, the barrier at $630 was strong and kept the BCH price confined below this level. Thus, it may be too early to call a breakout yet due to the weak upside momentum. Instead, the consolidation may likely extend further for a while. Currently, BCH is trading in the upper part of its consolidation range while targetting a breakout past the $630 barrier.

BCH Price rose over 10% on Monday, settling at $625 as at the time of writing. Bitcoin cash turned into a sideways consolidation in late February after hitting yearly highs at $773. While it’s recovering today, the barrier at $630 was strong and kept the BCH price confined below this level. Thus, it may be too early to call a breakout yet due to the weak upside momentum. Instead, the consolidation may likely extend further for a while. Currently, BCH is trading in the upper part of its consolidation range while targetting a breakout past the $630 barrier.  Blockchain evaluation agency, Chainalysis’ newest crime report has named Mirror Buying and selling Worldwide (MTI) as the largest cryptocurrency rip-off of 2020. Chainalysis arrived at this conclusion after an investigation discovered that MTI had taken in $589 million from greater than 471,000 deposits. In line with the report, MTI’s haul is considerably greater than that of Forsage and J-enco, the following greatest scams. Each scams raked in lower than $350 million every.

Blockchain evaluation agency, Chainalysis’ newest crime report has named Mirror Buying and selling Worldwide (MTI) as the largest cryptocurrency rip-off of 2020. Chainalysis arrived at this conclusion after an investigation discovered that MTI had taken in $589 million from greater than 471,000 deposits. In line with the report, MTI’s haul is considerably greater than that of Forsage and J-enco, the following greatest scams. Each scams raked in lower than $350 million every.  Non-fungible tokens, or NFTs, are changing the way we think about art (and other collectibles), and in 2021, investors have started to take notice. As Decrypt writes, in the last year, NFTs have shot to the forefront of the crypto space. The cryptographically-unique tokens make it possible to create real-world scarcity for digital objects, and artists have seized on the opportunity presented by the technology.

Non-fungible tokens, or NFTs, are changing the way we think about art (and other collectibles), and in 2021, investors have started to take notice. As Decrypt writes, in the last year, NFTs have shot to the forefront of the crypto space. The cryptographically-unique tokens make it possible to create real-world scarcity for digital objects, and artists have seized on the opportunity presented by the technology.