Why China ‘Bad Bank’ Huarong’s Fall Is Big Bad News: QuickTake

Rebecca Choong Wilkins, 18April 2021

What happens when a company set up by the Chinese government to help clean up toxic debt in the country’s banking system gets into trouble itself? We’re finding out now. Investors were spooked in April after China Huarong Asset Management Co., one of the country’s biggest distressed asset managers, failed to release financial statements in the wake of the execution of its former top executive for bribery. That raised questions about its financial health — and broader worries about whether China would let an institution backed by the central government fail. The ending of a presumed safety net that’s long been priced into Chinese bond values would mean a seismic shift for investors across emerging markets. Continue reading “Article: Why China ‘Bad Bank’ Huarong’s Fall Is Big Bad News: QuickTake”

What happens when a company set up by the Chinese government to help clean up toxic debt in the country’s banking system gets into trouble itself? We’re finding out now. Investors were spooked in April after China Huarong Asset Management Co., one of the country’s biggest distressed asset managers, failed to release financial statements in the wake of the execution of its former top executive for bribery. That raised questions about its financial health — and broader worries about whether China would let an institution backed by the central government fail. The ending of a presumed safety net that’s long been priced into Chinese bond values would mean a seismic shift for investors across emerging markets. Continue reading “Article: Why China ‘Bad Bank’ Huarong’s Fall Is Big Bad News: QuickTake”

(Bloomberg) — Morgan Stanley became the latest bank to get swept up in the implosion of Archegos Capital Management, reporting $911 million in total losses related to the debacle.

(Bloomberg) — Morgan Stanley became the latest bank to get swept up in the implosion of Archegos Capital Management, reporting $911 million in total losses related to the debacle. (Bloomberg) — The full implications of Beijing’s rapid-fire moves against Jack Ma’s internet empire in recent days won’t be apparent for weeks, but one lesson is already clear: The glory days for China’s technology giants are over.

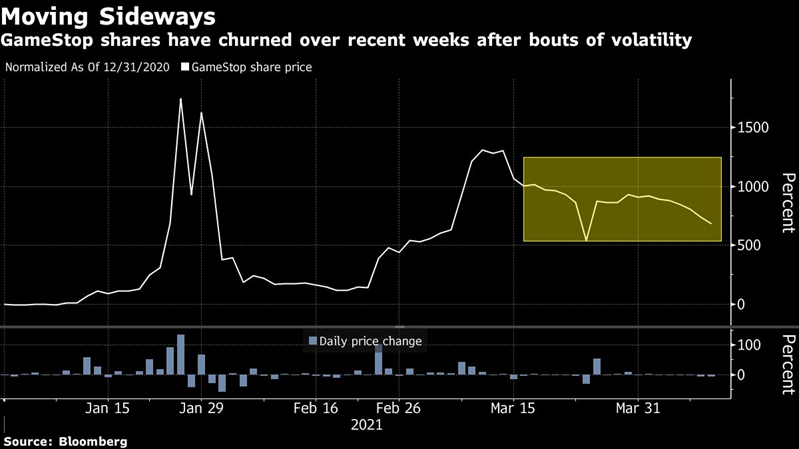

(Bloomberg) — The full implications of Beijing’s rapid-fire moves against Jack Ma’s internet empire in recent days won’t be apparent for weeks, but one lesson is already clear: The glory days for China’s technology giants are over. (Bloomberg) — GameStop Corp.’s Reddit-fueled trading surge is likely going to fade as threats from digital game downloads sink in, according to one skeptical Wall Street analyst.

(Bloomberg) — GameStop Corp.’s Reddit-fueled trading surge is likely going to fade as threats from digital game downloads sink in, according to one skeptical Wall Street analyst. Back in December, Bloomberg published a sweeping expose that raised serious questions about the ESG investing craze sweeping the world. In the piece, Bloomberg detailed how the Nature Conservancy, the world’s biggest environmental group and a prominent seller of carbon offsets, had sold “worthless” credits to JPMorgan, Disney and BlackRock as the corporations sought to finance the protection of carbon-absorbing forest land to absolve them of their sins tied to fossil fuel usage.

Back in December, Bloomberg published a sweeping expose that raised serious questions about the ESG investing craze sweeping the world. In the piece, Bloomberg detailed how the Nature Conservancy, the world’s biggest environmental group and a prominent seller of carbon offsets, had sold “worthless” credits to JPMorgan, Disney and BlackRock as the corporations sought to finance the protection of carbon-absorbing forest land to absolve them of their sins tied to fossil fuel usage.  Goldman Sachs managed to avoid billions of dollars in potential losses from the implosion of highly levered hedge fund Archegos Capital Management by breaking ranks with other syndicate banks to dump large blocks of shares representing Archegos’s exposure to a coterie of tech and media names. When the dust settled, the bank told shareholders any losses would be insignificant, while Credit Suisse, the bank with perhaps the biggest exposure, said Tuesday it has booked a nearly $5 billion loss.

Goldman Sachs managed to avoid billions of dollars in potential losses from the implosion of highly levered hedge fund Archegos Capital Management by breaking ranks with other syndicate banks to dump large blocks of shares representing Archegos’s exposure to a coterie of tech and media names. When the dust settled, the bank told shareholders any losses would be insignificant, while Credit Suisse, the bank with perhaps the biggest exposure, said Tuesday it has booked a nearly $5 billion loss.  It’s official: the Financial Times (citing an informal polling of anonymous bankers) has declared Deliveroo’s botched London offering the “worst IPO in London’s history.”

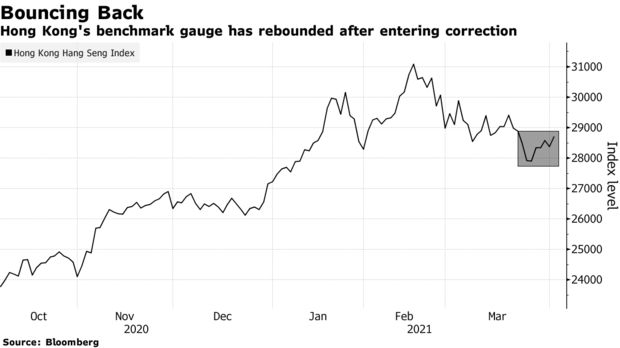

It’s official: the Financial Times (citing an informal polling of anonymous bankers) has declared Deliveroo’s botched London offering the “worst IPO in London’s history.” Trading in more than 50 Hong Kong-listed companies was suspended on Thursday, after a number of firms failed to report earnings ahead of the March 31 deadline.

Trading in more than 50 Hong Kong-listed companies was suspended on Thursday, after a number of firms failed to report earnings ahead of the March 31 deadline. Unlike the devastating London Whale debacle in 2012, which was all JPMorgan eventually drawn and quartered quite theatrically before Congress (and was a clear explanation of how banks used Fed reserves to manipulate markets, something most market participants had no idea was possible), this time JPMorgan was nowhere to be found in the aftermath of the historic margin call that destroyed hedge fund Archegos. Which is may explain why JPMorgan bank analyst Kian Abouhossein admits he is quite “puzzled” by the recent fallout from the Archegos implosion (or maybe JPM simply was not a Prime Broker of the notorious Tiger cub), which however does not prevent him from trying to calculate the capital at risk from the Archegos collapse.

Unlike the devastating London Whale debacle in 2012, which was all JPMorgan eventually drawn and quartered quite theatrically before Congress (and was a clear explanation of how banks used Fed reserves to manipulate markets, something most market participants had no idea was possible), this time JPMorgan was nowhere to be found in the aftermath of the historic margin call that destroyed hedge fund Archegos. Which is may explain why JPMorgan bank analyst Kian Abouhossein admits he is quite “puzzled” by the recent fallout from the Archegos implosion (or maybe JPM simply was not a Prime Broker of the notorious Tiger cub), which however does not prevent him from trying to calculate the capital at risk from the Archegos collapse.  Imagine if Goldman Sachs GS -0.5% lent a billion dollars to RoaringKitty.

Imagine if Goldman Sachs GS -0.5% lent a billion dollars to RoaringKitty.