Mark Stainton is a Special Advisor to the CEO. He joined Citadel in 2006 as Head of Commodities and was subsequently appointed to Head of Global Equities in 2016 before assuming his current role. Prior to Citadel, he served as Head of CDO and Exotic Credit Trading at Deutsche Bank. Prior to Deutsche Bank, he spent three years at JPMorgan Chase in London, where he was a specialist in interest rate and currency products. Mark began his career at McKinsey & Company and holds a bachelor’s degree from Oxford University.

Mark Stainton is a Special Advisor to the CEO. He joined Citadel in 2006 as Head of Commodities and was subsequently appointed to Head of Global Equities in 2016 before assuming his current role. Prior to Citadel, he served as Head of CDO and Exotic Credit Trading at Deutsche Bank. Prior to Deutsche Bank, he spent three years at JPMorgan Chase in London, where he was a specialist in interest rate and currency products. Mark began his career at McKinsey & Company and holds a bachelor’s degree from Oxford University.

Subject: Anshu Jain

Subject of Interest Anshu Jain is the President of Cantor Fitzgerald L.P., he works alongside Howard W. Lutnick, Chairman and Chief Executive Officer. Mr. Jain was Co-CEO of Deutsche Bank from June 2012 to June 2015. Prior to that, he worked at Merrill Lynch He served on the International Advisory Panel of the Monetary Authority of Singapore. Mr. Jain received his Bachelor’s degree in Economics, with honors, from the University of Delhi and his MBA in Finance degree, Beta Gamma Sigma, from the University of Massachusetts Amherst.

Anshu Jain is the President of Cantor Fitzgerald L.P., he works alongside Howard W. Lutnick, Chairman and Chief Executive Officer. Mr. Jain was Co-CEO of Deutsche Bank from June 2012 to June 2015. Prior to that, he worked at Merrill Lynch He served on the International Advisory Panel of the Monetary Authority of Singapore. Mr. Jain received his Bachelor’s degree in Economics, with honors, from the University of Delhi and his MBA in Finance degree, Beta Gamma Sigma, from the University of Massachusetts Amherst.

Subject: Marcus Freeman

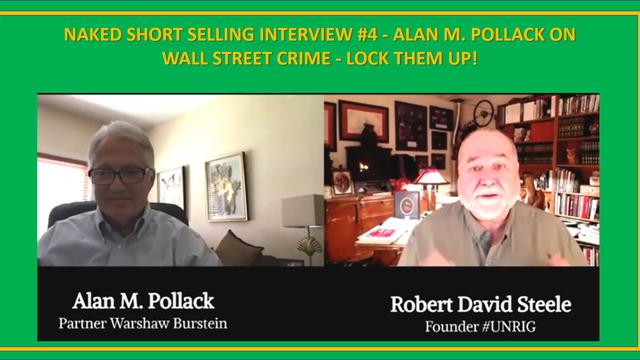

Subject of Interest#UNRIG Video (33:44) Naked Short Selling Interview #4 – Alan M. Pollack on Wall Street Crime – Lock Them Up!

Video#UNRIG Video (39:06) Naked Short Selling Interview #1 – Wes Christian, pioneering attorney on the big picture

VideoArticle: The Tide Is Going Out and JPMorgan, Deutsche Bank and AIG Appear to Be Swimming (Read Trading) Naked

Article - MediaThe Tide Is Going Out and JPMorgan, Deutsche Bank and AIG Appear to Be Swimming (Read Trading) Naked

Pam Martens, Russ Martens

Wall Street on Parade, 29 March 2020

Warren Buffet is credited with the quote: “Only when the tide goes out do you discover who’s been swimming naked.”

Friday’s closing prices among some of the heavily interconnected mega Wall Street banks and insurance companies known to be counterparties to Wall Street’s derivatives appeared to show who’s swimming naked in the realm of derivatives – naked meaning who has sold derivative protection (gone short the risk) on something that is blowing up.

Article: Metals Trader Says Deutsche Bank Used Him as Spoofing Scapegoat

Article - MediaMetals Trader Says Deutsche Bank Used Him as Spoofing Scapegoat

Janan Hanna

Bloomberg, 13 January 2020

A former Deutsche Bank AG precious-metals trader accused by the U.S. of manipulating commodity markets claims the bank used him as a scapegoat to curry favor with regulators investigating the company.

James Vorley, who is awaiting trial in Chicago, said in a court filing Friday that the bank was acting at the request of federal investigators when it conducted an internal investigation of possible unlawful trading, or spoofing, on its precious-metals desk and obtained a recorded statement from him.

Article: Ex-Deutsche Bank Traders Must Face Spoofing Case, Judge Says

Article - MediaEx-Deutsche Bank Traders Must Face Spoofing Case, Judge Says

Janan Hanna

Bloomberg, 21 October 2019

The criminal case against two former Deutsche Bank AG employees accused of fraudulent and manipulative precious-metals trading can proceed, after a federal judge on Monday rejected their request for dismissal.

U.S. District Judge John J. Tharp in Chicago said prosecutors had properly used the wire-fraud statute to charge James Vorley and Cedric Chanu with spoofing, part of an alleged multiyear scheme to defraud other traders on the Commodity Exchange Inc., a venue run by CME Group Inc.’s Chicago Mercantile Exchange.

Article: JPMorgan’s Metals Desk Was a Criminal Enterprise, U.S. Says

Article - MediaJPMorgan’s Metals Desk Was a Criminal Enterprise, U.S. Says

By Tom Schoenberg and David Voreacos

Bloomberg

-

U.S. invokes racketeering law in charging three metals traders

-

RICO statute is rarely used in cases involving big banks

The head of the bank’s global precious metals desk, Michael Nowak, 45, and two others ripped off market participants and even clients as they illegally moved prices for gold, silver, platinum and palladium, the Justice Department said Monday. Nowak was placed on leave last month, a person familiar with the matter has said. The other traders charged were Gregg Smith, 55 and Christopher Jordan, 47.

Article: Factbox: European banks hit by Russian money laundering scandal

Article - Media, PublicationsFactbox: European banks hit by Russian money laundering scandal

Reuters Staff, 08 March 2019

Several European banks are facing allegations of being involved in a Baltic money laundering scandal and failing to prevent tainted Russian money from flowing through their branches across the world. Continue reading “Article: Factbox: European banks hit by Russian money laundering scandal”

Article: The Government’s New Strategy to Crack Down on ‘Spoofing’

Article - MediaThe Government’s New Strategy to Crack Down on ‘Spoofing’

Peter J. Henning

New York Times, 4 September 2018

The Justice Department has tried to crack down on traders who try to move markets by entering and quickly canceling orders, conduct that goes by the catchy moniker “spoofing.”

But the government’s early prosecution of the crime has faced a big setback. In just the second trial for spoofing, which the Dodd-Frank Act outlawed, a Connecticut jury acquitted a former trader at UBS of spoofing this spring. That raised questions about whether prosecutors can pursue these cases.

Article: Ex-UBS trader beats market manipulation charge

Article - Media, PublicationsEx-UBS trader beats market manipulation charge

New York (AFP), 25 April 2018

Former UBS precious metals trader Andre Flotron was acquitted on Wednesday of market manipulation, a development that could spell trouble for similar cases against other Wall Street traders.

Authorities arrested Flotron late last year on charges he engaged in a Wall Street practice called “spoofing,” which involves placing and then immediately aborting trades to move prices. The acquittal follows January’s $46.6 million settlement with UBS, Deutsche Bank and HSBC over allegations traders at the banks worked to manipulate futures markets in precious metals between 2008 and early 2014.

Before this case, only three other people had ever been charged with “spoofing,” according to the Justice Department, a practice banned under the 2010 Dodd-Frank Wall Street reform legislation. Continue reading “Article: Ex-UBS trader beats market manipulation charge”

Article: Key to catching the traders charged with manipulating metals futures: electronic chatter

Article - MediaKey to catching the traders charged with manipulating metals futures: electronic chatter

Francine McKenna

MarketWatch, 30 January 2018

The Commodity Futures Trading Commission announced criminal and civil enforcement actions on Monday against Deutsche Bank AG and Deutsche Bank Securities Inc, UBS AG and HSBC Securities (USA) Inc. and six individuals involved in spoofing and stop loss collusion schemes. The criminal and civil enforcement actions were filed in conjunction with the Department of Justice and Federal Bureau of Investigation’s Criminal Investigative Division.

Deutsche Bank AG and Deutsche Bank Securities Inc. were hit the hardest, agreeing to pay a $30 million penalty while neither admitting or denying they failed to supervise precious metals traders who allegedly schemed to manipulate the price of precious metals futures contracts and allegedly colluding to trigger customer stop-loss orders. The fraud allegedly ran from Feb. 2008 to at least Sept. 2014.

Article: US fines Deutsche Bank, UBS and HSBC over market manipulation

Article - Media, PublicationsUS fines Deutsche Bank, UBS and HSBC over market manipulation

Agence France-Presse, 30 January 2018

US authorities on Monday announced fines and charges against three major European banks and eight individuals accused of manipulating futures markets for precious metals.

Deutsche Bank, UBS and HSBC will together pay a total of $46.6 million to settle allegations that traders at the banks worked to manipulate futures markets in precious metals through a process known as “spoofing,” the Justice Department and Commodity Futures Trading Commission said.Seven former traders, including ex-UBS trader Andre Flotron, who was indicted last year, as well as a technology consultant, also face charges of “spoofing” — in which traders place and then abort trades to manipulate prices — on markets for various precious metals including gold and silver between early 2008 and about 2014. Continue reading “Article: US fines Deutsche Bank, UBS and HSBC over market manipulation”

Article: Federal Charges Filed in Price ‘Spoofing’ Inquiry on Wall St.

Article - MediaFederal Charges Filed in Price ‘Spoofing’ Inquiry on Wall St.

Emily Flitter

New York Times, 29 January 2018

Federal authorities have filed civil and criminal charges against a group of Wall Street banks and individuals that they say tried to manipulate markets in gold, silver and certain financial products, including by showing potential customers fake prices.

The actions, filed over the past several days, are part of a yearslong effort by financial regulators and the Department of Justice to stamp out behavior that gives the biggest banks an advantage over smaller market players.

Marcus Freeman is the Managing Director & Chief Executive Officer of Canaccord Genuity (Australia) Limited (Asia-Pacific). He was appointed in February, 2015. He co-founded BGF Equities in 2008. Freeman completed his B. Com and was originally recruited to the graduate program of Price Waterhouse. Some years later he relocated to London, where he worked at Sakura Bank (Foreign Exchange), Rabobank International (Foreign Exchange) and Deutsche Bank (Global Equities). He returned to Australia in 2000 to work in Bell Potter’s equities business for approximately eight years, where he built significant institutional and investment banking relationships before founding BGF Equities.

Marcus Freeman is the Managing Director & Chief Executive Officer of Canaccord Genuity (Australia) Limited (Asia-Pacific). He was appointed in February, 2015. He co-founded BGF Equities in 2008. Freeman completed his B. Com and was originally recruited to the graduate program of Price Waterhouse. Some years later he relocated to London, where he worked at Sakura Bank (Foreign Exchange), Rabobank International (Foreign Exchange) and Deutsche Bank (Global Equities). He returned to Australia in 2000 to work in Bell Potter’s equities business for approximately eight years, where he built significant institutional and investment banking relationships before founding BGF Equities.