Citi Must Face Former Trader’s Malicious-Prosecution Lawsuit

Bob Van Voris, Jenny Surane and Michael Leonard, Bloomberg News, 12 March 2021

(Bloomberg) — One of three British traders acquitted of using an online chatroom to fix prices in the foreign exchange market can go forward with a lawsuit claiming that Citigroup Inc. “fabricated” a baseless case against him, a judge ruled.

U.S. District Judge Victor Marrero on Thursday rejected the bank’s attempt to have the case dismissed. Former Citigroup trader Rohan Ramchandani sued in 2019 claiming damages of $112 million.

Read More: Citigroup Framed Me, Acquitted Forex Trader Claims in Suit

The ruling clears the way for Ramchandani, a former London-based trader, to move forward with the malicious-prosecution suit, which he brought in New York against a group of the bank’s affiliates after his acquittal.

“Mr. Ramchandani’s claims of malicious prosecution are without merit and we will contest them vigorously,” Danielle Romero-Apsilos, a spokeswoman for the bank, said in an emailed statement.

A Manhattan federal jury in October 2018 found Ramchandani and two other British traders working for other banks — a group dubbed “the Cartel” — not guilty of conspiring through online chatrooms to manipulate the $5.1-trillion-a-day foreign exchange market.

Citigroup, JPMorgan Chase & Co., Barclays Plc and Royal Bank of Scotland Group Plc pleaded guilty to currency manipulation in 2015 as part of a $5.8 billion settlement with the DOJ.

Read Full Article

It is a striking paradox that postwar Germany has achieved sustained success as an economy, even with a flailing banking sector, headed by the flag-carrying Deutsche Bank, to underpin it. But there are signs the contradiction may be resolving.

It is a striking paradox that postwar Germany has achieved sustained success as an economy, even with a flailing banking sector, headed by the flag-carrying Deutsche Bank, to underpin it. But there are signs the contradiction may be resolving.

ZURICH (Reuters) -Credit Suisse said on Tuesday it will take a 4.4 billion Swiss franc ($4.7 billion) hit from dealings with Archegos Capital Management, prompting it to overhaul the leadership of its investment bank and risk division.

ZURICH (Reuters) -Credit Suisse said on Tuesday it will take a 4.4 billion Swiss franc ($4.7 billion) hit from dealings with Archegos Capital Management, prompting it to overhaul the leadership of its investment bank and risk division. It’s official: the Financial Times (citing an informal polling of anonymous bankers) has declared Deliveroo’s botched London offering the “worst IPO in London’s history.”

It’s official: the Financial Times (citing an informal polling of anonymous bankers) has declared Deliveroo’s botched London offering the “worst IPO in London’s history.” It was a bleak moment for the oil industry. U.S. shale companies were failing by the dozen. Petrostates were on the brink of bankruptcy. Texas roughnecks and Kuwaiti princes alike had watched helplessly for months as the commodity that was their lifeblood tumbled to prices that had until recently seemed unthinkable. Below $50 a barrel, then below $40, then below $30.

It was a bleak moment for the oil industry. U.S. shale companies were failing by the dozen. Petrostates were on the brink of bankruptcy. Texas roughnecks and Kuwaiti princes alike had watched helplessly for months as the commodity that was their lifeblood tumbled to prices that had until recently seemed unthinkable. Below $50 a barrel, then below $40, then below $30. Unlike the devastating London Whale debacle in 2012, which was all JPMorgan eventually drawn and quartered quite theatrically before Congress (and was a clear explanation of how banks used Fed reserves to manipulate markets, something most market participants had no idea was possible), this time JPMorgan was nowhere to be found in the aftermath of the historic margin call that destroyed hedge fund Archegos. Which is may explain why JPMorgan bank analyst Kian Abouhossein admits he is quite “puzzled” by the recent fallout from the Archegos implosion (or maybe JPM simply was not a Prime Broker of the notorious Tiger cub), which however does not prevent him from trying to calculate the capital at risk from the Archegos collapse.

Unlike the devastating London Whale debacle in 2012, which was all JPMorgan eventually drawn and quartered quite theatrically before Congress (and was a clear explanation of how banks used Fed reserves to manipulate markets, something most market participants had no idea was possible), this time JPMorgan was nowhere to be found in the aftermath of the historic margin call that destroyed hedge fund Archegos. Which is may explain why JPMorgan bank analyst Kian Abouhossein admits he is quite “puzzled” by the recent fallout from the Archegos implosion (or maybe JPM simply was not a Prime Broker of the notorious Tiger cub), which however does not prevent him from trying to calculate the capital at risk from the Archegos collapse.

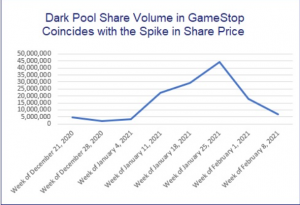

A Massive Increase in Trading in GameStop by Dark Pools Owned by the Mega Wall Street Banks Coincided with the Spike in its Share Price

A Massive Increase in Trading in GameStop by Dark Pools Owned by the Mega Wall Street Banks Coincided with the Spike in its Share Price