Wall Street Warned by U.S. Regulators to Speed Up Libor Exit

Jesse Hamilton, Alex Harris, and Christopher Condon, 11 June 2021

Wall Street banks must speed up their efforts to stop using Libor, regulators said Friday, issuing one of their sternest warnings yet about abandoning the scandal-plagued benchmark.

Wall Street banks must speed up their efforts to stop using Libor, regulators said Friday, issuing one of their sternest warnings yet about abandoning the scandal-plagued benchmark.

From Treasury Secretary Janet Yellen to Federal Reserve Chairman Jerome Powell, watchdogs made clear during a meeting of the Financial Stability Oversight Council that time is running out. The admonishment — coming from the heads of all of the U.S.’s most powerful financial agencies — marked a remarkably high-profile push to light a fire under banks including Citigroup Inc., JPMorgan Chase & Co. and Goldman Sachs Group Inc. Continue reading “Article: Wall Street Warned by U.S. Regulators to Speed Up Libor Exit”

President Joe Biden’s administration and the Federal Reserve are pushing for U.S. lawmakers to ease Wall Street’s transition away from the London interbank offered rate and help head off legal headaches for many contracts that risk being left in limbo under present plans.

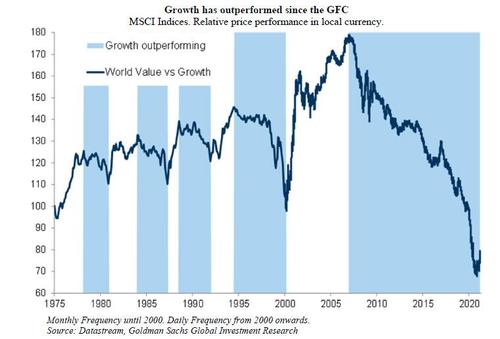

President Joe Biden’s administration and the Federal Reserve are pushing for U.S. lawmakers to ease Wall Street’s transition away from the London interbank offered rate and help head off legal headaches for many contracts that risk being left in limbo under present plans. In many ways, David Einhorn’s Greenlight appears to be back to its “new normal” – in a letter sent to investors, Einhorn writes that Greenlight again underperformed the market and returned -0.1% in the first quarter, badly underperforming the 6.2% return for the S&P 500 index, before proceeding to bash the Fed, broken markets, Chamath and Elon, the basket of short stocks and much more.

In many ways, David Einhorn’s Greenlight appears to be back to its “new normal” – in a letter sent to investors, Einhorn writes that Greenlight again underperformed the market and returned -0.1% in the first quarter, badly underperforming the 6.2% return for the S&P 500 index, before proceeding to bash the Fed, broken markets, Chamath and Elon, the basket of short stocks and much more. Cyberattacks are the greatest threat to the world’s financial system, Federal Reserve Chairman Jerome Powell said in an interview with CBS News this week. Speaking to “60 Minutes” on Sunday (April 11), Powell said the risks posed by cybercriminals are greater than the lending and liquidity troubles that triggered the 2008 financial crisis.

Cyberattacks are the greatest threat to the world’s financial system, Federal Reserve Chairman Jerome Powell said in an interview with CBS News this week. Speaking to “60 Minutes” on Sunday (April 11), Powell said the risks posed by cybercriminals are greater than the lending and liquidity troubles that triggered the 2008 financial crisis. Novelist-philosopher Ayn Rand famously admonished us to “check our premises.” That’s a fancy way of saying that it pays to ask ourselves if we might be missing something—especially when confronted with a situation that makes no sense.

Novelist-philosopher Ayn Rand famously admonished us to “check our premises.” That’s a fancy way of saying that it pays to ask ourselves if we might be missing something—especially when confronted with a situation that makes no sense. BCH Price rose over 10% on Monday, settling at $625 as at the time of writing. Bitcoin cash turned into a sideways consolidation in late February after hitting yearly highs at $773. While it’s recovering today, the barrier at $630 was strong and kept the BCH price confined below this level. Thus, it may be too early to call a breakout yet due to the weak upside momentum. Instead, the consolidation may likely extend further for a while. Currently, BCH is trading in the upper part of its consolidation range while targetting a breakout past the $630 barrier.

BCH Price rose over 10% on Monday, settling at $625 as at the time of writing. Bitcoin cash turned into a sideways consolidation in late February after hitting yearly highs at $773. While it’s recovering today, the barrier at $630 was strong and kept the BCH price confined below this level. Thus, it may be too early to call a breakout yet due to the weak upside momentum. Instead, the consolidation may likely extend further for a while. Currently, BCH is trading in the upper part of its consolidation range while targetting a breakout past the $630 barrier.  Jerome H. Powell took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee. Prior to his appointment to the Board, Powell was a visiting scholar at the Bipartisan Policy Center in Washington, D.C. From 1997 through 2005, Powell was a partner at The Carlyle Group. Powell served as an Assistant Secretary and as Under Secretary of the U.S. Department of the Treasury under President George H.W. Bush. Prior to joining the Bush administration, Mr. Powell worked as a lawyer and investment banker in New York City. He received an AB in politics from Princeton University in 1975 and earned a law degree from Georgetown University in 1979. While at Georgetown, he was editor-in-chief of the Georgetown Law Journal.

Jerome H. Powell took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee. Prior to his appointment to the Board, Powell was a visiting scholar at the Bipartisan Policy Center in Washington, D.C. From 1997 through 2005, Powell was a partner at The Carlyle Group. Powell served as an Assistant Secretary and as Under Secretary of the U.S. Department of the Treasury under President George H.W. Bush. Prior to joining the Bush administration, Mr. Powell worked as a lawyer and investment banker in New York City. He received an AB in politics from Princeton University in 1975 and earned a law degree from Georgetown University in 1979. While at Georgetown, he was editor-in-chief of the Georgetown Law Journal.