Reddit Trader Roaring Kitty Accused Of Fraud In The Latest Wild Lawsuit Coming Out Of GameStop Saga

Jonathan Ponciano, 17 February 2021

One of the most outspoken retail traders on Reddit’s WallStreetBets discussion board has been targeted in a proposed class-action lawsuit alleging the 34-year-old securities broker behind the widely followed “Roaring Kitty” persona committed securities fraud for misrepresenting himself as an amateur trader online while pumping up GameStop stock prices.

One of the most outspoken retail traders on Reddit’s WallStreetBets discussion board has been targeted in a proposed class-action lawsuit alleging the 34-year-old securities broker behind the widely followed “Roaring Kitty” persona committed securities fraud for misrepresenting himself as an amateur trader online while pumping up GameStop stock prices.

“As a licensed securities professional, including the period he was licensed by and associated with MML and MassMutual, Gill was obligated to follow various securities laws, [SEC] rules and regulations and FINRA rules,” the 38-page suit says. The suit specifically references five securities rules, including one that requires licensed securities professionals to observe “high standards of commercial honor and just and equitable principles of trade” while conducting business and another saying that their public communications–on social media included–should “be fair and balanced” and “not omit any material fact or qualification” if the omission could mislead investors.

Purpose Investments announced Friday morning that it has been cleared by Canadian securities regulators to launch Purpose Bitcoin ETF (BTCC), which is the first Bitcoin ETF in North America to gain regulatory approval, according to Bloomberg.

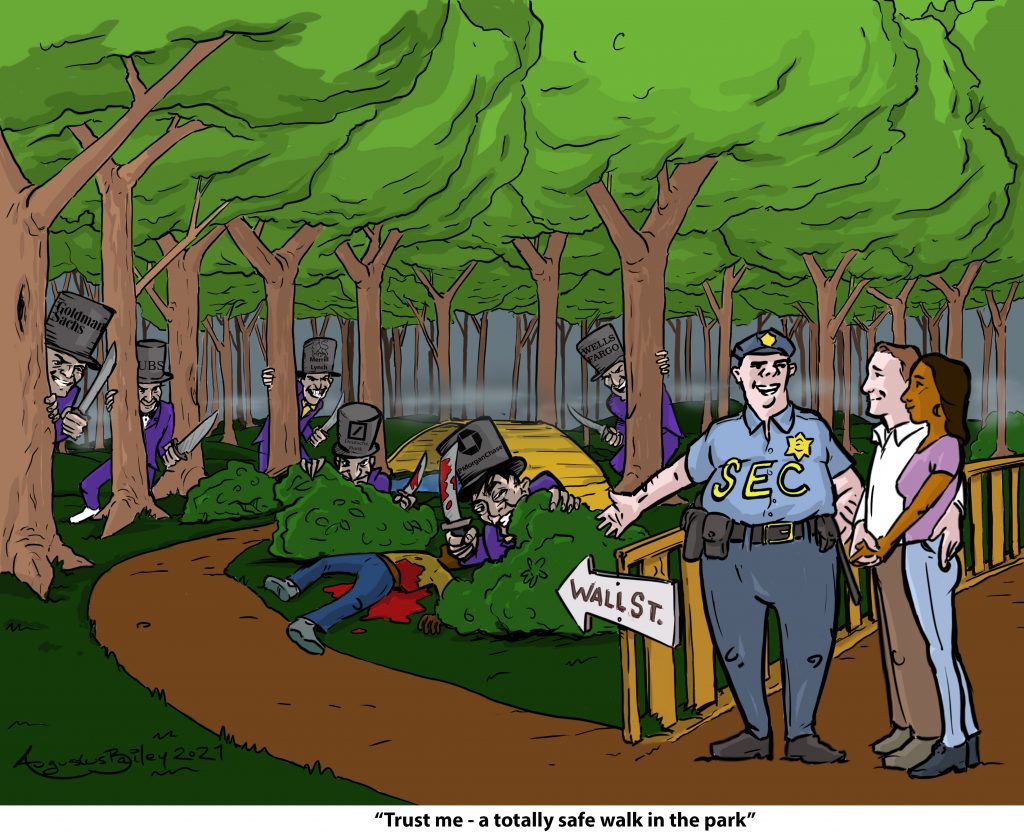

Purpose Investments announced Friday morning that it has been cleared by Canadian securities regulators to launch Purpose Bitcoin ETF (BTCC), which is the first Bitcoin ETF in North America to gain regulatory approval, according to Bloomberg. The Reddit/GameStop aftermath continues. Now, it’s been reported, investigators at the US Securities and Exchange Commission (SEC) are allegedly scouring posts on social media and online message boards for evidence of fraud and coordinated stock-price manipulation in the hype that led to recent unlikely surges in the stock prices of GameStop, AMC Entertainment Holdings, and a few other companies.

The Reddit/GameStop aftermath continues. Now, it’s been reported, investigators at the US Securities and Exchange Commission (SEC) are allegedly scouring posts on social media and online message boards for evidence of fraud and coordinated stock-price manipulation in the hype that led to recent unlikely surges in the stock prices of GameStop, AMC Entertainment Holdings, and a few other companies.

As just about everyone knows by now, investors communicating on the Reddit forum WallStreetBets drove up the stock price of GameStop while openly discussing both their tactics and their reasoning. Some of them purchased GameStop shares as part of a strategy expressly intended to squeeze hedge funds that were shorting the stock. Others simply saw the stock as undervalued.

As just about everyone knows by now, investors communicating on the Reddit forum WallStreetBets drove up the stock price of GameStop while openly discussing both their tactics and their reasoning. Some of them purchased GameStop shares as part of a strategy expressly intended to squeeze hedge funds that were shorting the stock. Others simply saw the stock as undervalued.