Article: Breakwater Trading sues JPMorgan for alleged manipulation of prices of US Treasury futures

Article - MediaBreakwater Trading sues JPMorgan for alleged manipulation of prices of US Treasury futures

Maria Nikolova

FinanceFeeds, 6 May 2020

Breakwater Trading LLC has launched a civil lawsuit against JPMorgan Chase & Co. (NYSE:JPM), JP Morgan Clearing Corp., JP Morgan Securities LLC, and JP Morgan Securities LLC, accusing them of manipulating the US Treasuries futures market. The complaint, seen by FinanceFeeds, was filed on May 5, 2020, with the New York Southern District Court.

Video: Emerging Concept for New Documentary — Call for Overt and Covert Testimony

Video The original documentary, The Wall Street Conspiracy, will be posted to YouTube and here shortly, with the written permission of the co-owners. A new low-budget documentary harvesting about 40 video interviews will be offered around 22 June. We have a new witness protection recording capability and will start doing at least 20 short interviews with individuals ready to name names.

The original documentary, The Wall Street Conspiracy, will be posted to YouTube and here shortly, with the written permission of the co-owners. A new low-budget documentary harvesting about 40 video interviews will be offered around 22 June. We have a new witness protection recording capability and will start doing at least 20 short interviews with individuals ready to name names.

Below is the emerging concept for the new documentary. Suggestions and additional witnesses are sought. The hardest aspect of this is showing the American public that Wall Street has destroyed their pension funds and is naked short selling the future of the USA.

Continue reading “Video: Emerging Concept for New Documentary — Call for Overt and Covert Testimony”

Lawyer (RIP): John O’Quinn — Won $20B for His Clients Against Banks and Corporations Cheating the Public

Lawyer John Maurice O’Quinn (September 4, 1941 – October 29, 2009) was a Texas trial lawyer and founding partner of The O’Quinn Law Firm (formerly known as O’Quinn & Laminack). His firm made its business handling plaintiff’s litigation, including representing clients suing breast implant manufacturers, medical facilities, and tobacco companies. In 2009, O’Quinn, along with his passenger, died in a single car crash in Houston, Texas.

John Maurice O’Quinn (September 4, 1941 – October 29, 2009) was a Texas trial lawyer and founding partner of The O’Quinn Law Firm (formerly known as O’Quinn & Laminack). His firm made its business handling plaintiff’s litigation, including representing clients suing breast implant manufacturers, medical facilities, and tobacco companies. In 2009, O’Quinn, along with his passenger, died in a single car crash in Houston, Texas.

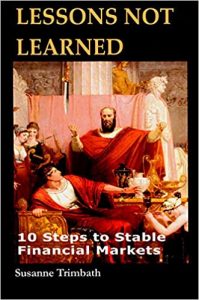

Book: Lessons Not Learned – 10 Steps to Stable Financial Markets

Book

Much has been written and spoken about the lessons learned from the financial crisis of 2009. In this book, we list the lessons not learned before the financial crisis. The purpose of this book is to demonstrate that the theoretical and intellectual frameworks for regulating financial systems that had been available since at least 2001 could have prevented the systemic failure in the United States that led to the collapse of global credit markets in 2008.

Continue reading “Book: Lessons Not Learned – 10 Steps to Stable Financial Markets”

Subject: Elizabeth Warren (D-MA)

Subject of Interest U.S Senator Elizabeth Warren (D-MA) is a minority member of the US Senate Committee on Banking. She was re-elected to the United States Senate for a second term on November 6, 2018, by the people of Massachusetts. Elizabeth is a graduate of the University of Houston and Rutgers School of Law and was a law professor for over 30 years. She is also a subcommittee member on Economic Policy, Securities, Insurance, and Investment as well as Committee on Health, Education, Labor & Pensions (HELP), Special Committee on Aging and Armed Services.

U.S Senator Elizabeth Warren (D-MA) is a minority member of the US Senate Committee on Banking. She was re-elected to the United States Senate for a second term on November 6, 2018, by the people of Massachusetts. Elizabeth is a graduate of the University of Houston and Rutgers School of Law and was a law professor for over 30 years. She is also a subcommittee member on Economic Policy, Securities, Insurance, and Investment as well as Committee on Health, Education, Labor & Pensions (HELP), Special Committee on Aging and Armed Services.

Subject: Mark R. Warner (D-VA)

Subject of Interest U. S. Senator Mark R. Warner (D-VA) is a minority member of the US Senate Committee on Banking. Warner was elected to the U.S. Senate in November 2008 and reelected to a second term in November 2014. From 2002 to 2006, he served as Governor of Virginia. He also Vice-Chairman of the Select Committee on Intelligence. Warner is a heavy investor in in the cellular technology and co-founded the company that became Nextel.

U. S. Senator Mark R. Warner (D-VA) is a minority member of the US Senate Committee on Banking. Warner was elected to the U.S. Senate in November 2008 and reelected to a second term in November 2014. From 2002 to 2006, he served as Governor of Virginia. He also Vice-Chairman of the Select Committee on Intelligence. Warner is a heavy investor in in the cellular technology and co-founded the company that became Nextel.

Subject: Jon Tester (D-MT)

Subject of Interest U. S Senator Jon Tester (D-MT) is a minority member of the US Senate Committee on Banking. In the Senate, Tester also serves as Ranking Member of the Senate Veterans’ Affairs Committee. and member of the Senate Commerce, and Indian Affairs. He earned a degree in Music from the College of Great Falls and taught Music at F.E. Miley Elementary for several years.

U. S Senator Jon Tester (D-MT) is a minority member of the US Senate Committee on Banking. In the Senate, Tester also serves as Ranking Member of the Senate Veterans’ Affairs Committee. and member of the Senate Commerce, and Indian Affairs. He earned a degree in Music from the College of Great Falls and taught Music at F.E. Miley Elementary for several years.

Subject: Kyrsten Sinema (D-AZ)

Subject of Interest U. S. Senator Kyrsten Sinema (D-AZ) is a minority member of the US Senate Committee on Banking. Other Committee Appointments include: Homeland Security & Governmental Affairs , Subcommittee on National Security and International Trade and Finance, Subcommittee on Securities, Insurance, and Investment, Subcommittee on Economic Policy, Commerce, Science, & Transportation , Veterans’ Affairs, and Special Committee on Aging.

U. S. Senator Kyrsten Sinema (D-AZ) is a minority member of the US Senate Committee on Banking. Other Committee Appointments include: Homeland Security & Governmental Affairs , Subcommittee on National Security and International Trade and Finance, Subcommittee on Securities, Insurance, and Investment, Subcommittee on Economic Policy, Commerce, Science, & Transportation , Veterans’ Affairs, and Special Committee on Aging.

Subject: Tina Smith (D-MN)

Subject of Interest U.S. Senator Tina Smith (D-MN) is a minority member of the US Senate Committee on Banking. She serves as United States Senator for Minnesota. She graduated from Stanford University and in 1984, earned an MBA from the Tuck School of Business at Dartmouth College. She’s served as Chief of Staff to both Minneapolis Mayor R.T. Rybak and Governor Mark Dayton. In 2014, Tina was elected to serve as Minnesota’s 48th Lieutenant Governor. Other Committee Assignments include: The Senate Committee on Health, Education, Labor, and Pensions, the Committee on Agriculture, Nutrition and Forestry, and the Senate Committee on Indian Affairs.

U.S. Senator Tina Smith (D-MN) is a minority member of the US Senate Committee on Banking. She serves as United States Senator for Minnesota. She graduated from Stanford University and in 1984, earned an MBA from the Tuck School of Business at Dartmouth College. She’s served as Chief of Staff to both Minneapolis Mayor R.T. Rybak and Governor Mark Dayton. In 2014, Tina was elected to serve as Minnesota’s 48th Lieutenant Governor. Other Committee Assignments include: The Senate Committee on Health, Education, Labor, and Pensions, the Committee on Agriculture, Nutrition and Forestry, and the Senate Committee on Indian Affairs.

Subject: Doug Jones (D-AL)

Subject of Interest U.S Senator Doug Jones (D-AL) is a minority member of the US Senate Committee on Banking. After graduating from Cumberland School of Law at Samford University, he worked as staff counsel to the U.S. Senate Judiciary Committee for Senator Howell Heflin. Following his stint in Washington, Senator Jones served as an Assistant United States Attorney from 1980-1984. He left government service in 1984 and was in the private practice of law in Birmingham, Alabama, until President Bill Clinton nominated him to the position of United States Attorney for the Northern District of Alabama. He also sits on the Senate Committee on Health, Education, Labor and Pensions, Senate Committee on Armed Services, and Senate Special Committee on Aging.

U.S Senator Doug Jones (D-AL) is a minority member of the US Senate Committee on Banking. After graduating from Cumberland School of Law at Samford University, he worked as staff counsel to the U.S. Senate Judiciary Committee for Senator Howell Heflin. Following his stint in Washington, Senator Jones served as an Assistant United States Attorney from 1980-1984. He left government service in 1984 and was in the private practice of law in Birmingham, Alabama, until President Bill Clinton nominated him to the position of United States Attorney for the Northern District of Alabama. He also sits on the Senate Committee on Health, Education, Labor and Pensions, Senate Committee on Armed Services, and Senate Special Committee on Aging.

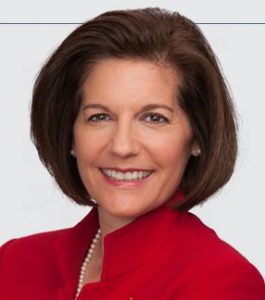

Subject: Catherine Cortez Masto (D-NV)

Subject of Interest U.S. Senator Catherine Cortez Masto (D-NV) is a minority member of the US Senate Committee on Banking. She served two terms as Attorney General of Nevada and in November 2016. She also sits on the Committee on Energy and Natural Resources; the Committee on Rules and Administration; and the Committee on Indian Affairs. Cortez Masto currently serves as the Ranking Member of the Economic Policy Subcommittee of the U.S. Senate Committee on Banking, Housing, and Urban Affairs; and the Ranking Member of the Water and Power Subcommittee of the Energy and Natural Resources Committee. She earned a Bachelor of Science in Business Administration in Finance from the University of Nevada, Reno in 1986, and a J.D. from Gonzaga University School of Law in 1990.

U.S. Senator Catherine Cortez Masto (D-NV) is a minority member of the US Senate Committee on Banking. She served two terms as Attorney General of Nevada and in November 2016. She also sits on the Committee on Energy and Natural Resources; the Committee on Rules and Administration; and the Committee on Indian Affairs. Cortez Masto currently serves as the Ranking Member of the Economic Policy Subcommittee of the U.S. Senate Committee on Banking, Housing, and Urban Affairs; and the Ranking Member of the Water and Power Subcommittee of the Energy and Natural Resources Committee. She earned a Bachelor of Science in Business Administration in Finance from the University of Nevada, Reno in 1986, and a J.D. from Gonzaga University School of Law in 1990.

Subject: Chris Van Hollen (D-MD)

Subject of Interest U. S. Senator Chris Van Hollen (D-MD) is a minority member of the US Senate Committee on Banking. Elected to the United States Senate by the people of Maryland in November 2016. Chris Van Hollen is a graduate of Swarthmore College, the John F. Kennedy School of Public Policy at Harvard University, and Georgetown University Law Center. He also serves as member of Subcommittee on Commerce, Justice, Science, Subcommittee on Department of the Interior, Environment, Member, Subcommittee on Legislative Branch, and Member, Subcommittee on State, Foreign Operations.

U. S. Senator Chris Van Hollen (D-MD) is a minority member of the US Senate Committee on Banking. Elected to the United States Senate by the people of Maryland in November 2016. Chris Van Hollen is a graduate of Swarthmore College, the John F. Kennedy School of Public Policy at Harvard University, and Georgetown University Law Center. He also serves as member of Subcommittee on Commerce, Justice, Science, Subcommittee on Department of the Interior, Environment, Member, Subcommittee on Legislative Branch, and Member, Subcommittee on State, Foreign Operations.

Subject: Brian Schatz (D-HI)

Subject of Interest U. S. Senator Brian Schatz (D-HI) is a minority member of the US Senate Committee on Banking. Brian serves on other Senate Committees including: Commerce, Science, and Transportation; and Indian Affairs. Senator Schatz also serves as Chair of Senate Democratic Special Committee on the Climate Crisis as well as Chief Deputy Whip. From 1998 to 2006, Schatz was a member of the State House of Representatives. He graduated from Pomona College in Claremont, California.

U. S. Senator Brian Schatz (D-HI) is a minority member of the US Senate Committee on Banking. Brian serves on other Senate Committees including: Commerce, Science, and Transportation; and Indian Affairs. Senator Schatz also serves as Chair of Senate Democratic Special Committee on the Climate Crisis as well as Chief Deputy Whip. From 1998 to 2006, Schatz was a member of the State House of Representatives. He graduated from Pomona College in Claremont, California.

Tweet: Fraser Perring — Liar and Naked Short Seller?

TweetWish @EY_Germany auditor of @Wirecard AG and @pwc_de auditor of #WirecardBank the best of success in signing off $WDI accounts: June 04, 2020. Will they wallpaper over the serious issues @KPMG_DE_For raised creating a regulatory and legal clusterf&%k?https://t.co/Rbb2wBf5Sj pic.twitter.com/gdRpP7jBfu

— Fraser Perring – Grand Poobah of “criminal” shorts (@AIMhonesty) May 1, 2020

Comment: Perring operates Viceroy Research.