As Ransomware Hackers Sit On Millions In Extorted Money, America’s Military Is Urged To Hack Back

Thomas Brewster, 05 June 2021

In just two months last year, the FBI watched three companies pay hackers wielding ransomware called NetWalker millions in Bitcoin to get their hacked data back. While that seems like a big win for the cybercriminals, it also gave investigators in the U.S. and elsewhere a new roadmap for tracking and prosecuting them.

In just two months last year, the FBI watched three companies pay hackers wielding ransomware called NetWalker millions in Bitcoin to get their hacked data back. While that seems like a big win for the cybercriminals, it also gave investigators in the U.S. and elsewhere a new roadmap for tracking and prosecuting them.

Netwalker was a ransomware-as-a-service crew, similar to DarkSide and REvil, whose tools were used in the attacks on Colonial Pipeline and JBS, which led to gas and food shortages across America in the last month. The creators of NetWalker rented it out to other cybercriminals, who would find a way to break into a company and then deploy Netwalker to lock up the victims’ files. Only the key the Netwalker crew controlled could unlock that data. Since it emerged in 2019, its myriad victims included universities, healthcare bodies and government departments, making close to $50 million in that time. Continue reading “Article: As Ransomware Hackers Sit On Millions In Extorted Money, America’s Military Is Urged To Hack Back”

AMC Entertainment Holdings Inc AMC 6.51% held on to its weekly gains in early afternoon trading on Friday after a sharp pullback in Thursday’s session.

AMC Entertainment Holdings Inc AMC 6.51% held on to its weekly gains in early afternoon trading on Friday after a sharp pullback in Thursday’s session. Biblical cycle expert and financial analyst Bo Polny predicted in November of 2020 the stock market (DOW) would “top out in May 2021 at around 33,000 to 34,000 and then crash in June.” So far, half of the prediction is spot on, and we are waiting for the crash. Polny says, “The greatest financial event in human history is not and will not happen on a Trump watch. I repeat, the greatest financial event in human history is not going down on a Trump watch. It’s going to go down under the current, whatever you want to call him. Trump is a builder. The builder comes in to fix things.”

Biblical cycle expert and financial analyst Bo Polny predicted in November of 2020 the stock market (DOW) would “top out in May 2021 at around 33,000 to 34,000 and then crash in June.” So far, half of the prediction is spot on, and we are waiting for the crash. Polny says, “The greatest financial event in human history is not and will not happen on a Trump watch. I repeat, the greatest financial event in human history is not going down on a Trump watch. It’s going to go down under the current, whatever you want to call him. Trump is a builder. The builder comes in to fix things.” A longtime bookkeeper and office manager at a family-owned tree nursery in North Carolina has pleaded guilty to stealing upwards of $1 million from his employer over six years, according to the federal government.

A longtime bookkeeper and office manager at a family-owned tree nursery in North Carolina has pleaded guilty to stealing upwards of $1 million from his employer over six years, according to the federal government. The rise of the “meme stocks” has been a fascinating adventure with the combination of ubiquitous technology and the ability to drive trading by retail investors in a way that has never been experienced before. While a certain amount of manipulation of markets has always existed, the recent advent of trading forums, like Wallstreetbets on Reddit, and other digital communication methods, has shifted some of the influence away from big money to smaller investors pooling resources.

The rise of the “meme stocks” has been a fascinating adventure with the combination of ubiquitous technology and the ability to drive trading by retail investors in a way that has never been experienced before. While a certain amount of manipulation of markets has always existed, the recent advent of trading forums, like Wallstreetbets on Reddit, and other digital communication methods, has shifted some of the influence away from big money to smaller investors pooling resources. The Maltese government has signed a United Nations declaration promising to “investigate, prosecute, and punish threats and acts of violence” against journalists, provide a “Safe and enabling environment” for whistleblowers, and ‘take effective measures” to “prevent, investigate, and prosecute” corruption involving public officials.

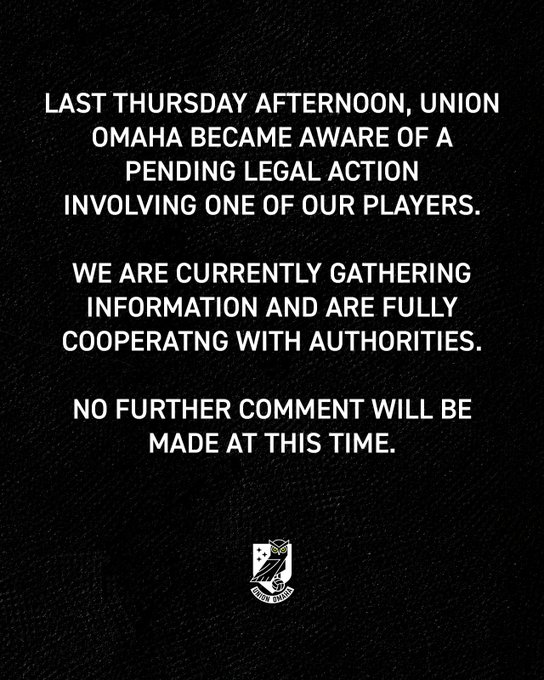

The Maltese government has signed a United Nations declaration promising to “investigate, prosecute, and punish threats and acts of violence” against journalists, provide a “Safe and enabling environment” for whistleblowers, and ‘take effective measures” to “prevent, investigate, and prosecute” corruption involving public officials. A United Soccer League player has been indicted on charges that he allegedly catfished two people out of a combined $215,000.

A United Soccer League player has been indicted on charges that he allegedly catfished two people out of a combined $215,000.  Wall Street’s top brokers are quietly tightening their rules for who can bet against retail traders’ most-popular meme stocks.

Wall Street’s top brokers are quietly tightening their rules for who can bet against retail traders’ most-popular meme stocks. Pouring more fuel on what was already today’s dumpster fire of a market, Bloomberg reported that according to a memo it had seen, Jefferies told clients its prime brokerage arm will no longer allow the execution of short sells in meme stocks such as AMC, GameStop and MicroVision.

Pouring more fuel on what was already today’s dumpster fire of a market, Bloomberg reported that according to a memo it had seen, Jefferies told clients its prime brokerage arm will no longer allow the execution of short sells in meme stocks such as AMC, GameStop and MicroVision. This week and last, AMC was targeted again and its shares skyrocketed 496% between May 24 and June 2 before retracing Thursday.

This week and last, AMC was targeted again and its shares skyrocketed 496% between May 24 and June 2 before retracing Thursday. Jefferies told clients Wednesday its prime brokerage arm will no longer allow the execution of short sells in GameStop Corp., AMC Entertainment Holdings Inc. and MicroVision Inc., according to a memo seen by Bloomberg News.

Jefferies told clients Wednesday its prime brokerage arm will no longer allow the execution of short sells in GameStop Corp., AMC Entertainment Holdings Inc. and MicroVision Inc., according to a memo seen by Bloomberg News. Such calls have gained fresh momentum in recent months following the recent controversial decision to drop serious criminal charges against Portugal’s former Prime Minister Jose Socrates.

Such calls have gained fresh momentum in recent months following the recent controversial decision to drop serious criminal charges against Portugal’s former Prime Minister Jose Socrates.