How The AMC Squeeze Compares To The GameStop Run: Are Buyers Just Playing A Game?

Wayne Duggan, 05 June 2021

AMC Entertainment Holdings Inc AMC 6.51% held on to its weekly gains in early afternoon trading on Friday after a sharp pullback in Thursday’s session.

AMC Entertainment Holdings Inc AMC 6.51% held on to its weekly gains in early afternoon trading on Friday after a sharp pullback in Thursday’s session.

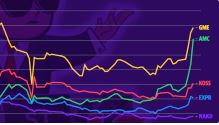

Heading into next week, AMC traders will be asking themselves if this week’s run-up is a repeat of January trading action in GameStop Corp. GME 3.89%, or if the rally in AMC had legs.

Deja Vu? GameStop shares hit their all-time high of $483 on Jan. 28. In the month leading up to that peak, the stock rallied about 1,560%. Continue reading “Article: How The AMC Squeeze Compares To The GameStop Run: Are Buyers Just Playing A Game?”

The rise of the “meme stocks” has been a fascinating adventure with the combination of ubiquitous technology and the ability to drive trading by retail investors in a way that has never been experienced before. While a certain amount of manipulation of markets has always existed, the recent advent of trading forums, like Wallstreetbets on Reddit, and other digital communication methods, has shifted some of the influence away from big money to smaller investors pooling resources.

The rise of the “meme stocks” has been a fascinating adventure with the combination of ubiquitous technology and the ability to drive trading by retail investors in a way that has never been experienced before. While a certain amount of manipulation of markets has always existed, the recent advent of trading forums, like Wallstreetbets on Reddit, and other digital communication methods, has shifted some of the influence away from big money to smaller investors pooling resources. Wall Street’s top brokers are quietly tightening their rules for who can bet against retail traders’ most-popular meme stocks.

Wall Street’s top brokers are quietly tightening their rules for who can bet against retail traders’ most-popular meme stocks. Pouring more fuel on what was already today’s dumpster fire of a market, Bloomberg reported that according to a memo it had seen, Jefferies told clients its prime brokerage arm will no longer allow the execution of short sells in meme stocks such as AMC, GameStop and MicroVision.

Pouring more fuel on what was already today’s dumpster fire of a market, Bloomberg reported that according to a memo it had seen, Jefferies told clients its prime brokerage arm will no longer allow the execution of short sells in meme stocks such as AMC, GameStop and MicroVision. This week and last, AMC was targeted again and its shares skyrocketed 496% between May 24 and June 2 before retracing Thursday.

This week and last, AMC was targeted again and its shares skyrocketed 496% between May 24 and June 2 before retracing Thursday. Jefferies told clients Wednesday its prime brokerage arm will no longer allow the execution of short sells in GameStop Corp., AMC Entertainment Holdings Inc. and MicroVision Inc., according to a memo seen by Bloomberg News.

Jefferies told clients Wednesday its prime brokerage arm will no longer allow the execution of short sells in GameStop Corp., AMC Entertainment Holdings Inc. and MicroVision Inc., according to a memo seen by Bloomberg News. It has only been a few months since Reddit-enabled retail investors, or what some unflatteringly refer to as the “retail mob,” embraced GameStop Corp. and drove its valuation to the moon only to be frustrated by a sudden change against them in the rules of the game. Today, it’s all about AMC Entertainment Holdings Inc., whose skyrocketing value this week has already overcome what would normally curtail investor enthusiasm. The similarities are notable, as is the broader message about what is happening to the investment landscape.

It has only been a few months since Reddit-enabled retail investors, or what some unflatteringly refer to as the “retail mob,” embraced GameStop Corp. and drove its valuation to the moon only to be frustrated by a sudden change against them in the rules of the game. Today, it’s all about AMC Entertainment Holdings Inc., whose skyrocketing value this week has already overcome what would normally curtail investor enthusiasm. The similarities are notable, as is the broader message about what is happening to the investment landscape.  What happened

What happened AMC Entertainment Holdings (NYSE:AMC) is going on the offensive, selling over $230 million worth of stock to hedge fund operator Mudrick Capital Management at a premium so it can use the proceeds to make acquisitions.

AMC Entertainment Holdings (NYSE:AMC) is going on the offensive, selling over $230 million worth of stock to hedge fund operator Mudrick Capital Management at a premium so it can use the proceeds to make acquisitions. About three months ago, the investing world was left reeling after retail investors proved they can beat Wall Street at its own game.

About three months ago, the investing world was left reeling after retail investors proved they can beat Wall Street at its own game. Adam Aron says he wants to increase his Twitter following to include about 1,000 more professed small-investor shareholders of the company he runs, AMC Entertainment.

Adam Aron says he wants to increase his Twitter following to include about 1,000 more professed small-investor shareholders of the company he runs, AMC Entertainment.  In January 2021, the rise of retail investing and the subreddit r/WallStreetBets sparked a broader speculative movement in a few stocks that ended up disrupting trading at brokerages and culminating in a Congressional hearing.

In January 2021, the rise of retail investing and the subreddit r/WallStreetBets sparked a broader speculative movement in a few stocks that ended up disrupting trading at brokerages and culminating in a Congressional hearing. What happens when a company set up by the Chinese government to help clean up toxic debt in the country’s banking system gets into trouble itself? We’re finding out now. Investors were spooked in April after China Huarong Asset Management Co., one of the country’s biggest distressed asset managers, failed to release financial statements in the wake of the execution of its former top executive for bribery. That raised questions about its financial health — and broader worries about whether China would let an institution backed by the central government fail. The ending of a presumed safety net that’s long been priced into Chinese bond values would mean a seismic shift for investors across emerging markets.

What happens when a company set up by the Chinese government to help clean up toxic debt in the country’s banking system gets into trouble itself? We’re finding out now. Investors were spooked in April after China Huarong Asset Management Co., one of the country’s biggest distressed asset managers, failed to release financial statements in the wake of the execution of its former top executive for bribery. That raised questions about its financial health — and broader worries about whether China would let an institution backed by the central government fail. The ending of a presumed safety net that’s long been priced into Chinese bond values would mean a seismic shift for investors across emerging markets.