China ups fines and widens scope of draft money laundering law

Stella Qiu, Lusha Zhang and Tony Munroe, 01 June 2021

BEIJING (Reuters) – China’s central bank on Tuesday issued a revised draft anti-money laundering law, under which fines for certain offences would rise to as much as 10 million yuan ($1.6 million) and a host of non-financial institutions would be brought within its scope.

BEIJING (Reuters) – China’s central bank on Tuesday issued a revised draft anti-money laundering law, under which fines for certain offences would rise to as much as 10 million yuan ($1.6 million) and a host of non-financial institutions would be brought within its scope.

The draft, which updates proposals first made in 2006, would include the likes of property developers, accounting firms and precious metal exchanges, according to a copy of the draft law posted by the People’s Bank of China (PBOC) on its website. Non-bank payment firms, online microlenders, financial asset management firms and financial leasing companies will also be included. Continue reading “Article: China ups fines and widens scope of draft money laundering law”

Congrats to America’s finance bros for finally getting their reward from the Chinese Communist Party. But surely, after obediently lobbying in favor of opening up to Beijing for decades, Wall Street deserved more than it received.

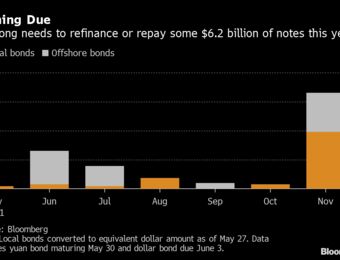

Congrats to America’s finance bros for finally getting their reward from the Chinese Communist Party. But surely, after obediently lobbying in favor of opening up to Beijing for decades, Wall Street deserved more than it received. China’s finance ministry is considering a proposal to transfer its shares in China Huarong Asset Management Co. and three other bad-debt managers to a new holding company modeled after the one that owns the government’s stakes in state-run banks, according to a person familiar with the matter.

China’s finance ministry is considering a proposal to transfer its shares in China Huarong Asset Management Co. and three other bad-debt managers to a new holding company modeled after the one that owns the government’s stakes in state-run banks, according to a person familiar with the matter. HONG KONG—Buffeted by rising costs, some Chinese manufacturers are refusing to accept new orders or are even considering shutting down operations temporarily—moves that could put more strain on global supply chains and cause more inflation.

HONG KONG—Buffeted by rising costs, some Chinese manufacturers are refusing to accept new orders or are even considering shutting down operations temporarily—moves that could put more strain on global supply chains and cause more inflation. Focusing on romance scams, online sextortion, investment fraud, voice phishing and money laundering associated with illegal online gambling, police in nine Asian countries arrested more than 500 suspects and seized US$83 million, Interpol said on Thursday.

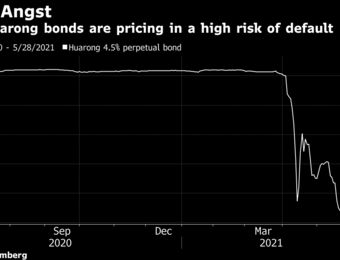

Focusing on romance scams, online sextortion, investment fraud, voice phishing and money laundering associated with illegal online gambling, police in nine Asian countries arrested more than 500 suspects and seized US$83 million, Interpol said on Thursday. China Huarong Asset Management Co. made the biggest bond payment since confidence in its financial health began plunging two months ago, adding to signs that the company still has access to near-term liquidity.

China Huarong Asset Management Co. made the biggest bond payment since confidence in its financial health began plunging two months ago, adding to signs that the company still has access to near-term liquidity. The Interpol (short for International Criminal Police Organisation) has intercepted $83 million belonging to victims of online financial crime from being transferred to the accounts of their attackers.

The Interpol (short for International Criminal Police Organisation) has intercepted $83 million belonging to victims of online financial crime from being transferred to the accounts of their attackers. As food prices continue to rise, beef and pork have surged out front.

As food prices continue to rise, beef and pork have surged out front. Chinese regulators including the central bank will crack down on manipulation of the forex market, according to a statement published on the central bank’s website on Thursday.

Chinese regulators including the central bank will crack down on manipulation of the forex market, according to a statement published on the central bank’s website on Thursday. The Chinese Communist Party blasted President Biden’s decision to renew the investigation into whether the coronavirus leaked from a Chinese lab as “political manipulation” and one that “does not care about facts and truth.”

The Chinese Communist Party blasted President Biden’s decision to renew the investigation into whether the coronavirus leaked from a Chinese lab as “political manipulation” and one that “does not care about facts and truth.”  BEIJING — The global surge in commodity prices is adding another burden to China’s small businesses, many of which have barely put the coronavirus pandemic behind them.

BEIJING — The global surge in commodity prices is adding another burden to China’s small businesses, many of which have barely put the coronavirus pandemic behind them. However loudly U.S. politicians vow to compete with China, they seem happy to quit the field and let Beijing win in one crucial area: trade. If President Joe Biden hopes to build a coalition in Asia to counterbalance China’s rise, he can’t afford such defeatism.

However loudly U.S. politicians vow to compete with China, they seem happy to quit the field and let Beijing win in one crucial area: trade. If President Joe Biden hopes to build a coalition in Asia to counterbalance China’s rise, he can’t afford such defeatism. China is trying to cool red-hot markets for key industrial commodities such as iron ore, seeking to ensure runaway prices for these raw materials don’t hurt the broader post-pandemic recovery.

China is trying to cool red-hot markets for key industrial commodities such as iron ore, seeking to ensure runaway prices for these raw materials don’t hurt the broader post-pandemic recovery. On his social media pages, billionaire Elon Musk has repeatedly endorsed cryptocurrencies. However, he seems divided regarding whether he is actually a supporter, especially after the recent market crash.

On his social media pages, billionaire Elon Musk has repeatedly endorsed cryptocurrencies. However, he seems divided regarding whether he is actually a supporter, especially after the recent market crash.