FINRA Fines Credit Suisse $345K For Worker Oversight Lapse

Al Barbarino, 06 April 2021

Credit Suisse Securities failed to monitor thousands of its employees’ outside brokerage accounts for “potentially deceptive” trading practices, according to a Financial Industry Regulatory Authority settlement that censures the broker-dealer and slaps it with a $345,000 fine.

The New York-based subsidiary of Credit Suisse Group failed to adequately track whether its new employees had disclosed outside brokerage accounts, according to the settlement, which was published Monday. Continue reading “Article: FINRA Fines Credit Suisse $345K For Worker Oversight Lapse”

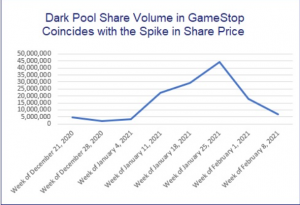

A Massive Increase in Trading in GameStop by Dark Pools Owned by the Mega Wall Street Banks Coincided with the Spike in its Share Price

A Massive Increase in Trading in GameStop by Dark Pools Owned by the Mega Wall Street Banks Coincided with the Spike in its Share Price Mary Lovelace Schapiro (born June 19, 1955) served as the 29th Chair of the U.S. Securities and Exchange Commission (SEC). She was appointed by President Barack Obama, unanimously confirmed by the U.S. Senate, and assumed the Chairship on January 27, 2009. She is the first woman to be the permanent Chair of the SEC.

Mary Lovelace Schapiro (born June 19, 1955) served as the 29th Chair of the U.S. Securities and Exchange Commission (SEC). She was appointed by President Barack Obama, unanimously confirmed by the U.S. Senate, and assumed the Chairship on January 27, 2009. She is the first woman to be the permanent Chair of the SEC. One of the most outspoken retail traders on Reddit’s WallStreetBets discussion board has been targeted in a proposed class-action lawsuit alleging the 34-year-old securities broker behind the widely followed “Roaring Kitty” persona committed securities fraud for misrepresenting himself as an amateur trader online while pumping up GameStop stock prices.

One of the most outspoken retail traders on Reddit’s WallStreetBets discussion board has been targeted in a proposed class-action lawsuit alleging the 34-year-old securities broker behind the widely followed “Roaring Kitty” persona committed securities fraud for misrepresenting himself as an amateur trader online while pumping up GameStop stock prices. The Reddit/GameStop aftermath continues. Now, it’s been reported, investigators at the US Securities and Exchange Commission (SEC) are allegedly scouring posts on social media and online message boards for evidence of fraud and coordinated stock-price manipulation in the hype that led to recent unlikely surges in the stock prices of GameStop, AMC Entertainment Holdings, and a few other companies.

The Reddit/GameStop aftermath continues. Now, it’s been reported, investigators at the US Securities and Exchange Commission (SEC) are allegedly scouring posts on social media and online message boards for evidence of fraud and coordinated stock-price manipulation in the hype that led to recent unlikely surges in the stock prices of GameStop, AMC Entertainment Holdings, and a few other companies. James J. Angel specializes in the market structure and regulation of global financial markets. He teaches undergraduate, MBA, and executive courses, including Investments and Capital Markets at Georgetown University. ”Dr. Jim” has testified before Congress about issues relating to the design of financial markets. Dr. Jim began his professional career as a rate engineer at Pacific Gas and Electric. Along the way he has also worked at BARRA (later part of Morgan Stanley). He has also served as a Visiting Academic Fellow in residence at the National Association of Securities Dealers (NASD – now FINRA) and also as a visiting economist at the Shanghai Stock Exchange. He has also been chairman of the Nasdaq Economic Advisory Board, a member of the OTC Bulletin Board Advisory Committee, and has served on the board of directors of the Direct Edge Stock Exchanges (later part of BATS Global Markets). He graduated from the

James J. Angel specializes in the market structure and regulation of global financial markets. He teaches undergraduate, MBA, and executive courses, including Investments and Capital Markets at Georgetown University. ”Dr. Jim” has testified before Congress about issues relating to the design of financial markets. Dr. Jim began his professional career as a rate engineer at Pacific Gas and Electric. Along the way he has also worked at BARRA (later part of Morgan Stanley). He has also served as a Visiting Academic Fellow in residence at the National Association of Securities Dealers (NASD – now FINRA) and also as a visiting economist at the Shanghai Stock Exchange. He has also been chairman of the Nasdaq Economic Advisory Board, a member of the OTC Bulletin Board Advisory Committee, and has served on the board of directors of the Direct Edge Stock Exchanges (later part of BATS Global Markets). He graduated from the

Howard W. Lutnick is Chairman & CEO of Cantor Fitzgerald L.P., and Chairman & CEO of BGC Partners Inc. Lutnick graduated from Haverford College in 1983 with a degree in economics and joined Cantor Fitzgerald the same year. Mr. Lutnick served on the Haverford College Board of Managers for 21 years, including as vice-chair and chair. He has also served on the boards of the Zachary and Elizabeth M. Fisher Center for Alzheimer’s Disease Research and the Intrepid Museum Foundation. Mr. Lutnick is a member of the Board of Trustees for the National September 11 Memorial and Museum at the World Trade Center.

Howard W. Lutnick is Chairman & CEO of Cantor Fitzgerald L.P., and Chairman & CEO of BGC Partners Inc. Lutnick graduated from Haverford College in 1983 with a degree in economics and joined Cantor Fitzgerald the same year. Mr. Lutnick served on the Haverford College Board of Managers for 21 years, including as vice-chair and chair. He has also served on the boards of the Zachary and Elizabeth M. Fisher Center for Alzheimer’s Disease Research and the Intrepid Museum Foundation. Mr. Lutnick is a member of the Board of Trustees for the National September 11 Memorial and Museum at the World Trade Center. Anshu Jain is the President of Cantor Fitzgerald L.P., he works alongside Howard W. Lutnick, Chairman and Chief Executive Officer. Mr. Jain was Co-CEO of Deutsche Bank from June 2012 to June 2015. Prior to that, he worked at Merrill Lynch He served on the International Advisory Panel of the Monetary Authority of Singapore. Mr. Jain received his Bachelor’s degree in Economics, with honors, from the University of Delhi and his MBA in Finance degree, Beta Gamma Sigma, from the University of Massachusetts Amherst.

Anshu Jain is the President of Cantor Fitzgerald L.P., he works alongside Howard W. Lutnick, Chairman and Chief Executive Officer. Mr. Jain was Co-CEO of Deutsche Bank from June 2012 to June 2015. Prior to that, he worked at Merrill Lynch He served on the International Advisory Panel of the Monetary Authority of Singapore. Mr. Jain received his Bachelor’s degree in Economics, with honors, from the University of Delhi and his MBA in Finance degree, Beta Gamma Sigma, from the University of Massachusetts Amherst. Stephen Merkel is the Executive Managing Director, General Counsel and Secretary of Cantor Fitzgerald, L.P. He joined the firm in 1993. He is also Executive Vice-President, General Counsel and Secretary of BGC Partners, Inc. Previously, he was the Director, Senior Vice-President, General Counsel and Secretary of eSpeed. Prior to joining Cantor Fitzgerald, Mr. Merkel was Vice-President and Assistant General Counsel at Goldman Sachs & Co., dedicated to the J. Aron Division. Mr. Merkel graduated with a B.A. Magna Cum Laude from the University of Pennsylvania and received his law degree from the University of Michigan School of Law.

Stephen Merkel is the Executive Managing Director, General Counsel and Secretary of Cantor Fitzgerald, L.P. He joined the firm in 1993. He is also Executive Vice-President, General Counsel and Secretary of BGC Partners, Inc. Previously, he was the Director, Senior Vice-President, General Counsel and Secretary of eSpeed. Prior to joining Cantor Fitzgerald, Mr. Merkel was Vice-President and Assistant General Counsel at Goldman Sachs & Co., dedicated to the J. Aron Division. Mr. Merkel graduated with a B.A. Magna Cum Laude from the University of Pennsylvania and received his law degree from the University of Michigan School of Law.