Why Naked Short Selling Is Not As Prevalent As You Think

Wayne Duggan , 07 June 2021

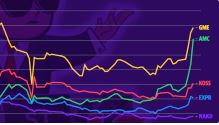

AMC Entertainment Holdings Inc AMC 0.16% jumped another 10% on Monday, and the hashtag #NakedShorting was trended on Twitter in the process.

AMC Entertainment Holdings Inc AMC 0.16% jumped another 10% on Monday, and the hashtag #NakedShorting was trended on Twitter in the process.

On Monday’s Benzinga PreMarket Prep, co-host Dennis Dick discussed why the idea that naked short sellers are behind the high short interest in stocks like AMC and GameStop Corp. GME 0.03% is a completely false social media narrative. Continue reading “Article: Why Naked Short Selling Is Not As Prevalent As You Think”

AMC Entertainment Holdings Inc AMC 6.51% held on to its weekly gains in early afternoon trading on Friday after a sharp pullback in Thursday’s session.

AMC Entertainment Holdings Inc AMC 6.51% held on to its weekly gains in early afternoon trading on Friday after a sharp pullback in Thursday’s session. The rise of the “meme stocks” has been a fascinating adventure with the combination of ubiquitous technology and the ability to drive trading by retail investors in a way that has never been experienced before. While a certain amount of manipulation of markets has always existed, the recent advent of trading forums, like Wallstreetbets on Reddit, and other digital communication methods, has shifted some of the influence away from big money to smaller investors pooling resources.

The rise of the “meme stocks” has been a fascinating adventure with the combination of ubiquitous technology and the ability to drive trading by retail investors in a way that has never been experienced before. While a certain amount of manipulation of markets has always existed, the recent advent of trading forums, like Wallstreetbets on Reddit, and other digital communication methods, has shifted some of the influence away from big money to smaller investors pooling resources. Wall Street’s top brokers are quietly tightening their rules for who can bet against retail traders’ most-popular meme stocks.

Wall Street’s top brokers are quietly tightening their rules for who can bet against retail traders’ most-popular meme stocks. Pouring more fuel on what was already today’s dumpster fire of a market, Bloomberg reported that according to a memo it had seen, Jefferies told clients its prime brokerage arm will no longer allow the execution of short sells in meme stocks such as AMC, GameStop and MicroVision.

Pouring more fuel on what was already today’s dumpster fire of a market, Bloomberg reported that according to a memo it had seen, Jefferies told clients its prime brokerage arm will no longer allow the execution of short sells in meme stocks such as AMC, GameStop and MicroVision. This week and last, AMC was targeted again and its shares skyrocketed 496% between May 24 and June 2 before retracing Thursday.

This week and last, AMC was targeted again and its shares skyrocketed 496% between May 24 and June 2 before retracing Thursday. Jefferies told clients Wednesday its prime brokerage arm will no longer allow the execution of short sells in GameStop Corp., AMC Entertainment Holdings Inc. and MicroVision Inc., according to a memo seen by Bloomberg News.

Jefferies told clients Wednesday its prime brokerage arm will no longer allow the execution of short sells in GameStop Corp., AMC Entertainment Holdings Inc. and MicroVision Inc., according to a memo seen by Bloomberg News. It has only been a few months since Reddit-enabled retail investors, or what some unflatteringly refer to as the “retail mob,” embraced GameStop Corp. and drove its valuation to the moon only to be frustrated by a sudden change against them in the rules of the game. Today, it’s all about AMC Entertainment Holdings Inc., whose skyrocketing value this week has already overcome what would normally curtail investor enthusiasm. The similarities are notable, as is the broader message about what is happening to the investment landscape.

It has only been a few months since Reddit-enabled retail investors, or what some unflatteringly refer to as the “retail mob,” embraced GameStop Corp. and drove its valuation to the moon only to be frustrated by a sudden change against them in the rules of the game. Today, it’s all about AMC Entertainment Holdings Inc., whose skyrocketing value this week has already overcome what would normally curtail investor enthusiasm. The similarities are notable, as is the broader message about what is happening to the investment landscape.  What happened

What happened About three months ago, the investing world was left reeling after retail investors proved they can beat Wall Street at its own game.

About three months ago, the investing world was left reeling after retail investors proved they can beat Wall Street at its own game. Adam Aron says he wants to increase his Twitter following to include about 1,000 more professed small-investor shareholders of the company he runs, AMC Entertainment.

Adam Aron says he wants to increase his Twitter following to include about 1,000 more professed small-investor shareholders of the company he runs, AMC Entertainment.  In January 2021, the rise of retail investing and the subreddit r/WallStreetBets sparked a broader speculative movement in a few stocks that ended up disrupting trading at brokerages and culminating in a Congressional hearing.

In January 2021, the rise of retail investing and the subreddit r/WallStreetBets sparked a broader speculative movement in a few stocks that ended up disrupting trading at brokerages and culminating in a Congressional hearing. SEC chair Gensler says agency will enforce rules ‘aggressively’ against bad actors

SEC chair Gensler says agency will enforce rules ‘aggressively’ against bad actors

Today is the deadline for 13F filings and while we already know what most of the marquee hedge funds have done during the quarter thanks to previously leaked investor letters (with the notable exception of the Soros Family Office which we learned over the weekend bought some $375MM of the Archegos shares liquidated by its prime brokers in late March), one filing was of particular interest, that of Scion Asset Management’s Michael “Big Short” Burry. And boy were there surprises.

Today is the deadline for 13F filings and while we already know what most of the marquee hedge funds have done during the quarter thanks to previously leaked investor letters (with the notable exception of the Soros Family Office which we learned over the weekend bought some $375MM of the Archegos shares liquidated by its prime brokers in late March), one filing was of particular interest, that of Scion Asset Management’s Michael “Big Short” Burry. And boy were there surprises.