Article: New NSCC Rule Change Poised to End the Short Squeeze Saga

Article - Media

New NSCC Rule Change Poised to End the Short Squeeze Saga

Tim Fries, 22 June 2021

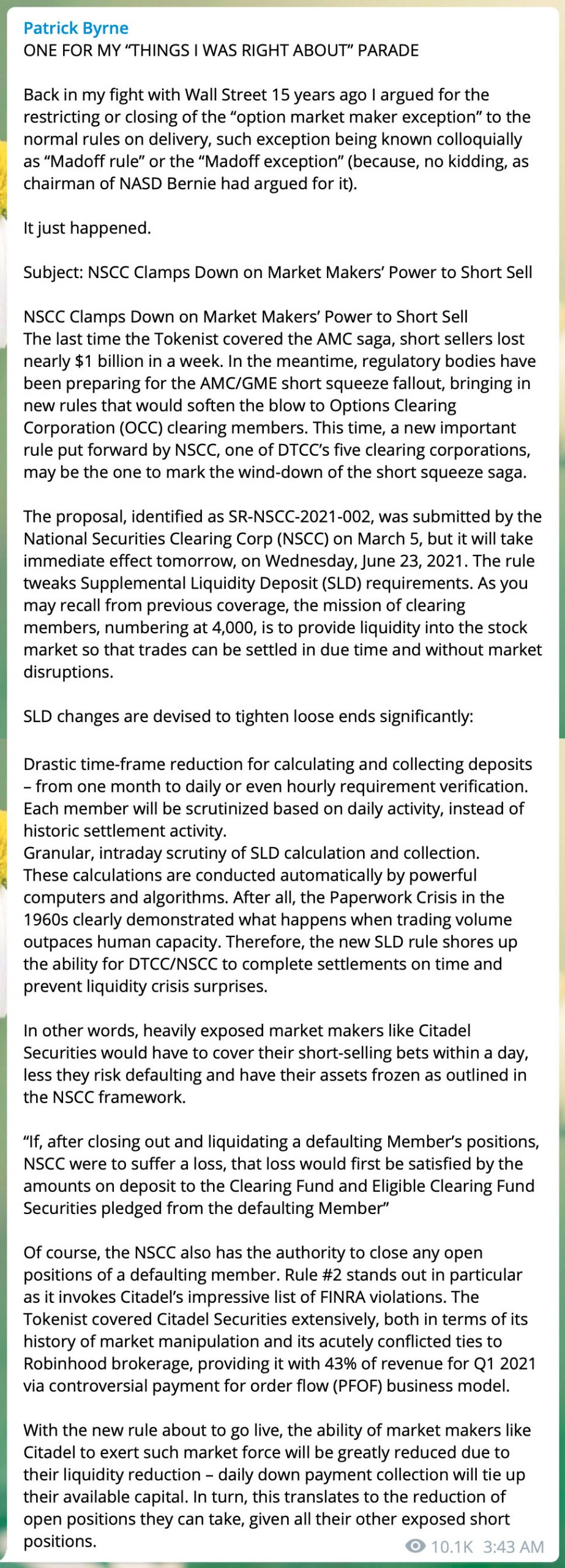

On Wednesday, market makers, which are also DTCC clearing members, will have to tighten up their short-selling belts. Because their available capital will be contrasted more frequently with member deposits, their ability to maintain massive short positions is slated to be crippled.

Larry Smith: Open Letter to President Donald Trump on Wall Street Crime

LetterRelease: President Trump Urged to Create DoD-DoJ Task Force on Financial Crime

Release

President Trump Urged to Create DoD-DoJ Task Force on Financial Crime

In combination, NSA data and DTCC discovery will end both naked short selling and money laundering associated with human trafficking as well as trafficking in drugs and weapons.

Continue reading “Release: President Trump Urged to Create DoD-DoJ Task Force on Financial Crime”

Article: Part 10 of Illegal Naked Shorting Series: Legal Shorting of Stocks is a Loser’s Game but Illegal Naked Shorting Transforms It into a Winner’s Game

Article - MediaLarry Smith

Smith On Stocks, 24 July 2019

When I launched my research on stock manipulation and the prominent role played by illegal naked shorting, I believed that I had a fair understanding of the subject and could knock out comprehensive research in just a few blogs. However, as I dug in I was taken aback at how complex and widespread this subject is. I think that a team of hundreds of experts with unlimited resources would have difficulty ferreting out all of the details on a scam that Wall Street has been perpetrating and perfecting for over 40 years.

Article: Part 7: Illegal Naked Shorting: DTCC Continuous Net Settlement and Stock Borrowing Programs Have Loopholes That Facilitate Illegal Naked Shorting

Article - MediaLarry Smith

Smith On Stocks, 31 May 2019

There is an integral relationship between the DTCC and hedge funds. The DTCC is owned by Prime Brokers; these are Goldman Sachs, Morgan Stanley, Merrell Lynch and other household name investment banks. Prime Brokers provide basic services to hedge funds that allow them to trade with multiple brokerage houses while maintaining a centralized master account at their prime broker containing cash and securities. The prime broker offers stock loan services, portfolio reporting, consolidated cash management and other services. Hedge fund support is a very meaningful percentage of the net income of Prime Brokers.

Paper: Counterfeiting Stock

PaperCounterfeiting Stock

Anna McParland

The Creation of Counterfeit Shares — There are a variety of names that the securities industry has dreamed up that are euphemisms for counterfeit shares. Don’t be fooled : Unless the short seller has actually borrowed a real share from the account of a long investor, the short sale is counterfeit. It doesn’t matter what you call it and it may become non–counterfeit if a share is later borrowed, but until then, there are more shares in the system than the company has sold.

The magnitude of the counterfeiting is hundreds of millions of shares every day, and it may be in the billions. The real answer is locked within the prime brokers and the DTC. Incidentally, counterfeiting of securities is as

It is estimated that 1000 small companies have been put out of business by the shorts.

PDF (12 Pages): Paper Counterfeiting Stock

Report: SEC IG Practices Related to Naked Short Selling Complaints and Referrals

ReportEditor: bottom line up front: SEC does not “do” complaints and considers naked short selling to be legal and generally contributing to “liquidity,”

Practices Related to Naked Short Selling Complaints and Referrals

Naked short selling has been a controversial practice for several years and, while not illegal per se, abusive or manipulative naked short selling (e.g., intentionally failing to borrow and deliver shares sold short in order to drive down the stock price) violates the federal securities laws.

The prior GAO audit found that Enforcement’s system for receiving and tracking referrals from the Self-Regulatory Organizations (SRO) needed improvements and recommended enhancements that would facilitate the monitoring and analysis of trend information and case activities.

Continue reading “Report: SEC IG Practices Related to Naked Short Selling Complaints and Referrals”

Article: The Economics of Naked Short Selling — The Koch Brothers Approve!

PaperThe Economics of Naked Short Selling

Christopher Culp and J. B. Heaton

Despite the cries of alarm, we believe that naked short selling

is unlikely to have significant detrimental effects on capital markets.

In this article, we will first examine the relevant economics

and regulation, and then argue that, from an economic perspective,

naked shorting is little different from traditional shorting.

PDF (6 Pages): Paper Economics of Naked Short Selling

Continue reading “Article: The Economics of Naked Short Selling — The Koch Brothers Approve!”

Article: Naked Short Selling – How Exposed Are Investors?

Article - AcademicNaked Short Selling: How Exposed are Investors?

James W. Christian, Robert Shapiro, John-Paul Whalen

The Houston Law Review, 10 November 2006

Regulation SHO is a start, but in order to guarantee a fair market place, the SEC must close the loopholes in Regulation SHO and institute comprehensive reforms to the clearing and settlement system. Until the SEC makes these necessary reforms and addresses the DTCC’s mismanagement of the Stock Borrow Program, investors will continue to be exposed to the manipulative potential of naked short selling.

PDF (58 Pages): HLR Naked Short Selling 2006-11-10

Letter: NASAA Letter to SEC on Proposed Amendments to Regulation SHO

LetterNASAA Letter to SEC on Proposed Amendments to Regulation SHO

Joseph P. Borg

NASAA, 4 October 2006

NASAA offers its support of the proposed amendments to Regulation SHO. While we are encouraged that the Commission is adopting a more proactive stance in this area, we believe that much more is necessary in order to regain public confidence in the integrity of U.S. capital markets and protect both the investing public and our nation’s small business interests. NASAA strongly urges the Commission to take all necessary steps to eliminate abusive short selling, and the corrosive practices that surround it, consistent with the Commission’s mission to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.

PDF (22 pages): NASAA Letter to SEC on Proposed Amendments to Regulation SHO

Letter: Research Capital Corporation to SEC on Proposed Amendments to Regulation SHO

LetterResearch Capital Corporation to SEC on Proposed Amendments to Regulation SHO

Geoffrey G. Whitlam, Vanessa M. Gardiner

6 September 2006

Research Capital Corporation (“RCC”) and Research Capital USA Inc. (“RECA”) have reviewed both the existing regulation and the proposed amendments and we have the following submission regarding the proposed changes to Regulation SHO and the problems created by naked short sales.

RCC is a Canadian Investment Dealer that is registered with the Investment Dealers Association of Canada (“IDA”). RCC is a full service brokerage firm that provides selfclearing for both RCC and RECA. RECA is a U.S. Broker Dealer registered with the NASD. Both organizations are headquartered in Toronto, Canada.

PDF (4 pages): Research Capital Corporation to SEC on Proposed Amendments to Regulation SHO

Article: Strategic Delivery Failures in U.S. Equity Markets

AcademicStrategic Delivery Failures in U.S. Equity Markets

Leslie Boni

Journal of Financial Markets, 1 February 2006

Sellers of U.S. equities who have not provided shares by the third day after the transaction are said to have “failed-to-deliver” shares. Using a unique data set of the entire cross-section of U.S. equities, we document the pervasiveness of delivery failures and evidence consistent with the hypothesis that market makers strategically fail to deliver shares when borrowing costs are high. We then show that many firms that allow others to fail to deliver to them are themselves responsible for fails-to-deliver in other stocks. Finally, we discuss the implications of these findings for short-sale constraints, short interest, liquidity, and options listings in the context of the recently adopted SEC Regulation SHO.

PDF (40 pages): Strategic Delivery Failures in U.S. Equity Markets

Article: Short Selling, Death Spiral Convertibles, and the Profitability of Stock Manipulation

Article - AcademicShort Selling, Death Spiral Convertibles, and the Profitability of Stock Manipulation

John D. Finnerty

Fordham University, 31 March 2005

The SEC recently adopted Regulation SHO to tighten restrictions on short selling and curb abusive short sales, including naked shorting masquerading as routine fails to deliver. This paper models market equilibrium when short selling is permitted and contrasts the equilibrium with and without manipulators among the short sellers. I explain how naked short selling can routinely occur within the securities clearing system in the United States and characterize its potentially severe market impact. I show how a recent securities innovation called floating-price convertible securities can resolve the unraveling problem and enable manipulative short selling to intensify.

Paper: Boni Analysis of Failures-to-Deliver

PaperBoni Analysis of Failures-to-Deliver

Robert Shapiro

Sonecon, November 2004

A new study documents that significant failures to promptly deliver shares sold short (“fails” or “failures”) are not, as many market participants assume, rare, brief and inadvertent, but rather pervasive, extended and deliberate. The analysis was done by Dr. Leslie Boni, recently a visiting financial economist at the SEC and now economics professor at the University of New Mexico. Boni’s data show that failures-to-deliver affect almost all public companies and usually last several weeks. On any day, there are 180 million-to-300 million shares involving more than 10 percent of public companies that have gone undelivered for at least two months. Failures of these dimensions can seriously distort the normal economic operations of U.S. equity markets.

PDF (2 pages): Boni Analysis of Failures-to-Deliver