Stanley Freeman Druckenmiller is an American investor, hedge fund manager and philanthropist. He is the former chairman and president of Duquesne Capital, which he founded in 1981. He closed the fund in August 2010 because he felt unable to deliver high returns to his clients. At the time of closing, Duquesne Capital had over $12 billion in assets. From 1988 to 2000, he managed money for George Soros as the lead portfolio manager for Quantum Fund. In 2017, his net worth was estimated at $4.4 billion. Druckenmiller graduated from Bowdoin College (BA) at the University of Michigan.

Stanley Freeman Druckenmiller is an American investor, hedge fund manager and philanthropist. He is the former chairman and president of Duquesne Capital, which he founded in 1981. He closed the fund in August 2010 because he felt unable to deliver high returns to his clients. At the time of closing, Duquesne Capital had over $12 billion in assets. From 1988 to 2000, he managed money for George Soros as the lead portfolio manager for Quantum Fund. In 2017, his net worth was estimated at $4.4 billion. Druckenmiller graduated from Bowdoin College (BA) at the University of Michigan.

Subject: Michael E. Novogratz

Subject of Interest Michael E. Novogratz is the CEO of Galaxy Digital Holdings and a co-founder of Galaxy Digital LP — a cryptocurrency-focused merchant bank based in New York. Formerly a fund manager at the Fortress Investment Group, Novogratz is a noted cryptocurrency proponent, saying in 2017 that at least 20% of his net worth was in Bitcoin and Ether. Prior to joining Fortress, he was a partner at Goldman Sachs where he spent much time abroad. Novogratz is a 1987 graduate of Princeton University.

Michael E. Novogratz is the CEO of Galaxy Digital Holdings and a co-founder of Galaxy Digital LP — a cryptocurrency-focused merchant bank based in New York. Formerly a fund manager at the Fortress Investment Group, Novogratz is a noted cryptocurrency proponent, saying in 2017 that at least 20% of his net worth was in Bitcoin and Ether. Prior to joining Fortress, he was a partner at Goldman Sachs where he spent much time abroad. Novogratz is a 1987 graduate of Princeton University.

Subject: Mark Valentine

Subject of Interest Mark Valentine was the former chairman of Thomson Kernaghan & Co., a securities broker-dealer located in Ontario, Canada. Valentine controlled a significant amount of C-Me-Run, Inc. (“C-Me-Run”), SoftQuad Software, Ltd. (“SoftQuad”) and JagNotes.com, Inc. (“JagNotes”) stocks. He was arrested by German authorities in 2002 relating to a massive securities fraud and money-laundering scam that has resulted in indictments against 58 people. In 2004, Valentine pleaded guilty to one count of securities fraud in violation of Title 15 of the United States Code, Section 78j(b) and 78ff before the United States District Court for the Southern District of Florida, in Unites States v. Mark Valentine, et al., Criminal Indictment No. 02-80088-CR-Cohn. On May 21, 2004, a judgment in the criminal case was entered against Valentine. Valentine was sentenced to four years of probation with nine months of home detention and other special conditions of supervision and ordered to pay a $100 assessment to the court.

Mark Valentine was the former chairman of Thomson Kernaghan & Co., a securities broker-dealer located in Ontario, Canada. Valentine controlled a significant amount of C-Me-Run, Inc. (“C-Me-Run”), SoftQuad Software, Ltd. (“SoftQuad”) and JagNotes.com, Inc. (“JagNotes”) stocks. He was arrested by German authorities in 2002 relating to a massive securities fraud and money-laundering scam that has resulted in indictments against 58 people. In 2004, Valentine pleaded guilty to one count of securities fraud in violation of Title 15 of the United States Code, Section 78j(b) and 78ff before the United States District Court for the Southern District of Florida, in Unites States v. Mark Valentine, et al., Criminal Indictment No. 02-80088-CR-Cohn. On May 21, 2004, a judgment in the criminal case was entered against Valentine. Valentine was sentenced to four years of probation with nine months of home detention and other special conditions of supervision and ordered to pay a $100 assessment to the court.

Administrative Proceeding: Paul D. Lemmon, Mark Valentine, and Michael Vlahovic

Tip: Aurora Cannabis Naked Short Selling with NYSE Complicity?

Tipthanks to NYSE delisting the stock is now way lower then it was before the FORCED reversing of stock

HIGH was $8.21 now $5.46 at $8.21 it was .68 cents now at $5.45 is 45 cents

Just who does it help? ONLY the naked short selling crooks it reduces the numbers of naked shorts They still exist BUT now reduced by the 12- stock reverse 12X LESS thats the Wall St magic trick to hide the mess

Article: The Fed scolded Deutsche Bank for money-laundering protections, new report says

Article - MediaThe Fed scolded Deutsche Bank for money-laundering protections, new report says

Ben Winck

Business Insider, 14 May 2020

The Federal Reserve recently lambasted Deutsche Bank for loose controls as the firm looks to overhaul its reputation, The Wall Street Journal reported Thursday, citing a person familiar with the matter.

The central bank notified Deutsche Bank in a letter that it had ongoing concerns about the firm’s US money-laundering protections, according to the report. The Fed also criticized the company for not resolving issues that led to its “troubled condition” classification in 2017.

Tip: Genius Brands Being Naked Short Sold?

TipLook at volume last few days 100M 2X Its insane settlement failures (FTDs) have to be HUGE as a CIA spy I can see it. The SEC has their heads up their asses not to see this The Data doesn’t lie People do and here is the data

| Date | Open | High | Low | Close* | Adj Close** | Volume |

|---|---|---|---|---|---|---|

| May 13, 2020 | 0.7700 | 1.4100 | 0.7100 | 1.3100 | 1.3100 | 108,013,600 |

| May 12, 2020 | 0.7500 | 0.7900 | 0.7000 | 0.7280 | 0.7280 | 12,622,900 |

| May 11, 2020 | 0.6500 | 0.8480 | 0.6300 | 0.8050 | 0.8050 | 33,220,400 |

| May 08, 2020 | 0.7240 | 0.7490 | 0.5050 | 0.5800 | 0.5800 | 43,040,000 |

| May 07, 2020 | 0.7200 | 1.0300 | 0.6820 | 0.8350 | 0.8350 | 134,758,600 |

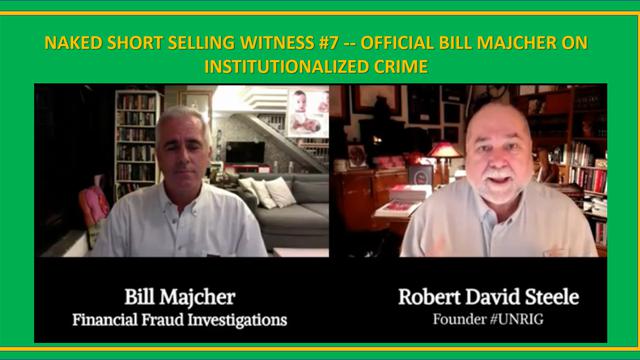

#UNRIG Video (*36:28) Naked Short Selling Witness #7 — Official Bill Majcher on Institutionalized Crime

VideoArticle: “Worse Than 2008” – American Pension Funds Report Record Losses In Q1

Article - Media“Worse Than 2008” – American Pension Funds Report Record Losses In Q1

Tyler Durden

Zero Hedge, 13 May 2020

Public pension plans lost a median 13.2% in the three months ended March 31, according to Wilshire Trust Universe Comparison Service data released Tuesday, slightly more than in the fourth quarter of 2008. March’s stock market plummet led to the biggest one-quarter drop in the 40 years the firm has been tracking.

Continue reading “Article: “Worse Than 2008” – American Pension Funds Report Record Losses In Q1″

Media: David Dayen

Media David Dayen is the executive editor of The American Prospect. He also writes regularly for The Intercept and The Nation. He is the author of Monopolized: Life in an Age of Corporate Power and Chain of Title: How Three Ordinary Americans Uncovered Wall Street’s Great Foreclosure Fraud. Dayen lives in Venice, California.

David Dayen is the executive editor of The American Prospect. He also writes regularly for The Intercept and The Nation. He is the author of Monopolized: Life in an Age of Corporate Power and Chain of Title: How Three Ordinary Americans Uncovered Wall Street’s Great Foreclosure Fraud. Dayen lives in Venice, California.

Subject: Steven A. Cohen

Subject of Interest Steven A. Cohen is an American billionaire hedge fund manager, He is the founder of hedge funds Point72 Asset Management and now-closed S.A.C. Capital Advisors, both based in Stamford, Connecticut. In 2013, the Cohen-founded S.A.C. Capital Advisors pleaded guilty to insider trading and agreed to pay $1.8 billion in fines in one of the biggest criminal cases against a hedge fund. Cohen was prohibited from managing outside money for 2 years as part of the settlement. The hedge fund agreed to plead guilty to wire fraud and four counts of securities fraud and to close to outside investors.

Steven A. Cohen is an American billionaire hedge fund manager, He is the founder of hedge funds Point72 Asset Management and now-closed S.A.C. Capital Advisors, both based in Stamford, Connecticut. In 2013, the Cohen-founded S.A.C. Capital Advisors pleaded guilty to insider trading and agreed to pay $1.8 billion in fines in one of the biggest criminal cases against a hedge fund. Cohen was prohibited from managing outside money for 2 years as part of the settlement. The hedge fund agreed to plead guilty to wire fraud and four counts of securities fraud and to close to outside investors.

Subject: Richard Choo-Beng Lee

Subject of Interest Richard Choo-Beng Lee, who co-founded Spherix Capital and once was an analyst at SAC Capital, pled guilty in 2009 along with Spherix co-founder Ali Far, admitting to engaging in an insider trading scheme that enabled Spherix to make $5 million. Lee secretly informed on various individuals and recorded several phone calls with 28 people, including billionaire Steven A. Cohen, whose SAC Capital employed Lee as an analyst from 1999 to 2004, prosecutors said. Lee was also ordered by U.S. District Judge Kevin Castel in Manhattan to pay a $100,000 fine in light of his 2009 guilty plea.

Richard Choo-Beng Lee, who co-founded Spherix Capital and once was an analyst at SAC Capital, pled guilty in 2009 along with Spherix co-founder Ali Far, admitting to engaging in an insider trading scheme that enabled Spherix to make $5 million. Lee secretly informed on various individuals and recorded several phone calls with 28 people, including billionaire Steven A. Cohen, whose SAC Capital employed Lee as an analyst from 1999 to 2004, prosecutors said. Lee was also ordered by U.S. District Judge Kevin Castel in Manhattan to pay a $100,000 fine in light of his 2009 guilty plea.

Three weeks prison for key informant in U.S. insider-trading cases

Subject: Ali Far

Subject of Interest Ali Far is a former employee at the Galleon Group. He left in 2008 to start his own Hedge fund (Spherix Capital Partners) with his Partner, Richard Choo-Beng Lee, aka “C.B.” Far was sentenced to one year of probation for his participation in multiple insider trading schemes during which he obtained, shared, and traded based on material, non-public information (“inside information”) stolen from several public companies. Far pled guilty in October 2009 to one count of conspiracy to commit securities fraud and one count of securities fraud pursuant to a cooperation agreement with the government. Together, he and his co-conspirator at Spherix gained approximately $5,209,464 for their hedge fund by placing trades in Spherix accounts based on Inside Information.

Ali Far is a former employee at the Galleon Group. He left in 2008 to start his own Hedge fund (Spherix Capital Partners) with his Partner, Richard Choo-Beng Lee, aka “C.B.” Far was sentenced to one year of probation for his participation in multiple insider trading schemes during which he obtained, shared, and traded based on material, non-public information (“inside information”) stolen from several public companies. Far pled guilty in October 2009 to one count of conspiracy to commit securities fraud and one count of securities fraud pursuant to a cooperation agreement with the government. Together, he and his co-conspirator at Spherix gained approximately $5,209,464 for their hedge fund by placing trades in Spherix accounts based on Inside Information.

Subject: Danielle Chiesi

Subject of Interest Danielle Chiesi is a former beauty queen turned stock analyst that helped former Galleon Group founder Raj Rajaratnam with insider trading. Chiesi pleaded guilty on three counts of securities fraud, and was sentenced to a West Virginia Prison in 2011. She served 15 months before being released. She agreed to pay $540,000 to settle related civil charges with the Securities and Exchange Commission.

Danielle Chiesi is a former beauty queen turned stock analyst that helped former Galleon Group founder Raj Rajaratnam with insider trading. Chiesi pleaded guilty on three counts of securities fraud, and was sentenced to a West Virginia Prison in 2011. She served 15 months before being released. She agreed to pay $540,000 to settle related civil charges with the Securities and Exchange Commission.

Subject: Raj Rajaratnam

Subject of Interest Raj Rajaratnam is a Sri Lankan-American former hedge fund manager and founder of the Galleon Group, a New York-based hedge fund management firm. On October 16, 2009, he was arrested by the FBI for insider trading, which also caused the Galleon Group to fold. He stood trial in U.S. v Rajaratnam (09 Cr. 01184) in the United States District Court for the Southern District of New York, and on May 11, 2011, was found guilty on all 14 counts of conspiracy and securities fraud. On October 13, 2011, Rajaratnam was sentenced to 11 years in prison and fined a criminal and civil penalty of over $150 million combined. Rajaratnam was released to home confinement in his Upper East Side Manhattan apartment, located on Sutton Place, in the summer of 2019.

Raj Rajaratnam is a Sri Lankan-American former hedge fund manager and founder of the Galleon Group, a New York-based hedge fund management firm. On October 16, 2009, he was arrested by the FBI for insider trading, which also caused the Galleon Group to fold. He stood trial in U.S. v Rajaratnam (09 Cr. 01184) in the United States District Court for the Southern District of New York, and on May 11, 2011, was found guilty on all 14 counts of conspiracy and securities fraud. On October 13, 2011, Rajaratnam was sentenced to 11 years in prison and fined a criminal and civil penalty of over $150 million combined. Rajaratnam was released to home confinement in his Upper East Side Manhattan apartment, located on Sutton Place, in the summer of 2019.

Tweet: President Donald J. Trump Knows!

TweetWhen the so-called “rich guys” speak negatively about the market, you must always remember that some are betting big against it, and make a lot of money if it goes down. Then they go positive, get big publicity, and make it going up. They get you both ways. Barely legal?

— Donald J. Trump (@realDonaldTrump) May 13, 2020