Government omits financial scams from Online Safety Bill

FHope William-Smith, 12 May 2021

It comes after the Work and Pensions Committee (WPC) called on the government to legislate against online investment fraud in March after it pledged its Online Safety Bill last December.

It comes after the Work and Pensions Committee (WPC) called on the government to legislate against online investment fraud in March after it pledged its Online Safety Bill last December.

The WPC’s report recommended the introduction of a regulatory framework for financial promotions to create parity between traditional media such as newspapers and TV, and new media including social media and paid-for advertising.

The Online Safety Bill was given the green light yesterday (11 May) in the Queen’s Speech; despite the parliamentary focus on rebuilding the nation in the wake of the Covid-19 pandemic, the soaring number of financial scams harnessing coronavirus to their benefit will remain largely unchecked.

Opening the parliamentary year, the Queen said the government “will lead the way in ensuring internet safety for all” while looking to retain “the benefits of a free, open and secure internet”.

WPC chair and MP Stephen Timms has said the government had been “repeatedly told by countless consumer groups and public bodies” about the financial and emotional harm caused by “online free-for-alls”.

“The government has so far failed to act,” he said. “Every day that goes by without proper regulation of online adverts gives scammers a free pass to prey on people on the internet.”

Timms said ministers had to work to ensure the Online Safety Bill would “live up to its name” and clearly lay out how it will cover scams before it was presented to the House of Commons.

Read Full Article

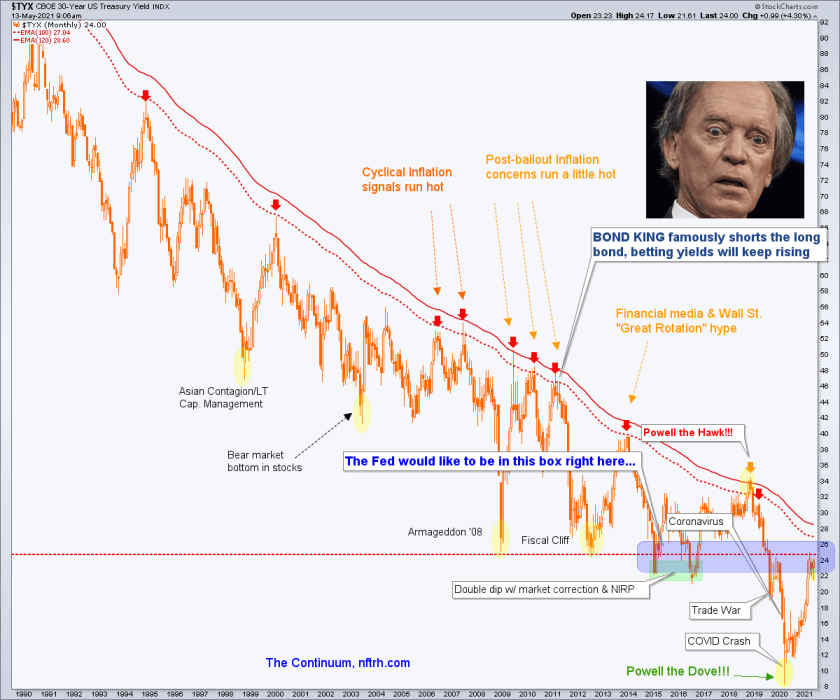

Stagflation in the offing, unless it’s not different this time…

Stagflation in the offing, unless it’s not different this time… The Financial Supervisory Commission (FSC) yesterday fined Citibank Taiwan Ltd (花旗台灣) NT$10 million (US$357,194) and DBS Bank Taiwan (星展台灣) NT$6 million for breaches of the nation’s anti-money laundering (AML) regulations.

The Financial Supervisory Commission (FSC) yesterday fined Citibank Taiwan Ltd (花旗台灣) NT$10 million (US$357,194) and DBS Bank Taiwan (星展台灣) NT$6 million for breaches of the nation’s anti-money laundering (AML) regulations. New contenders are emerging in the race to get rid of the London interbank offered rate by year-end.

New contenders are emerging in the race to get rid of the London interbank offered rate by year-end. German financial regulator BaFin has ordered mobile bank N26 to fix problems with its IT monitoring and customer due diligence to prevent money laundering and terrorist financing.

German financial regulator BaFin has ordered mobile bank N26 to fix problems with its IT monitoring and customer due diligence to prevent money laundering and terrorist financing. Gianluigi Torzi, the Italian businessman who brokered the final part of the Secretariat of State’s purchase of a London investment property, has been arrested in the United Kingdom.

Gianluigi Torzi, the Italian businessman who brokered the final part of the Secretariat of State’s purchase of a London investment property, has been arrested in the United Kingdom. It comes after the Work and Pensions Committee (WPC) called on the government to legislate against online investment fraud in March after it pledged its Online Safety Bill last December.

It comes after the Work and Pensions Committee (WPC) called on the government to legislate against online investment fraud in March after it pledged its Online Safety Bill last December. Shell companies sure make strange bedfellows.

Shell companies sure make strange bedfellows. The Commodity Futures Trading Commission’s whistleblower program is in turmoil over a potential payout exceeding $100 million to a former Deutsche Bank AG executive—one so large it would deplete the agency’s whistleblower funds and has led it to seek congressional action.

The Commodity Futures Trading Commission’s whistleblower program is in turmoil over a potential payout exceeding $100 million to a former Deutsche Bank AG executive—one so large it would deplete the agency’s whistleblower funds and has led it to seek congressional action.